Unmasking QQQ Performance: A Comprehensive Analysis for Modern Investors

As an investor, the fast-paced and ever-evolving world of finance can be daunting. However, a solid understanding of investment avenues, like the hugely popular QQQ performance, can provide a robust foundation for informed decision-making. In this piece, we delve into the intricacies of QQQ, exploring its characteristics, performance, and implications within the global stock market context.

Decoding QQQ

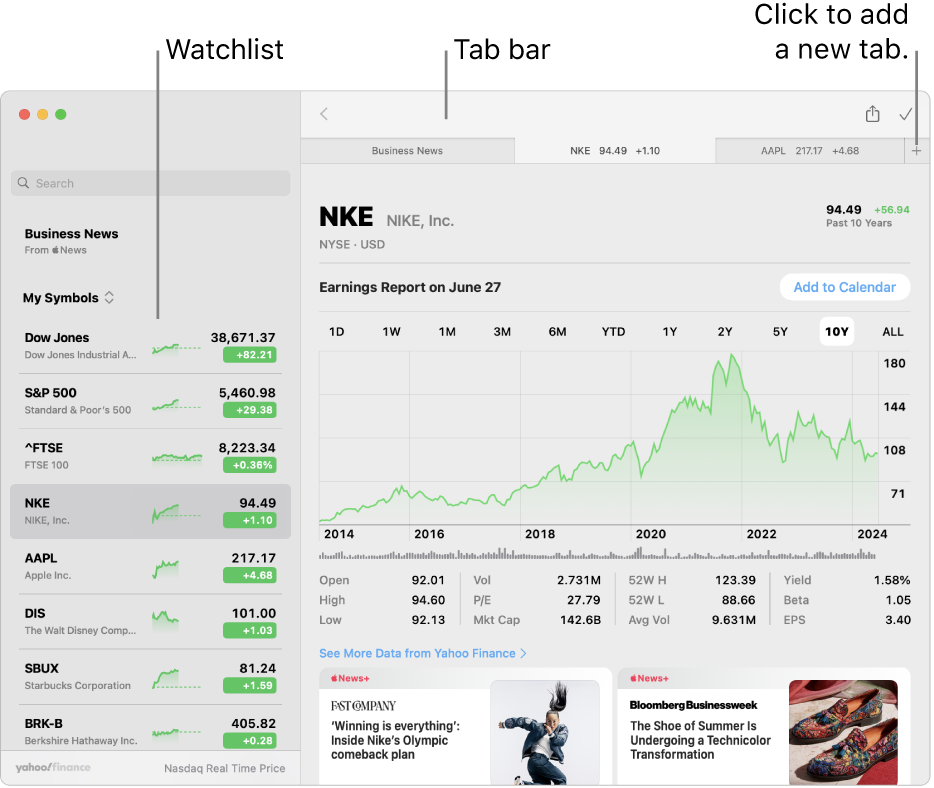

Issued by Invesco, QQQ, also known as the NASDAQ-100 Index Tracking Stock, is an Exchange Traded Fund (ETF) that tracks the performance of the NASDAQ-100 Index. This index is primarily composed of technology companies, along with industrial, health care, and telecommunications entities. As such, QQQ performance offers us a window into the fast-paced tech universe.

A Glance at the Global Stock Market Context

In the global context, QQQ enjoys a significant status due to the large-cap nature of the companies it represents and its exposure to the U.S. market, the largest stock market worldwide. In 2020, amidst the uncertainty triggered by the global pandemic, QQQ outperformed the broader market, demonstrating resilience and the growing influence of tech companies in the global financial landscape.

Navigating QQQ Performance

QQQ has consistently delivered strong returns for investors, thanks to the stellar performance of its constituent companies. Over the last decade, the QQQ performance has triumphed over that of the S&P 500, underscoring its potential as an investment vehicle. Its success can largely be attributed to the outstanding performance of technology giants like Apple, Amazon, and Microsoft.

However, it’s crucial to understand that QQQ’s sector concentration in technology also means higher volatility and potential risk. Thus, it is best suited for investors with a higher risk tolerance and a long-term investment horizon.

Final Thoughts

While the past QQQ performance paints a promising picture, remember that it’s not an assurance of future results. Align your investment with your financial goals, risk tolerance, and investment horizon.

QQQ certainly offers an efficient way to gain exposure to some of the most influential companies globally, hence deserving a spot in a diversified portfolio. However, regular monitoring and astute analysis are key to steering through volatility and getting the most out of your investment.

RELATED READING

-

Read also: Unlocking Potential: Exploring the Top AI Sector Companies for Savvy Investors

Exploring ETFs: A Beginner’s Guide

-

Read also: Unlocking Potential: Exploring the Top AI Sector Companies for Savvy Investors

Understanding Risk and Return in Investing

-

Read also: Unlocking Potential: Exploring the Top AI Sector Companies for Savvy Investors

How to Diversify Your Investment Portfolio

Disclaimer

The content provided in this article is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained herein constitutes a solicitation, recommendation, endorsement, or offer by William Club or any third party service provider to buy or sell any securities or other financial instruments herein.

Leave a Reply