What This Page Covers

This page provides an informational overview of market insights live, focusing on publicly available data, context, and commonly discussed considerations. It is designed to help readers understand the topic clearly and objectively.

Understanding market insights live

Market insights live refers to real-time data and analysis that provide a snapshot of the current financial market conditions. This information is often sought by investors, analysts, and financial professionals who aim to make informed decisions based on the latest market trends. People search for market insights live to gain an up-to-the-minute understanding of market dynamics, which can include stock prices, economic indicators, and geopolitical events impacting the financial landscape. In financial and market-related contexts, it is discussed in terms of its ability to offer immediate insights that are crucial for executing timely trades and strategic planning.

Key Factors to Consider

When engaging with market insights live, several key factors are typically associated with its data and analysis:

- Volatility: Live insights can help track market volatility, which reflects the degree of variation in trading prices. Understanding volatility is essential for assessing risk and potential return.

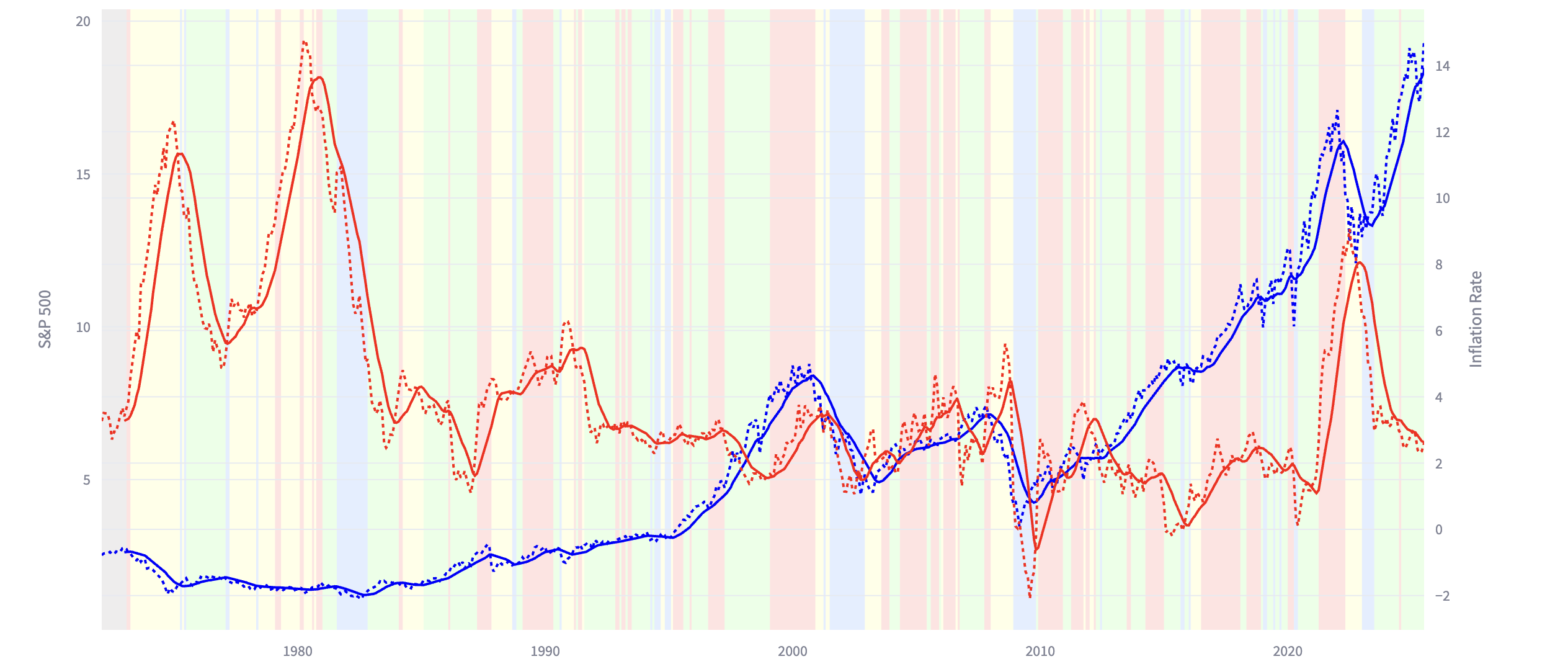

- Economic Indicators: Factors such as GDP growth rates, unemployment rates, and inflation can significantly impact market conditions. Live insights can provide real-time updates on these indicators.

- Market Sentiment: This reflects the overall attitude of investors towards market conditions, influenced by news events and economic reports. Live data can help gauge sentiment shifts.

- Global Events: Political developments, natural disasters, and international relations can all affect market dynamics. Real-time insights allow stakeholders to respond swiftly to such events.

Common Scenarios and Examples

Understanding market insights live is enhanced by examining common scenarios where it plays a pivotal role:

- Trading Strategies: Traders often rely on live insights to execute trades based on market movements. For instance, a sudden drop in oil prices might prompt traders to sell energy stocks.

- Investment Decisions: Investors use live data to refine their portfolios, ensuring they are aligned with current market conditions. A surge in technology stocks might lead to increased investment in that sector.

- Risk Management: Real-time data helps in assessing and mitigating risks. For example, a geopolitical crisis may lead investors to diversify their holdings to preserve capital.

Practical Takeaways for Readers

- Staying informed through market insights live can provide a competitive edge in understanding market dynamics.

- A common misunderstanding is that market insights live guarantee success; however, they are tools for informed decision-making, not predictors of exact outcomes.

- Readers may want to review information from sources such as financial news outlets, economic reports, and official market exchanges to complement live insights.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is market insights live?

Market insights live refers to real-time data and analysis that provide a snapshot of current financial market conditions, aiding in informed decision-making.

Why is market insights live widely discussed?

The topic is widely discussed because it offers immediate insights into market dynamics, which are crucial for timely trading and strategic planning.

Is market insights live suitable for everyone to consider?

While valuable, its suitability depends on individual circumstances, such as investment goals and risk tolerance.

Where can readers learn more about market insights live?

Readers can explore official filings, company reports, or reputable financial publications for more comprehensive understanding.

Understanding complex topics takes time and thoughtful evaluation. Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply