Tesla Stock Forecast: Expert Analysis and Future Investment Strategies

Tesla – a pioneering force in the electric vehicle industry and a household name known round the globe – has made significant waves in the global stock market. In recent years, investors have seen the company’s stock reach great highs, as well as considerable lows. Given the industry’s volatility, what could be the future outlook for Tesla’s stock? In this analytical yet easy-to-understand article, we will dissect expert opinions and potential strategies for investing in Tesla.

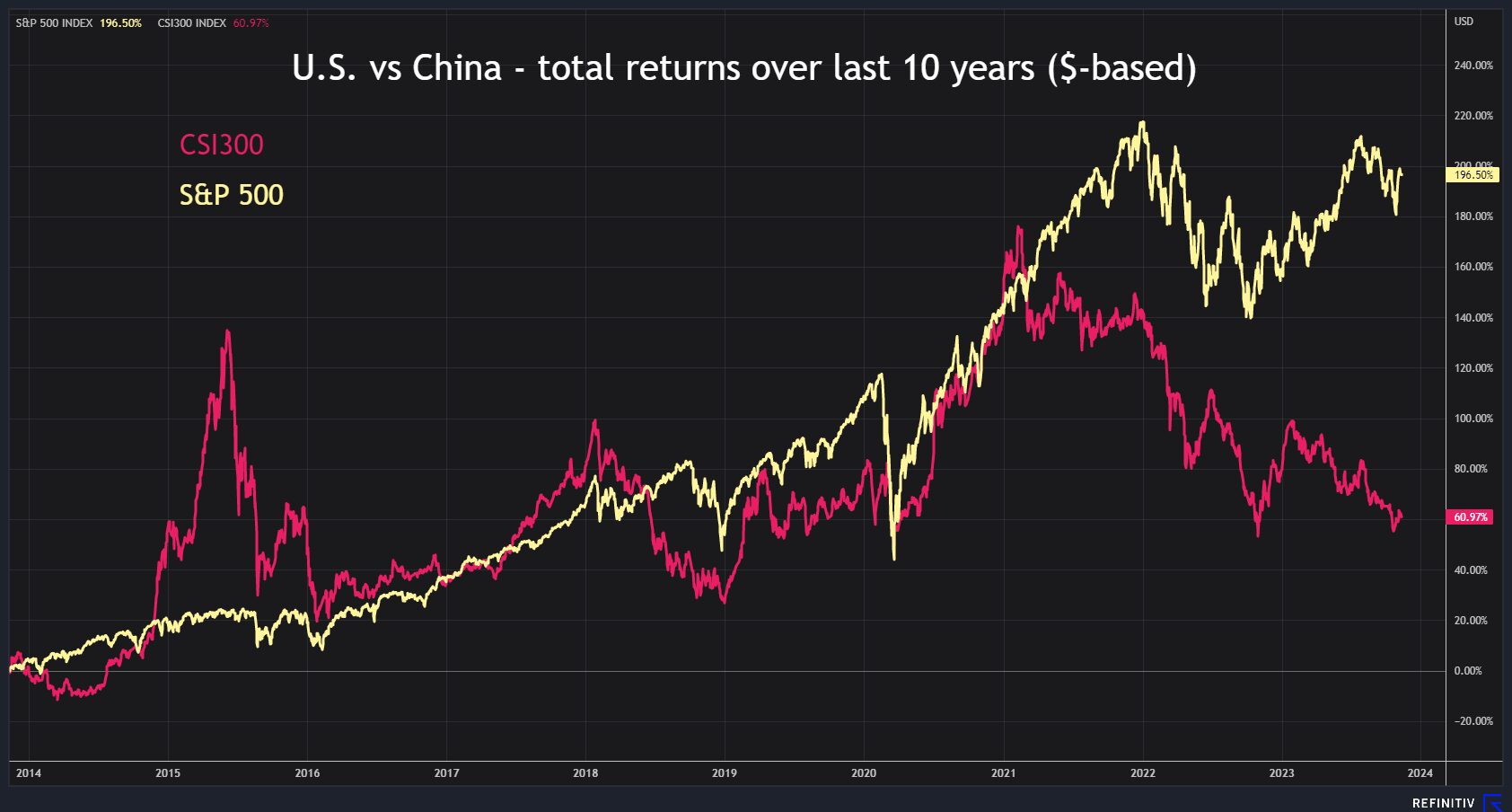

The Global Stock Market Context

For having an accurate Tesla stock forecast, it is vital to view the company’s performance in the larger context of the global stock market. In general, the market has exhibited tremendous resilience in the face of ongoing economic uncertainties and geopolitical tensions. However, sectors like tech and renewable energy have shown notable volatility, with Tesla being no exception.

Expert Analysis of Tesla Stock

Experts’ views regarding the Tesla stock price prediction are often split. Some analysts are bullish on Tesla, envisioning high growth potential due to its leadership in electric vehicle technology, advancements in battery technology, and its CEO Elon Musk’s ambitious plans.

However, bearish analysts caution about Tesla’s high valuation, increasing competition, and regulatory challenges. Yet, it’s worth noting that even in the face of adversity, Tesla has shown a sustained ability to confound critics and reach new heights.

Future Investment Strategies

When considering the Tesla stock future, it’s important to consider long-term investment strategies, rather than focusing solely on short-term price movements. Here are some strategies to consider:

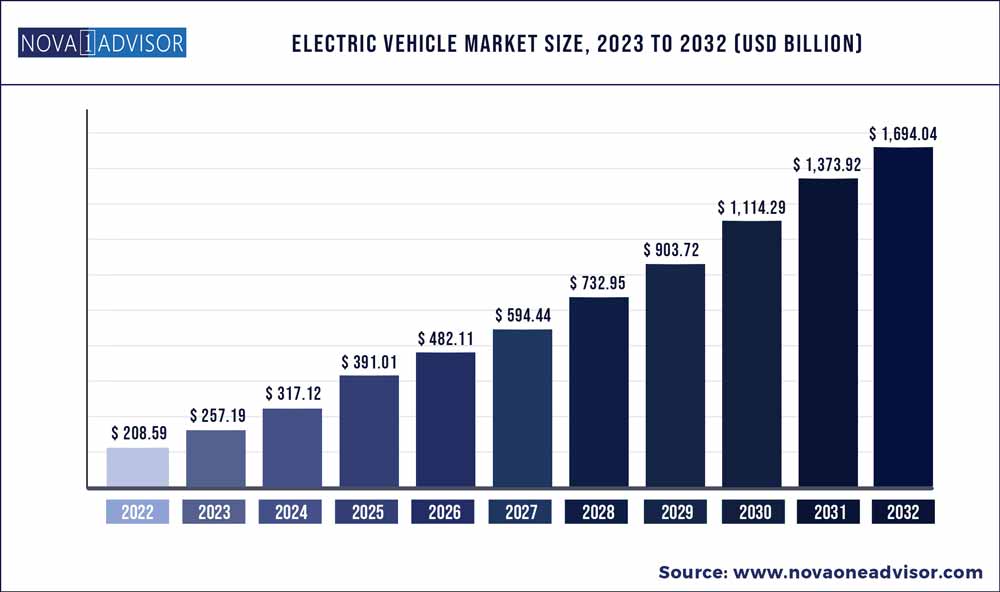

- Invest for the long-term: Tesla is positioned in a sector that’s set for exponential growth. By maintaining a long-term perspective, you stand a chance to reap significant benefits from this growth.

- Dollar-cost averaging: Investing in smaller regular intervals, rather than in one lump sum, can average out the cost of the share and lower the risk.

- Keep an eye on fundamentals: Despite Tesla’s enticing prospects, constantly review the company’s earnings, debts, and market opportunities to ensure a sound investment.

RELATED READING

-

Read also: Assessing and Navigating US Stock Market Crash Risks: a Guide for Today’s Investors

Understanding the Green Energy Market: A Guide for Investors

-

Read also: Assessing and Navigating US Stock Market Crash Risks: a Guide for Today’s Investors

Investing in Tech Stocks: Risks and Rewards

-

Read also: Assessing and Navigating US Stock Market Crash Risks: a Guide for Today’s Investors

Long-Term vs. Short-Term Investment Strategies

Conclusion

The Tesla stock forecast is undoubtedly a contentious topic among investors. While there are certainly risks involved, its strong market position and pioneering status confer undeniable potential. Adopting a disciplined, data-driven strategy may allow savvy investors to navigate the stock’s volatility and channel it towards significant long-term gains.

Disclaimer: The content of this article is for informational purposes only, it should not be considered Financial or Legal Advice. Consult with a financial advisor before making any major financial decisions.

Leave a Reply