What This Page Covers

This page provides an informational overview of market volatility guide breaking, focusing on publicly available data, context, and commonly discussed considerations. It is designed to help readers understand the topic clearly and objectively.

Understanding Market Volatility Guide Breaking

Market volatility guide breaking refers to the analysis and interpretation of dramatic changes in the market’s volatility. This typically involves identifying shifts in market trends, price fluctuations, and other indicators that suggest increased uncertainty or risk. Investors and analysts search for information on this topic to better understand market dynamics and prepare for potential impacts on investments. It is commonly discussed in financial contexts where the stability and predictability of markets are of paramount concern.

Key Factors to Consider

Several key factors are associated with market volatility guide breaking. These include:

- Market Indicators: Factors such as the Volatility Index (VIX), economic data releases, and geopolitical events can signal impending volatility.

- Investor Sentiment: Changes in investor confidence, often measured through surveys or trading volumes, can precede shifts in market volatility.

- Regulatory Changes: New regulations or changes in monetary policy can lead to uncertainty and increased market fluctuations.

- Global Events: Economic crises, political instability, or natural disasters can disrupt markets and lead to heightened volatility.

Understanding these factors helps in analyzing market conditions and preparing for possible scenarios.

Common Scenarios and Examples

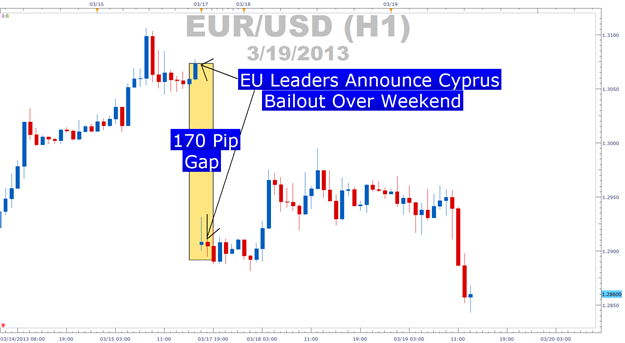

Market volatility guide breaking can be observed in several scenarios. For example, during the 2008 financial crisis, unforeseen economic shocks led to significant market fluctuations, prompting analysts to re-evaluate volatility guides. Similarly, the onset of the COVID-19 pandemic in 2020 created unprecedented market conditions, causing volatility indicators to hit record levels. Such events demonstrate how external shocks can lead to rapid changes in market stability, requiring close examination of volatility guides.

Practical Takeaways for Readers

- Staying informed about market indicators is crucial for anticipating potential volatility.

- Recognize that volatility is a natural part of market cycles, and not all fluctuations indicate a crisis.

- Consulting multiple sources, such as economic reports and expert analyses, can provide a broader perspective.

- Independent research and professional consultation are vital before making investment decisions.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is market volatility guide breaking?

Market volatility guide breaking is the analysis and interpretation of significant changes in market volatility, often through the use of specific indicators and analytical tools.

Why is market volatility guide breaking widely discussed?

It is widely discussed due to its impact on investment decisions, as understanding market volatility can help in risk management and strategic planning.

Is market volatility guide breaking suitable for everyone to consider?

While the concept can be beneficial for understanding market conditions, its suitability depends on individual financial goals and risk tolerance.

Where can readers learn more about market volatility guide breaking?

Readers can learn more from official filings, company reports, or reputable financial publications that provide in-depth analyses and data.

Understanding complex topics takes time and thoughtful evaluation. Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply