What This Page Covers

This page provides an informational overview of stocks trends weekly, focusing on publicly available data, context, and commonly discussed considerations. It is designed to help readers understand the topic clearly and objectively.

Understanding Stocks Trends Weekly

Stocks trends weekly refer to the analysis of stock market movements and patterns over the course of a week. Investors and analysts often look at these trends to gauge market sentiment, identify potential opportunities, and make informed decisions. The weekly perspective provides a short-term view that can capture the dynamics of market activity influenced by economic reports, corporate earnings, geopolitical events, and investor behavior. People search for stocks trends weekly to stay updated on market conditions and to adjust their investment strategies accordingly. In financial and market-related contexts, these trends are discussed in terms of price movements, volume changes, and emerging patterns that could signal future market directions.

Key Factors to Consider

Several key factors are typically associated with stocks trends weekly. These include:

- Market Sentiment: Weekly trends can reflect investor sentiment, which is influenced by news events, economic indicators, and broader market conditions. Positive sentiment may drive stock prices up, while negative sentiment can lead to declines.

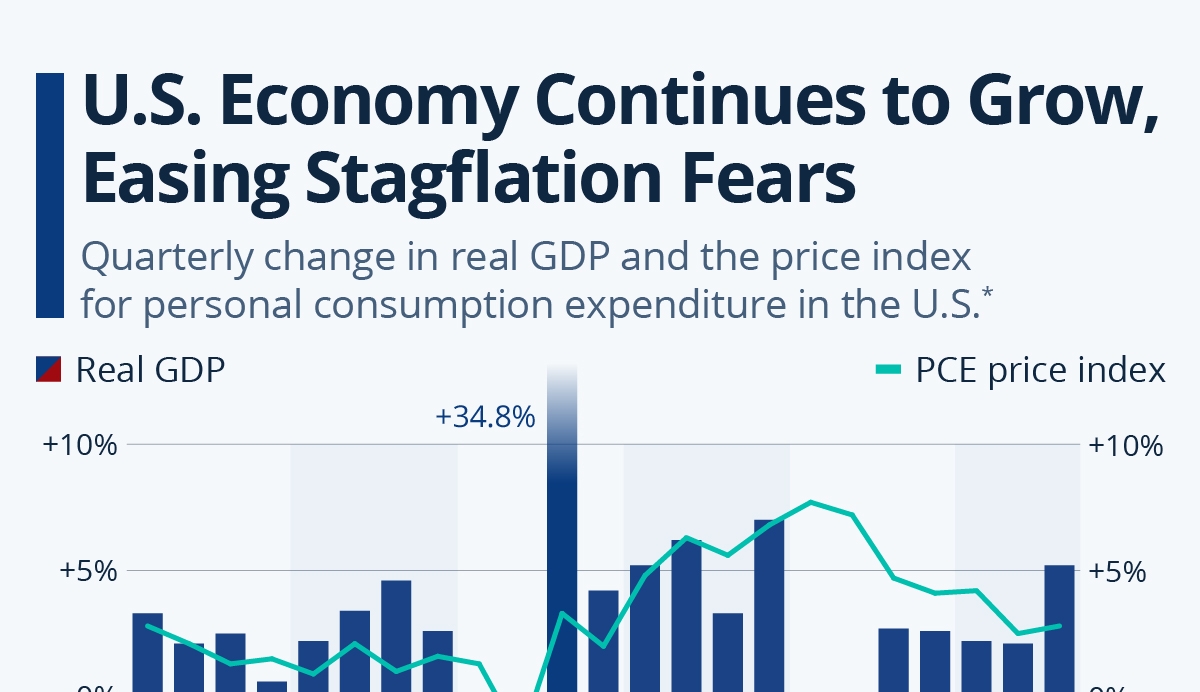

- Economic Reports: Weekly economic data releases, such as unemployment figures, consumer confidence indices, and GDP estimates, can significantly impact stock trends.

- Corporate Earnings: Companies often release earnings reports on a quarterly basis, and these reports can influence weekly trends as investors react to earnings surprises or disappointments.

- Technical Indicators: Analysts use technical analysis tools, such as moving averages and relative strength indices, to identify trends and potential reversals.

- Volume and Volatility: Changes in trading volume and market volatility can indicate the strength and sustainability of weekly trends.

Common Scenarios and Examples

Consider a scenario where a major tech company releases a better-than-expected earnings report. In the week following the release, the company’s stock may experience a significant upward trend as investors react to the positive news. Conversely, if geopolitical tensions rise, the overall market might trend downward due to increased uncertainty and risk aversion. These scenarios highlight how various factors can influence stocks trends weekly and demonstrate the importance of contextual analysis in interpreting these trends.

Practical Takeaways for Readers

- Keep in mind that stocks trends weekly offer a snapshot of short-term market movements, which can be influenced by numerous factors.

- Avoid assuming that weekly trends will continue indefinitely; they are subject to change based on new information and market conditions.

- Consider reviewing multiple sources of information, such as financial news sites, official company filings, and analyst reports, to gain a comprehensive understanding of market trends.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is stocks trends weekly?

Stocks trends weekly refer to the analysis and observation of stock market movements and patterns over the course of a week.

Why is stocks trends weekly widely discussed?

It is widely discussed because it helps investors and analysts understand short-term market dynamics, identify opportunities, and make informed decisions.

Is stocks trends weekly suitable for everyone to consider?

While it can be useful for many investors, individual circumstances, risk tolerance, and investment goals should guide whether or not to focus on weekly trends.

Where can readers learn more about stocks trends weekly?

Readers can learn more by reviewing official filings, company reports, and reputable financial publications that provide insights into market trends and analysis.

Understanding complex topics takes time and thoughtful evaluation. Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply