What This Page Covers

This page provides an informational overview of inflation insights for investors, focusing on publicly available data, context, and commonly discussed considerations. It is designed to help readers understand the topic clearly and objectively.

Understanding inflation insights for investors

Inflation insights for investors are critical for understanding the potential impact of inflation on investment portfolios. Inflation, which refers to the general rise in prices over time, can erode purchasing power and influence investment returns. Investors seek insights into inflation to make informed decisions about asset allocation, risk management, and future financial planning. This topic is commonly discussed in financial markets as it affects interest rates, bond yields, and stock valuations. By analyzing inflation trends, investors can better anticipate economic conditions and adjust their strategies accordingly.

Key Factors to Consider

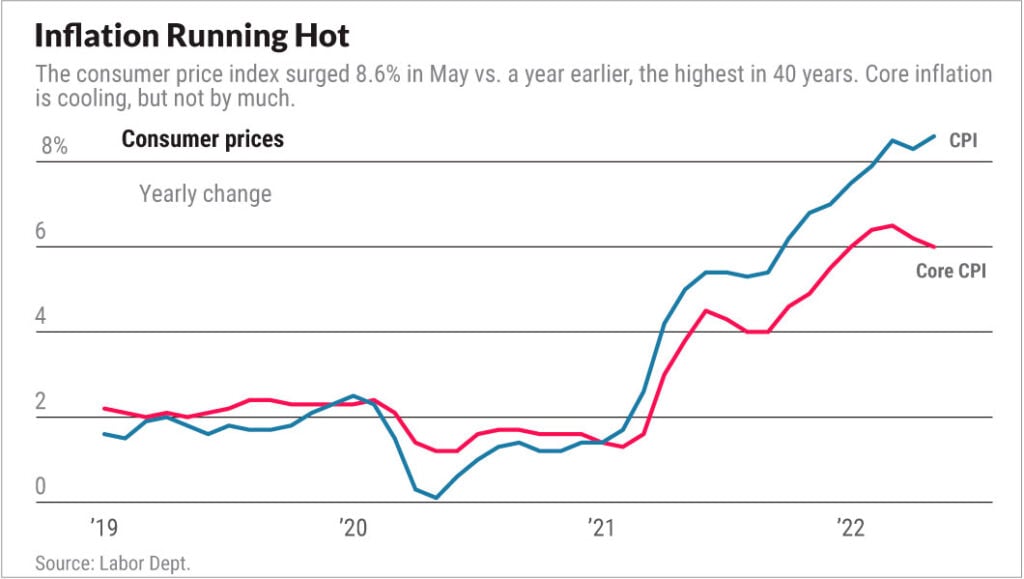

Several key factors are associated with inflation insights for investors. Firstly, the Consumer Price Index (CPI) and Producer Price Index (PPI) are crucial indicators that measure inflation at the consumer and wholesale levels, respectively. Changes in these indices can signal shifts in inflationary trends. Secondly, central bank policies, such as interest rate adjustments, are pivotal in controlling inflation. Investors closely monitor statements from institutions like the Federal Reserve to gauge future policy directions. Additionally, wage growth and employment data provide insights into inflationary pressures within the economy. Supply chain disruptions and commodity prices also play significant roles in influencing inflation rates. Understanding these factors helps investors assess potential risks and opportunities related to inflation.

Common Scenarios and Examples

Consider a scenario where inflation rates begin to rise steadily over several months. Investors might analyze how this trend affects different asset classes. For example, bonds typically suffer in inflationary environments because rising prices erode the fixed interest payments’ real value. Conversely, equities might offer a hedge against inflation if companies can pass increased costs to consumers through higher prices. Real estate can also act as a potential inflation hedge, given its tangible nature and the ability to adjust rents over time. Another example is the impact of inflation on retirement savings, where consistent inflationary pressure could diminish the purchasing power of fixed-income investments. These scenarios highlight how investors use inflation insights to navigate economic landscapes effectively.

Practical Takeaways for Readers

- Highlight important observations readers should be aware of. – Inflation affects different asset classes uniquely, and understanding these dynamics can help in portfolio diversification.

- Clarify common misunderstandings related to inflation insights for investors. – Not all assets are negatively impacted by inflation; some may offer protective benefits.

- Explain what information sources readers may want to review independently. – Regularly review economic reports, central bank announcements, and reputable financial publications to stay informed about inflation trends.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is inflation insights for investors?

Inflation insights for investors involve understanding how inflation trends impact investment strategies and economic conditions.

Why is inflation insights for investors widely discussed?

It is discussed because inflation affects purchasing power, asset valuations, and can influence central bank policies, making it crucial for investment planning.

Is inflation insights for investors suitable for everyone to consider?

While important, individual circumstances vary, and some may need more tailored advice. It’s advisable to consult financial professionals.

Where can readers learn more about inflation insights for investors?

Readers can explore official filings, company reports, or reputable financial publications to gain more insights.

Understanding complex topics takes time and thoughtful evaluation. Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply