As an investment enthusiast, you may find yourself pondering over the question, “When is the best time to buy investments?” While the question seems simple, the answer can be quite complex and dependent on a range of factors. This article aims to guide you through this labyrinth and provide practical tips to help you make informed investment decisions.

The Importance of Timing in Investment

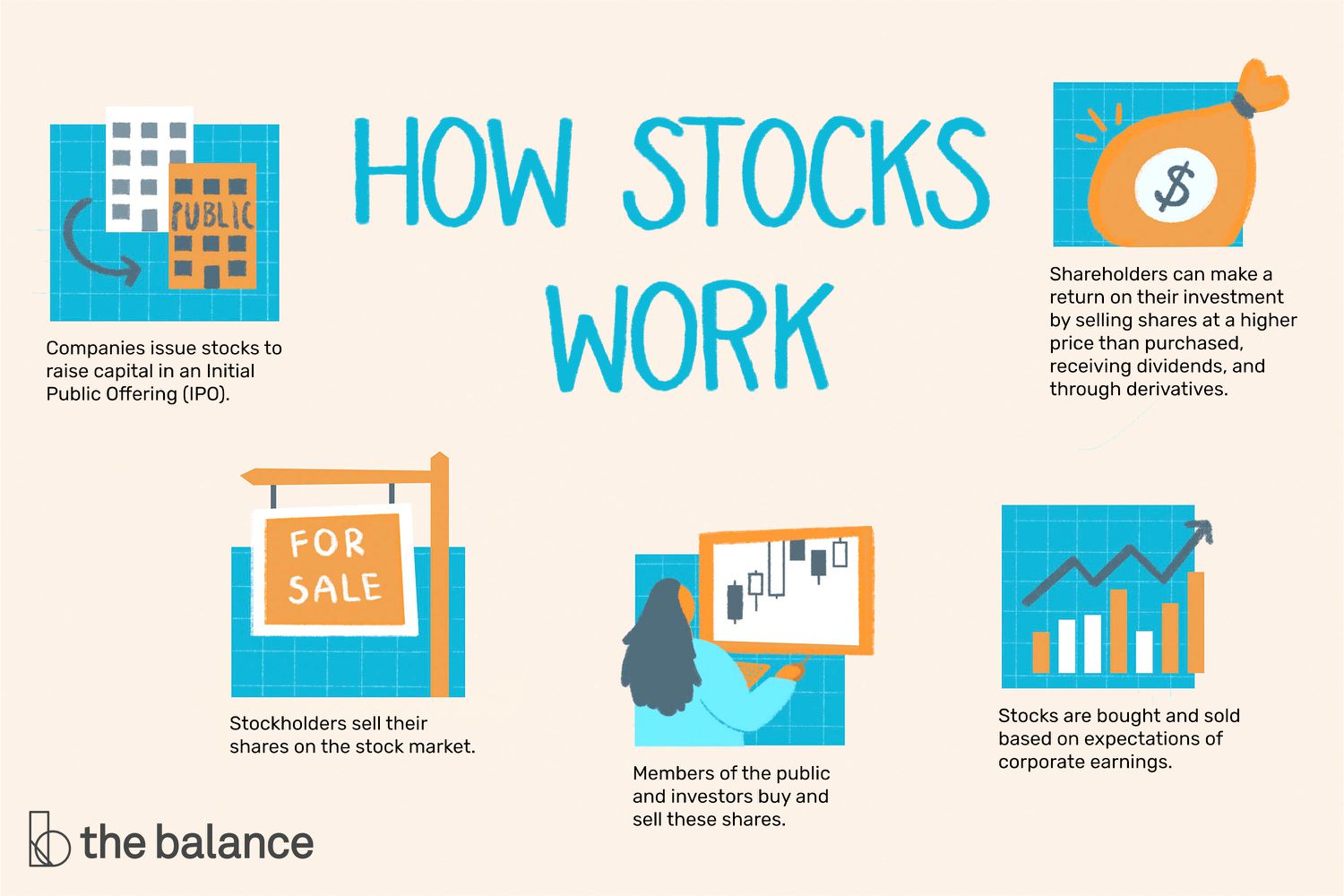

Timing is a crucial element in the investment world. The time you choose to enter the market can significantly impact your return on investment. For instance, buying stocks when prices are low and selling when they are high is a fundamental investment strategy. However, identifying the “right” time requires a thorough understanding of market trends, economic indicators, and investor sentiment, among other things.

Understanding Market Cycles

Financial markets are cyclical in nature, with periods of growth (bull markets) followed by periods of decline (bear markets). Understanding these cycles can help determine the best time to buy investments. In general, the best time to buy is at the start of a bull market when prices are low, and the market is poised for growth. Conversely, the worst time to invest is at the height of a bull market when prices are inflated, and a bear market may be looming.

Investment Types and Timing

Not all investments are created equal. The best time to buy can vary greatly depending on the type of investment. For instance, buying real estate might be best when interest rates are low, while purchasing mutual funds could be more about dollar-cost averaging irrespective of market conditions. Therefore, it’s essential to understand the dynamics of the specific investment type before deciding when to buy.

Practical Tips

-

Stay informed about global and local economic trends and news.

-

Understand the investment type and its market dynamics.

-

Consider dollar-cost averaging to mitigate the risk of market volatility.

-

Consult with a financial advisor or investment professional.

FAQ

When is the best time to invest in stocks?

Generally speaking, the best time to invest in stocks is when the market is at its low point or just beginning to recover. However, predicting these points is challenging, and it’s often more effective to follow a consistent investment strategy like dollar-cost averaging.

Does timing matter when investing in mutual funds?

Unlike stocks, timing isn’t as critical when investing in mutual funds. This is because mutual funds are designed to be long-term investments, and the goal is to build wealth over time rather than trying to time the market.

What is the best time to invest in real estate?

The best time to invest in real estate is usually when interest rates are low, making mortgages more affordable. Additionally, market conditions such as oversupply of properties or low demand can create good buying opportunities.

At the end of the day, remember that investing is not about getting rich quick. It’s about building wealth over time. The best time to buy investments is when you’re financially ready and have done your due diligence. Don’t rush. Be patient, stay informed, and make wise decisions that align with your financial goals and risk tolerance. You’re on a journey to financial freedom, and every step you take brings you closer to your destination.

Leave a Reply