Understanding the financial market is like piecing together a complex puzzle. One of the significant aspects of this puzzle is the analysis of stock trends. This practice has become an essential tool for investors, aiding them in making informed decisions. This article delves into the heart of stock trends analysis, providing you with the necessary knowledge to navigate the financial market confidently.

Understanding Stock Trends Analysis

Stock trends analysis is the study of historical data, which includes price and volume, to predict future market behavior. It is a fundamental aspect of technical analysis, a discipline used by traders to analyze financial markets and make investment decisions.

The Importance of Stock Trends Analysis

Stock trends analysis is a pivotal part of the investment process. It allows traders to understand the market’s direction—whether it’s bearish (downward trend) or bullish (upward trend). By analyzing stock trends, traders can identify potential investment opportunities and make informed decisions.

Key Elements of Stock Trends Analysis

There are several elements involved in analyzing stock trends. These include:

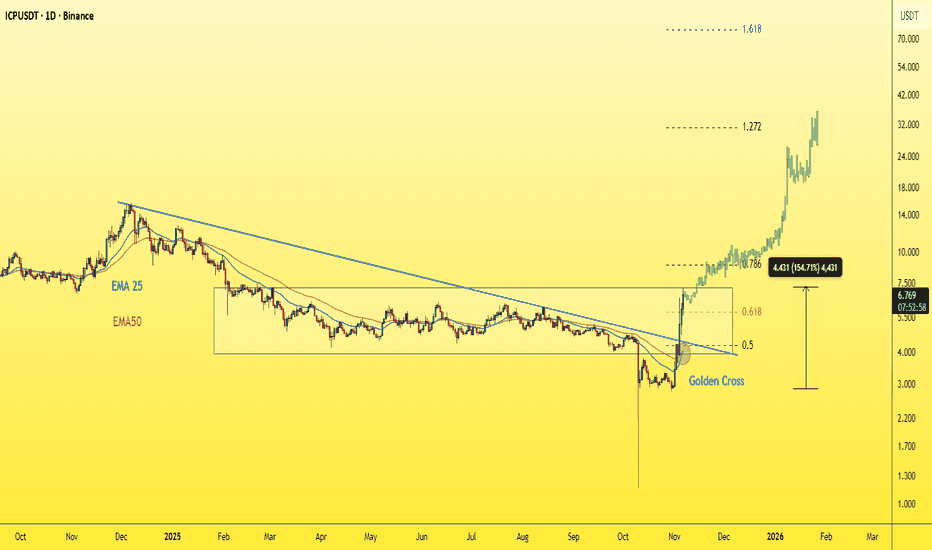

- Trend Lines: These are lines drawn on a stock chart that help identify the market direction.

- Volume: This refers to the number of shares traded during a particular period. It often confirms the trend.

- Moving Averages: These are used to smooth out price data and generate a line that traders use to identify the trend direction.

Practical Tips for Stock Trends Analysis

Here are a few practical tips for effective stock trends analysis:

- Stay Updated: Keep abreast of financial news and global events that affect stock prices.

- Use Reliable Charting Tools: Utilize reliable charting tools for accurate data analysis.

- Apply Multiple Timeframes: Analyze trends using multiple timeframes for a comprehensive view.

Common Questions about Stock Trends Analysis

What is the best time frame for stock trends analysis?

There is no one-size-fits-all answer to this question. The best time frame for stock trends analysis depends on your investment goals and trading style.

How reliable is stock trends analysis?

While stock trends analysis is a valuable tool, it does not guarantee success. It should be used in conjunction with fundamental analysis for a more comprehensive approach.

As we wrap up this journey of understanding stock trends analysis, remember that knowledge is power. The more you understand about the financial market, the better your decisions will be. The road to successful investing may be winding, but with the right tools and knowledge, you can navigate it with confidence.

Leave a Reply