What This Page Covers

This page provides an informational overview of navigating a recession without losing money, focusing on publicly available data, context, and commonly discussed considerations. It is designed to help readers understand the topic clearly and objectively.

Understanding is recession without losing money

The concept of experiencing a recession without losing money is a topic of great interest, particularly during times of economic uncertainty. A recession is typically characterized by a decline in economic activity, affecting markets, employment rates, and consumer confidence. When individuals and businesses face a recession, the primary concern is how to preserve wealth and mitigate financial loss. People search for ways to navigate these challenging periods without incurring significant financial setbacks. This topic is frequently discussed in financial circles as stakeholders look for strategies to weather economic downturns while maintaining financial stability.

Key Factors to Consider

There are several key factors to consider when attempting to navigate a recession without losing money. These factors include:

- Diversification: A well-diversified portfolio can help cushion the impact of a recession. By spreading investments across various asset classes—such as stocks, bonds, and commodities—investors can reduce risk.

- Cash Reserves: Maintaining an emergency fund or cash reserves can provide liquidity during economic downturns, allowing individuals to meet expenses without liquidating investments at a loss.

- Debt Management: Reducing high-interest debt before a recession can alleviate financial pressure, as income may be uncertain during economic downturns.

- Market Trends: Staying informed about market trends and economic indicators can help individuals make informed decisions regarding their investments.

Common Scenarios and Examples

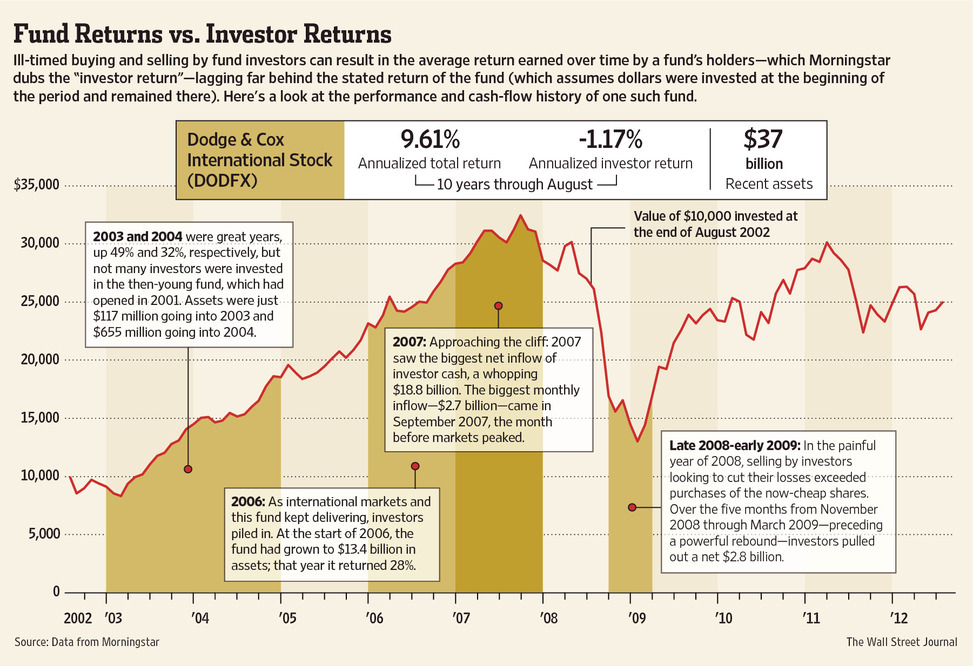

In practice, navigating a recession without losing money involves careful planning and strategic decision-making. For instance, during the 2008 financial crisis, many investors who maintained diversified portfolios and kept a long-term perspective were able to minimize losses. Some investors shifted their focus to defensive stocks, which tend to be less volatile during economic downturns. Others increased their holdings in government bonds, considered safer during times of market turbulence. Additionally, businesses that prioritized cost-cutting measures and maintained strong cash flow were better positioned to survive and recover post-recession.

Practical Takeaways for Readers

- Understanding the importance of diversification and maintaining a balanced portfolio is crucial in mitigating financial risks during a recession.

- Common misunderstandings include the belief that withdrawing from the market during a downturn is always the best strategy. Historically, markets have rebounded, and those who stayed invested often saw positive long-term outcomes.

- Readers may want to review information from reputable financial publications, government economic reports, and advice from financial professionals to better understand market dynamics during a recession.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is is recession without losing money?

It refers to strategies and practices aimed at preserving wealth and minimizing financial loss during economic downturns.

Why is is recession without losing money widely discussed?

This topic is widely discussed as individuals and businesses seek ways to protect their financial interests and ensure stability during uncertain economic times.

Is is recession without losing money suitable for everyone to consider?

While the principles can be beneficial, individual circumstances vary, and strategies should be tailored to personal financial situations and risk tolerance.

Where can readers learn more about is recession without losing money?

Readers can explore official economic reports, company filings, and reputable financial publications for more insights into managing finances during a recession.

Understanding complex topics takes time and thoughtful evaluation. Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply