What This Page Covers

This page provides an informational overview of 2025 trends in wealth management for passive income, focusing on publicly available data, context, and commonly discussed considerations. It is designed to help readers understand the topic clearly and objectively.

Understanding 2025 trends in wealth management for passive income

In recent years, wealth management has increasingly focused on generating passive income, allowing investors to earn returns with minimal active involvement. As we approach 2025, several trends are shaping this landscape. Individuals and institutions are keenly interested in these trends to optimize their portfolios and ensure sustainable income streams. The rise of technology, changing economic conditions, and evolving investor preferences are among the key drivers influencing these trends. Understanding these dynamics is crucial for making informed decisions and capitalizing on potential opportunities.

Key Factors to Consider

Several key factors are impacting 2025 trends in wealth management for passive income. First, technological advancements play a significant role. The integration of artificial intelligence and machine learning in portfolio management is enabling more efficient and personalized strategies. Second, the global economic landscape, influenced by factors such as interest rates and inflation, is crucial in shaping income-generating opportunities. Third, the increasing popularity of sustainable and ESG (Environmental, Social, and Governance) investments reflects a shift in investor priorities, affecting passive income strategies. These factors collectively underscore the complexity and dynamism of wealth management in 2025.

Common Scenarios and Examples

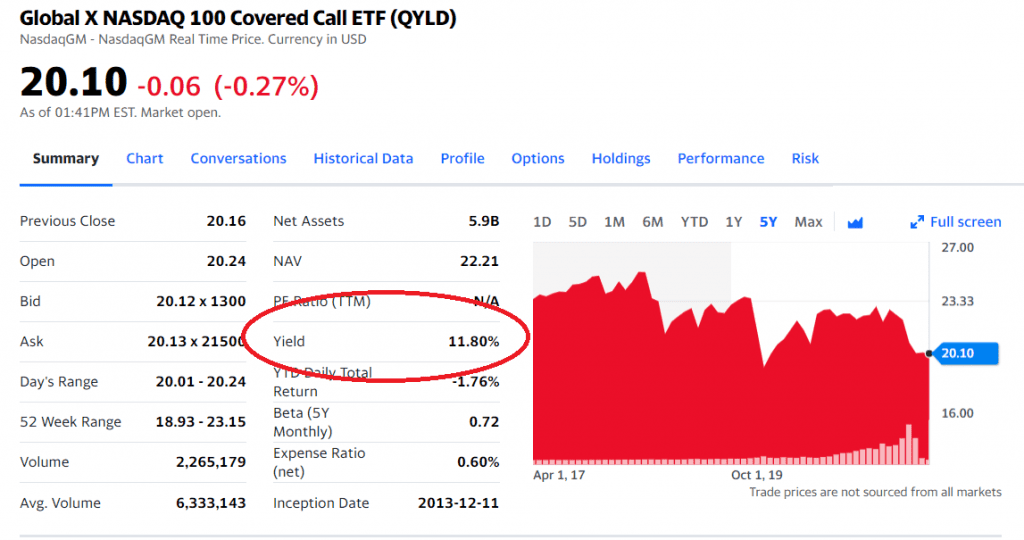

To better understand these trends, consider the example of a diversified investment portfolio that includes a mix of dividend-paying stocks, real estate investment trusts (REITs), and bonds. As AI-driven platforms become more prevalent, investors might use these tools to analyze large datasets, optimizing their asset allocation for better risk-adjusted returns. Additionally, with the growing emphasis on ESG criteria, investors may choose green bonds or socially responsible funds as part of their strategy, aligning financial goals with personal values. These scenarios highlight how wealth management practices are evolving to meet the demands of a changing environment.

Practical Takeaways for Readers

- Highlight important observations readers should be aware of.

- Clarify common misunderstandings related to 2025 trends in wealth management for passive income.

- Explain what information sources readers may want to review independently.

As wealth management trends evolve, it is crucial for investors to stay informed about technological advancements and economic conditions that may affect passive income strategies. A common misunderstanding is that passive income requires no oversight; however, regular portfolio reviews are essential to adapt to changing market conditions. Readers are encouraged to explore reputable financial publications, official filings, and company reports to gain a comprehensive understanding of the current and future landscape.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is 2025 trends in wealth management for passive income?

2025 trends in wealth management for passive income refer to the evolving strategies and practices aimed at generating income with minimal active involvement, influenced by technological, economic, and investor preference changes.

Why is 2025 trends in wealth management for passive income widely discussed?

This topic is widely discussed due to the growing interest in sustainable and efficient income strategies amidst economic uncertainties and the increasing role of technology in financial management.

Is 2025 trends in wealth management for passive income suitable for everyone to consider?

While passive income strategies can benefit many, their suitability depends on individual financial goals, risk tolerance, and investment horizon. Personalized advice from financial professionals is recommended.

Where can readers learn more about 2025 trends in wealth management for passive income?

Readers can explore official filings, company reports, and reputable financial publications to gain more insights into the trends and strategies shaping wealth management for passive income.

Understanding complex topics takes time and thoughtful evaluation. Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply