Unpacking Meta’s 2025 Earnings Report: Key Insights for Today’s Savvy Investor

An In-depth Look at Meta’s 2025 Earnings Report

In the volatile universe of the global stock market, the performance of influential tech juggernauts like Meta can significantly guide the overall sentiments. As we dissect Meta’s 2025 earnings report, let us delve deeper into the financial patterns this formidable player demonstrated, offering valuable insights to today’s tech-forward, savvy investors.

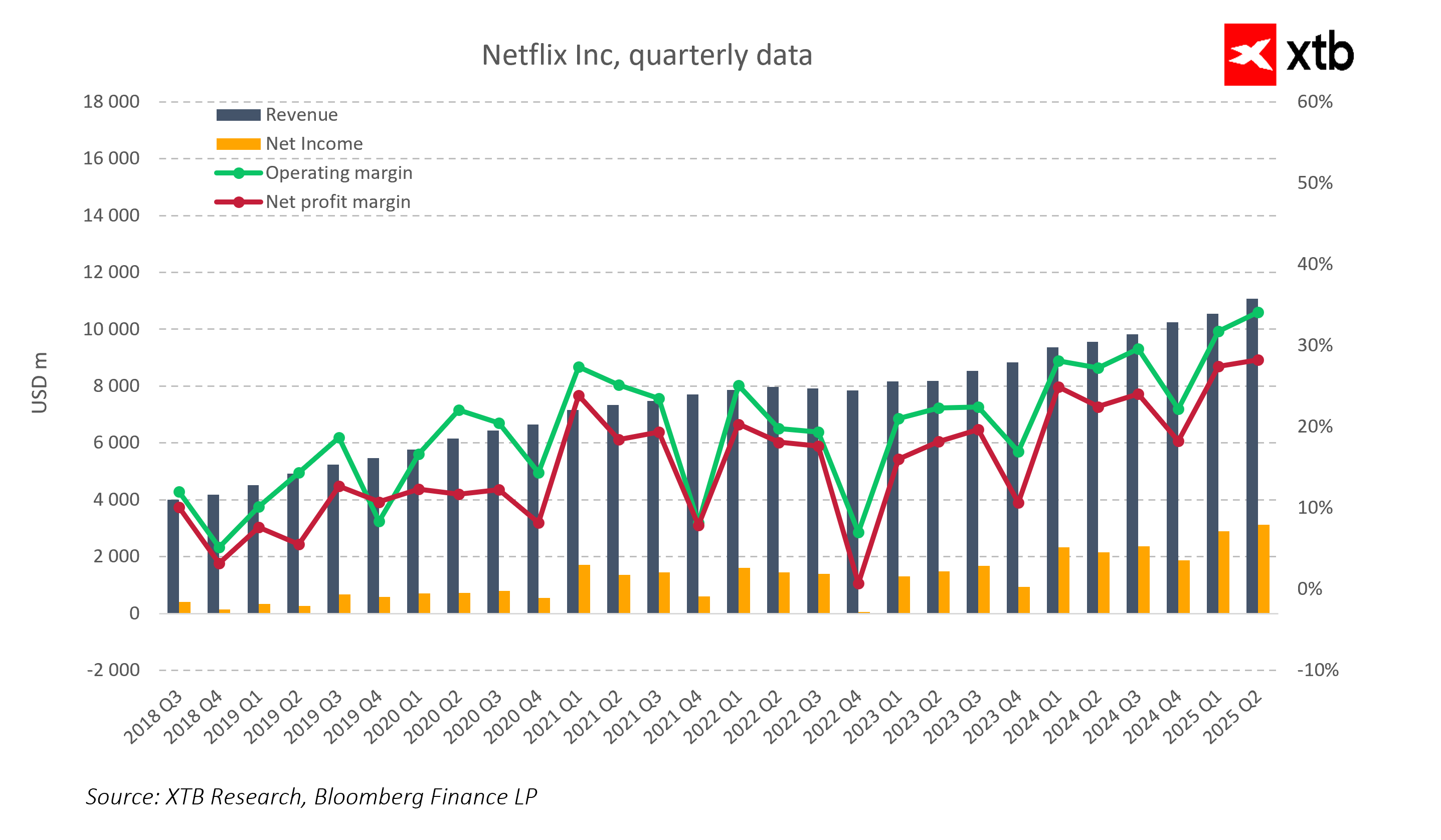

Precise Revenue Breakdown and Analysis

The report unpacks Meta’s revenue generation. Understanding the contribution of different business segments towards overall revenue is a strong predictor of a company’s financial health and future growth potential. The company’s consumer hardware, advertising, and other services have all shown differing trends. Professional investors can strategically allocate their investments keeping these insights in mind.

Growth Projection: Reality or Bubble?

Meta’s growth projection promises significant returns. However, it is crucial to discern whether this projected growth is sustainable or a bubble waiting to burst. Meta’s move towards developing its reality labs, the introduction of the metaverse, and its escalating AI ventures indicate noteworthy progress. Savvy investors would be wise to monitor the market’s response to these developments closely.

