What This Page Covers

This page provides an informational overview of the difference between swing trading step by step, focusing on publicly available data, context, and commonly discussed considerations.

It is designed to help readers understand the topic clearly and objectively.

Understanding Difference Between Swing Trading Step by Step

Swing trading is a popular strategy among traders who aim to capture gains in a stock (or any financial instrument) over a period of a few days to several weeks. The term “difference between swing trading step by step” often arises when individuals seek to understand the nuances of swing trading compared to other trading strategies. People search for this topic to gain clarity on the methodical steps involved in executing swing trades effectively and understanding how it stands apart from other trading styles like day trading or long-term investing. In financial contexts, swing trading is often discussed for its potential to capitalize on market volatility without the need for constant market monitoring.

Key Factors to Consider

When considering the difference between swing trading step by step, several factors come into play:

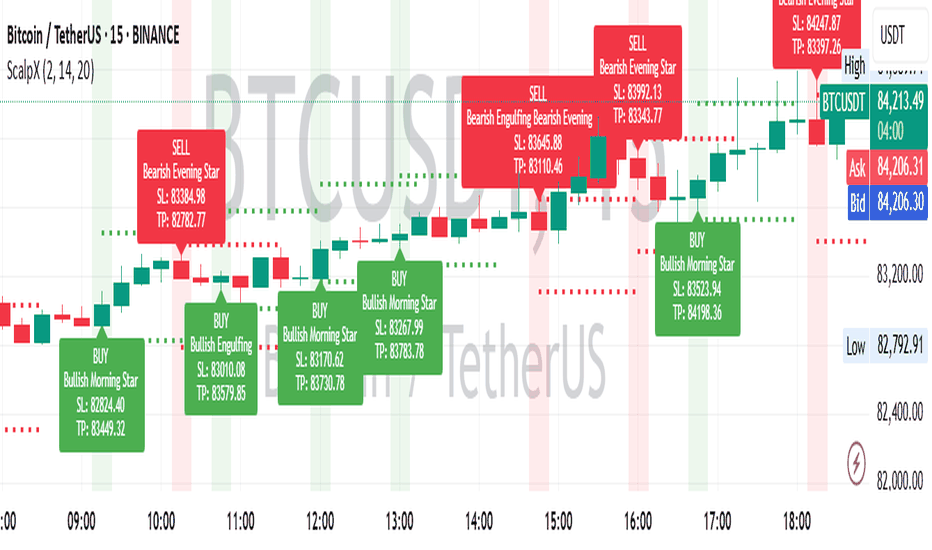

- Market Analysis: Swing traders typically use technical analysis to identify trends and patterns that signal potential trading opportunities. This involves examining charts, indicators, and historical data to make informed decisions.

- Time Frame: Unlike day trading, which focuses on short-term price movements within a single day, swing trading allows positions to be held for several days or weeks, providing more flexibility.

- Risk Management: Effective swing trading requires a robust risk management strategy, including setting stop-loss orders to minimize potential losses.

- Capital Requirements: While swing trading does not require large amounts of capital compared to other strategies, traders must ensure they have sufficient funds to cover potential losses and margin requirements.

- Emotional Resilience: The ability to stay calm during market fluctuations is crucial, as swing trading can involve holding positions during volatile periods.

Common Scenarios and Examples

To illustrate how the difference between swing trading step by step is applied in practice, consider the following example:

A trader identifies a stock that has been trading within a defined price range. Using technical analysis, they notice a bullish pattern forming, suggesting a potential upward movement. The trader enters a position, setting a stop-loss order below the current trading range to protect against downside risk. Over the next few days, the stock price climbs as anticipated, and the trader exits the position at a predetermined profit target, having successfully executed a swing trade.

This scenario exemplifies the strategic entry and exit points that define swing trading, showcasing the methodical approach required to capitalize on short- to medium-term market movements without the need for daily trading.

Practical Takeaways for Readers

- Important observations include the necessity for thorough technical analysis and a clear understanding of market trends before engaging in swing trading.

- A common misunderstanding is that swing trading is the same as day trading; however, swing trading involves holding positions for longer periods and requires different strategies and risk management techniques.

- Readers may want to review technical analysis guides, market trend reports, and risk management strategies to enhance their understanding of swing trading.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice.

Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is difference between swing trading step by step?

The difference between swing trading step by step refers to the methodical approach of planning, executing, and managing trades over a period of days to weeks, distinguishing it from more short-term or long-term trading strategies.

Why is difference between swing trading step by step widely discussed?

The topic is widely discussed because it addresses the strategic and analytical aspects of swing trading, appealing to those looking to understand and implement this trading style effectively.

Is difference between swing trading step by step suitable for everyone to consider?

Swing trading may not be suitable for everyone, as it requires a certain level of market knowledge, risk tolerance, and emotional resilience. Individual circumstances and trading goals should be considered before adopting this strategy.

Where can readers learn more about difference between swing trading step by step?

Readers can learn more from official filings, company reports, reputable financial publications, and educational resources focused on trading strategies and technical analysis.

Understanding complex topics takes time and thoughtful evaluation.

Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply