Today, we’re diving deep into the world of financial independence, more specifically, investigating the role real estate plays in achieving this coveted state. Our expert analysis on financial freedom vs real estate will explore the benefits, drawbacks, and considerations essential for anyone striving for financial autonomy.

Understanding Financial Freedom

Financial freedom refers to a state where you have enough savings, investments, and cash on hand to afford the lifestyle you desire without needing to work actively for basic necessities. It means your money is working for you and not the other way around. Achieving this kind of freedom is not a walk in the park; it takes strategic planning, disciplined saving, and smart investing.

The Role of Real Estate in Financial Freedom

Real estate investment has long been viewed as a reliable path to wealth creation and, ultimately, financial freedom. This is attributed to the steady cash flow from rental income, appreciation, tax advantages, and the ability to leverage real estate to build wealth. However, like any investment, it comes with its own set of risks and challenges.

Comparing Financial Freedom and Real Estate

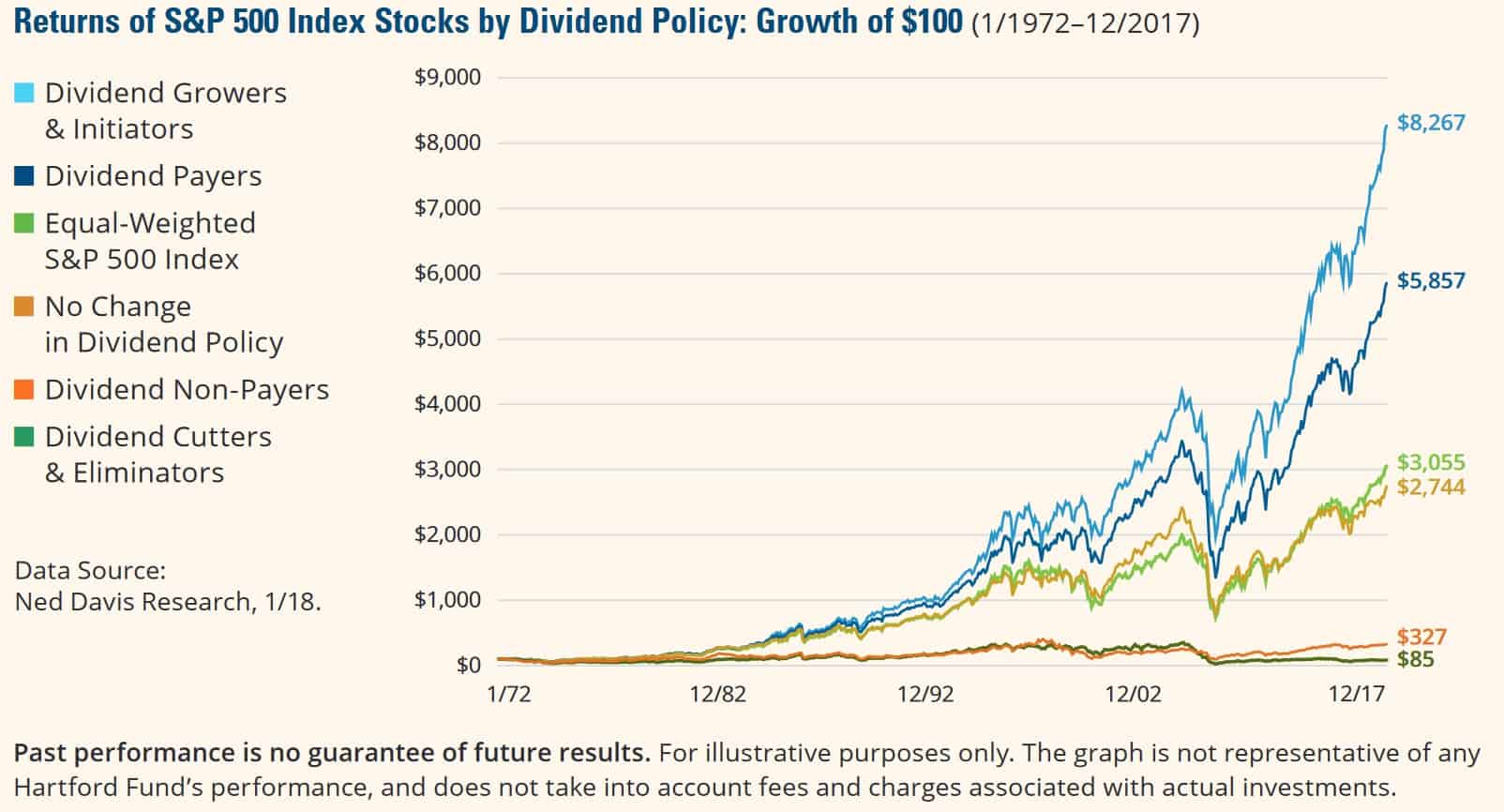

While real estate can contribute significantly to financial freedom, it’s not the only avenue worth exploring. Investments in stocks, bonds, and mutual funds can also provide hefty returns. The key is to diversify your portfolio to minimize risk and maximize potential returns.

Practical Tips on Investing in Real Estate for Financial Freedom

- Do your homework: Understand the market conditions, location, and potential return on investment before purchasing a property.

- Invest in rental properties: Rental income provides a steady stream of income and can pay off the mortgage over time.

- Consider Real Estate Investment Trusts (REITs): If managing physical properties isn’t your thing, consider investing in REITs. They offer a way to invest in real estate without the need to own, operate, or finance properties.

FAQ Section

Is real estate a good path to financial freedom?

Yes, real estate can be a viable path to financial freedom due to its potential for steady income and appreciation. However, it’s essential to understand the risks involved and to make informed decisions.

Do I need to own property to invest in real estate?

No, you can invest in real estate indirectly through Real Estate Investment Trusts (REITs) or real estate crowdfunding platforms.

Financial freedom is not a destination but a journey that requires commitment, discipline, and strategic planning. Investing in real estate is one pathway towards this goal, offering potential income streams and growth opportunities. However, it’s essential to do your homework, understand the risks, and diversify your investment portfolio to safeguard your financial future.

Leave a Reply