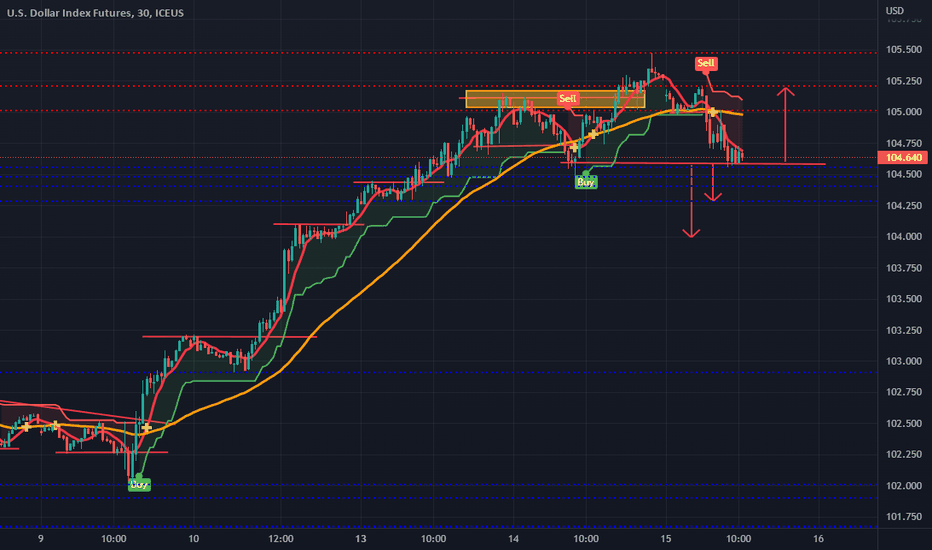

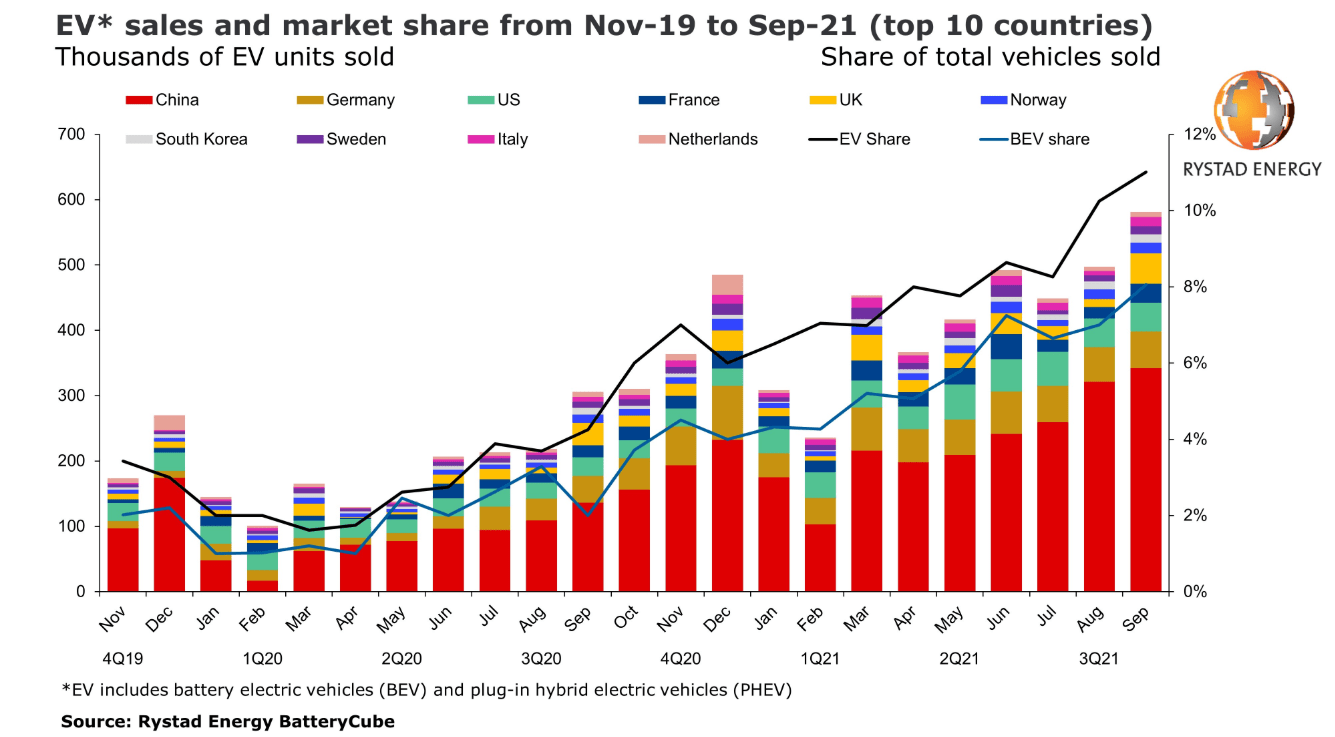

Global Stock Market Performance of Tech Giants

Observing the behaviour of major players in the global stock market, we note similar patterns. Many tech giants are heavily investing in innovation to stay ahead in the competitive landscape. Savvy investors will consider these patterns and Meta’s position within these trends for a more balanced and diversified portfolio.

Is Meta Worth the Investment?

Everything considered, Meta’s 2025 earnings report certainly presents an optimistic picture. However, investing should never be a spontaneous decision. A careful risk-versus-reward calculation, driven by data, and considering both short-term volatility and long-term potential, is crucial.

RELATED READING

-

Read also: SPY ETF Review: Navigating Current Market Volatility with the S&P 500 Proxy

Artificial Intelligence in Tech: An Investor’s Guide to Picking the Winning Stocks.

-

Read also: SPY ETF Review: Navigating Current Market Volatility with the S&P 500 Proxy

Navigating the Virtual World: The Rise of the Metaverse and Making Smart Investments.

-

Read also: SPY ETF Review: Navigating Current Market Volatility with the S&P 500 Proxy

How Big Tech is Reshaping the Global Stock Market.

Final Thoughts

The analysis of financial reports, like Meta’s 2025 earnings report, provides a considerable edge to the savvy, modern-day investor. Such insights, based on solid data and analytical understanding, can significantly influence your investment decisions, ensuring you remain well-positioned in this dynamic global stock market.

Disclaimer: This article is strictly for informational purposes and should not be considered financial advice. Always consult with a licensed financial advisor or professional before making any investment decisions.