Assessing and Navigating US Stock Market Crash Risks: A Guide for Today’s Investors

Stock market volatility is an inherent part of investing. As a discerning investor, understanding the impact of a potential US stock market crash in the global context is vital. No one can predict market downturns with certainty, but by being prepared, we limit potential losses and capitalize on strategic opportunities. This article aims to guide you in assessing and navigating the volatile waters of the financial market.

Understanding the Impact of a US Stock Market Crash

A US stock market crash can have overwhelming effects on global stock markets. As the world’s largest economy, any significant changes in the US economic landscape reverberate worldwide. Volatility in U.S. markets affects global investor sentiment, currency values, and commodity prices.

Assessing the Risk

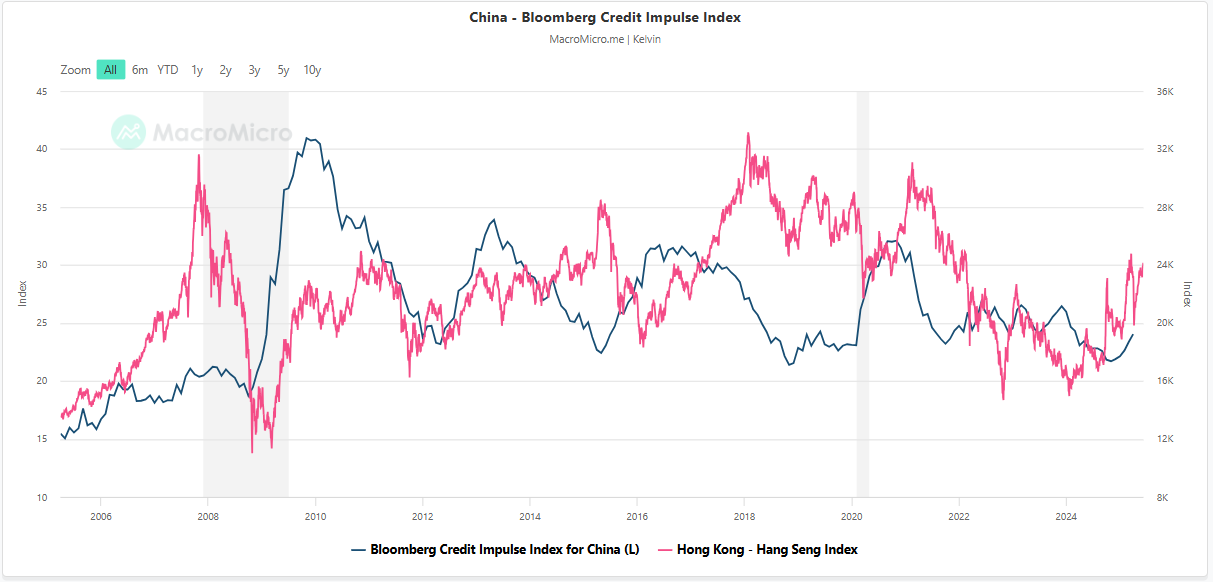

Assessing the risk of a stock market crash involves looking at economic indicators such as employment rate, gross domestic product (GDP), and consumer confidence. High levels of borrowing, speculative investments, and inflated market valuations are also warning signs. Keeping an eye on these indicators will allow you to gauge potential crash risks and take appropriate action.

Building a Diversified Portfolio

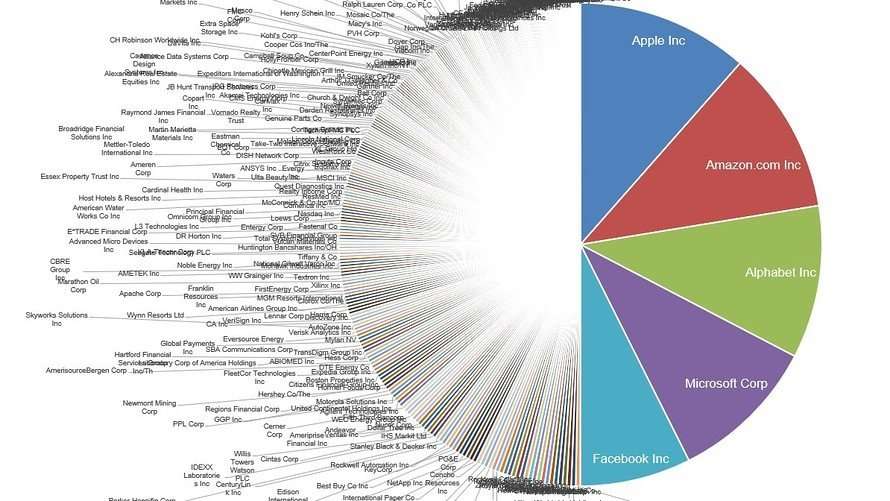

When it comes to risk management, diversification is key. Spreading your investments across different asset classes and geographical sectors can soften the blow of a potential stock market crash. A well-balanced portfolio will include a mix of equities, bonds, commodities, and potentially alternatives such as real estate or precious metals. This strategy tends to spread the risk, ensuring that a decline in one investment is offset by gains in another.

Staying Alert and Adaptable

It’s crucial to stay abreast of economic news and market trends. In times of financial turbulence, a vigilant investor that can adapt quickly will fare better. This means revisiting your investment strategy regularly, reviewing asset allocation, and making adjustments as needed to steer through tumultuous market conditions.

Cash Reserves: A Safety Net

Having cash reserves during a market downturn can be a powerful tool. This allows you to take advantage of lower prices and buy into the market when others are selling off, potentially earning high returns when the market recovers.

Working with a Trusted Advisor

Finally, it can be beneficial to work with a trusted financial advisor or wealth manager. An experienced professional can provide guidance, help navigate market fluctuations, and put your fears in perspective.

RELATED READING

-

Read also: Looking Ahead: Comprehensive Nvidia Stock Analysis for 2025 Investment Strategy

Taking the Fear Out of Investing: A Guide to Understanding Market Volatility

-

Read also: Looking Ahead: Comprehensive Nvidia Stock Analysis for 2025 Investment Strategy

Balancing Act: Mastering Asset Allocation for Optimal Returns

-

Read also: Looking Ahead: Comprehensive Nvidia Stock Analysis for 2025 Investment Strategy

Riding Out the Storm: How to Weather Market Downturns

Disclaimer: The content provided herein is for informational purposes only and should not be construed as financial advice. Always consult a financial advisor or do your own research when making investment decisions.

Leave a Reply