What This Page Covers

This page provides an informational overview of the best time to buy index funds versus real estate, focusing on publicly available data, context, and commonly discussed considerations. It is designed to help readers understand the topic clearly and objectively.

Understanding Best Time to Buy Index Fund vs Real Estate

The question of the best time to buy index funds versus real estate is a frequently discussed topic among investors and financial analysts. The core of this inquiry rests on understanding the timing for investing in these two distinct asset classes. Index funds are pools of investments tied to a specific index, such as the S&P 500, offering diversification and typically lower fees. Real estate investment, on the other hand, involves purchasing property either for rental income or capital appreciation.

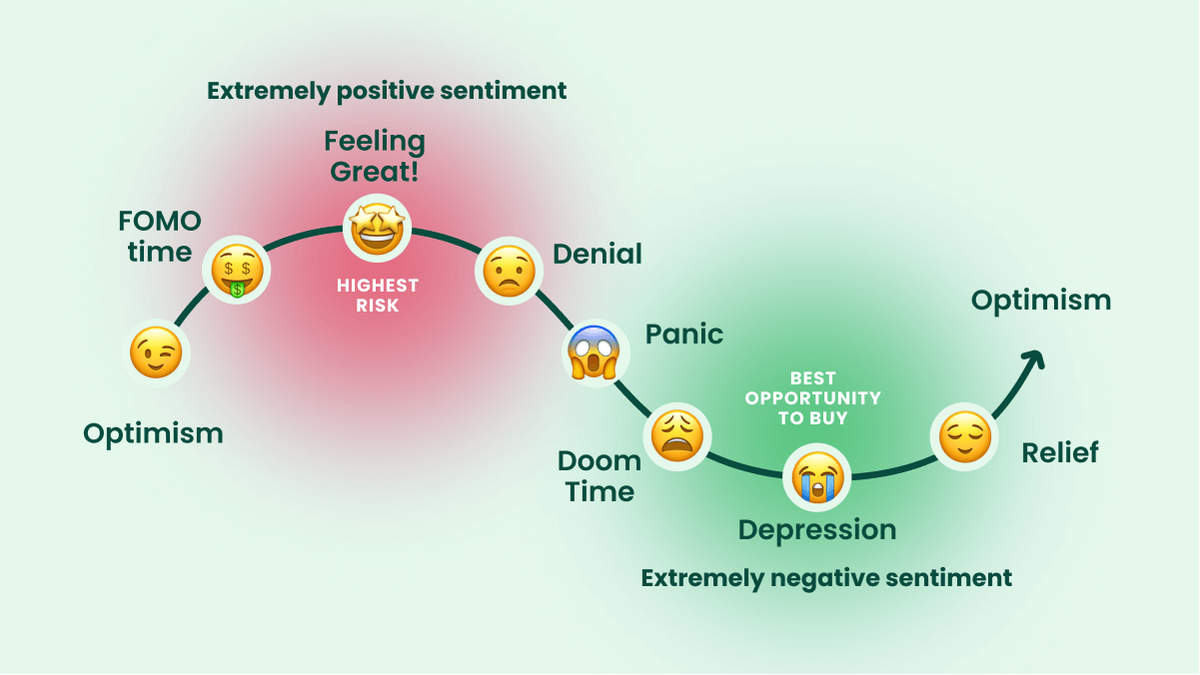

Investors often search for guidance on timing due to the cyclical nature of markets. Economic conditions, interest rates, and market sentiment can influence the decision on when to invest in index funds or real estate. Financial experts often debate this topic, analyzing historical data and economic indicators to provide insights.

Key Factors to Consider

Several factors influence the best time to invest in index funds or real estate. For index funds, market valuations, interest rates, and economic growth forecasts are crucial. Lower market valuations can present buying opportunities, while rising interest rates may impact the cost of borrowing and the valuation of stocks. Economic growth forecasts provide a macroeconomic backdrop that can affect market performance.

For real estate, interest rates, housing market trends, and local economic conditions are significant considerations. Lower interest rates can make borrowing more affordable, potentially boosting real estate demand. Understanding housing supply and demand dynamics in specific areas is also essential, as it affects property prices and investment potential.

Common Scenarios and Examples

Consider an investor in 2008, during the financial crisis. Index fund prices dropped significantly due to market turmoil, presenting potential buying opportunities for those with a long-term perspective. Conversely, real estate prices in certain areas also declined, offering opportunities for investors interested in property acquisition.

Another scenario could be an investor in 2020, amid the COVID-19 pandemic. The stock market experienced significant volatility, leading some investors to seek refuge in index funds for diversification. Meanwhile, low interest rates and remote work trends spurred interest in suburban and rural real estate, impacting property values and investment strategies.

Practical Takeaways for Readers

- Market conditions and economic indicators are crucial in determining the best time to invest in index funds or real estate.

- Investment decisions should align with individual financial goals and risk tolerance.

- Readers should review multiple information sources, such as economic reports and market analyses, to form a well-rounded perspective.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is the best time to buy index fund vs real estate?

The best time to buy depends on various factors, including market conditions, economic indicators, and individual financial goals.

Why is the best time to buy index fund vs real estate widely discussed?

It is widely discussed because timing can significantly impact investment outcomes, and both asset classes have unique characteristics and market cycles.

Is the best time to buy index fund vs real estate suitable for everyone to consider?

It depends on individual circumstances, including financial goals, risk tolerance, and investment strategies.

Where can readers learn more about the best time to buy index fund vs real estate?

Readers can consult official filings, company reports, reputable financial publications, and seek insights from financial advisors.

Understanding complex topics takes time and thoughtful evaluation. Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply