What This Page Covers

This page provides an informational overview of market volatility forecast 2025, focusing on publicly available data, context, and commonly discussed considerations. It is designed to help readers understand the topic clearly and objectively.

Understanding Market Volatility Forecast 2025

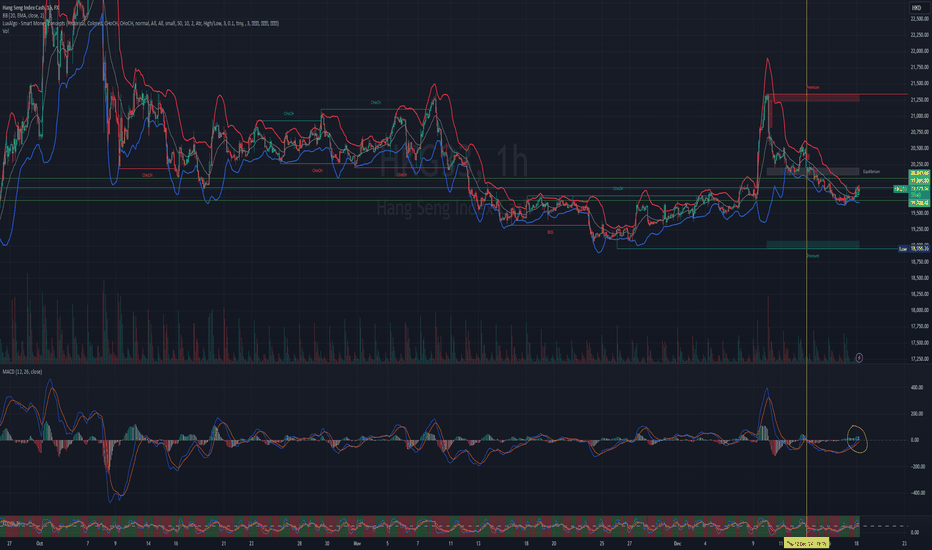

Market volatility forecast 2025 refers to the analysis and predictions regarding the expected fluctuations in financial markets during the year 2025. Investors and analysts frequently search for this term to anticipate market conditions and prepare their strategies accordingly. In financial contexts, market volatility is often associated with the degree of variation in trading prices over a certain period, usually influenced by economic, political, and industry-specific events. Understanding the forecast for 2025 involves examining potential changes in these factors and how they might impact market behavior.

Key Factors to Consider

Several factors are typically associated with market volatility forecast 2025, including:

- Economic Indicators: GDP growth rates, unemployment figures, and inflation data are crucial in assessing economic health and can significantly influence market volatility.

- Monetary Policy: Central bank policies, such as interest rates and quantitative easing, are instrumental in shaping investor expectations and market movements.

- Geopolitical Events: Political stability, trade agreements, and international conflicts can lead to uncertainty, affecting markets worldwide.

- Technological Advancements: Innovations and technological disruptions in industries may alter market dynamics and investor sentiment.

- Corporate Earnings: Company performance reports and earnings announcements can drive market volatility, especially in sectors sensitive to economic changes.

Common Scenarios and Examples

To better understand how the market volatility forecast 2025 might be analyzed, consider the following scenarios:

Increased geopolitical tensions, such as trade disputes between major economies, could potentially lead to heightened market volatility. For example, if trade negotiations between the United States and China become strained, it may result in fluctuating commodity prices and stock market indices.

Another scenario involves changes in monetary policy. If central banks decide to adjust interest rates to combat inflation, it could lead to shifts in investor behavior, impacting bond and equity markets. For instance, an unexpected rate hike might cause a sell-off in bonds, increasing yields and affecting stock valuations.

Practical Takeaways for Readers

- Market volatility is influenced by a multitude of factors, making it essential to consider a broad range of data and indicators.

- Volatility forecasts are not predictions but analyses of potential market conditions; they should be used as part of a comprehensive investment strategy.

- Readers should explore official filings, economic reports, and reputable financial publications for accurate and up-to-date information.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is market volatility forecast 2025?

Market volatility forecast 2025 is an analysis of expected fluctuations in financial markets for the year 2025, based on various economic, political, and industry-specific factors.

Why is market volatility forecast 2025 widely discussed?

It is widely discussed because understanding potential market conditions can help investors and analysts prepare strategies to manage risks and capitalize on opportunities.

Is market volatility forecast 2025 suitable for everyone to consider?

While the forecast provides valuable insights, its relevance depends on individual investment goals, risk tolerance, and market experience.

Where can readers learn more about market volatility forecast 2025?

Readers can explore official filings, company reports, and reputable financial publications for more detailed information on market volatility forecasts.

Understanding complex topics takes time and thoughtful evaluation. Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply