What This Page Covers

This page provides an informational overview of whether you should invest in finance for 2025, focusing on publicly available data, context, and commonly discussed considerations. It is designed to help readers understand the topic clearly and objectively.

Understanding Should You Invest in Finance for 2025

“Should you invest in finance for 2025?” is a question that has gained traction as investors and analysts anticipate the evolving landscape of the financial sector. With the rapid advancements in technology, changes in global economic policies, and the ever-present market volatility, the financial industry presents both opportunities and challenges. People search for this term to gain insights into potential investment strategies, risk assessments, and to understand how upcoming trends could impact their financial decisions. The topic is commonly discussed in financial news outlets, investment forums, and among market analysts, emphasizing the importance of informed decision-making in an unpredictable economy.

Key Factors to Consider

When contemplating whether to invest in finance for 2025, several key factors come into play:

Economic Indicators: Monitoring interest rates, inflation, and GDP growth can provide insights into the economic climate and its impact on financial markets. A stable or growing economy often bodes well for financial investments, whereas uncertainty may demand caution.

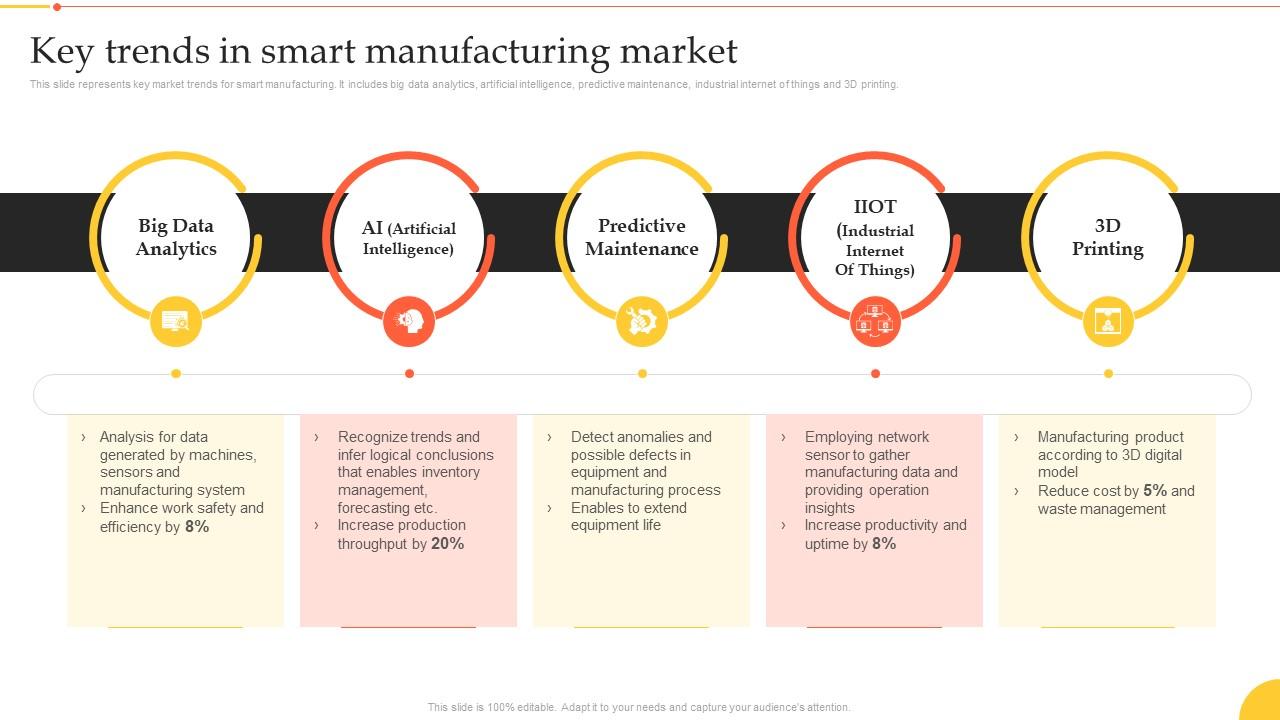

Technological Advancements: The financial sector is increasingly influenced by technology, including fintech innovations, blockchain technology, and AI-driven analytics. These advancements can create new opportunities for growth and efficiency but also introduce new risks.

Regulatory Changes: Financial regulations can shape the investment landscape significantly. Changes in laws and policies can affect everything from banking operations to investment strategies, making it crucial to stay informed about potential regulatory shifts.

Market Sentiment: The behavior and expectations of investors can influence market performance. Understanding market trends and sentiment can help in assessing the potential for returns and identifying sectors poised for growth.

Common Scenarios and Examples

One scenario involves the integration of fintech in traditional banking. As fintech companies continue to disrupt the financial services industry, traditional banks might adapt by incorporating digital solutions to enhance their service offerings. Investors might observe banks that are successfully integrating these technologies as potential opportunities.

Another example is the impact of global economic policies, such as trade agreements or changes in interest rates set by central banks. For instance, a decrease in interest rates could lead to increased borrowing and spending, potentially boosting financial markets. Investors may analyze these scenarios to forecast market movements and adjust their portfolios accordingly.

Practical Takeaways for Readers

- Stay informed about economic indicators and how they might affect the financial sector.

- Recognize the role of technology in shaping financial services and the associated opportunities and risks.

- Be aware of regulatory changes that could impact investment strategies.

- Consider analyzing market sentiment and trends to make informed investment decisions.

- Review independent, reputable information sources to verify insights and data.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is should you invest in finance for 2025?

It refers to the consideration of investment opportunities within the financial sector for the year 2025, evaluating potential risks and rewards based on current and projected trends.

Why is should you invest in finance for 2025 widely discussed?

The topic is widely discussed due to the dynamic nature of the financial industry, impacted by technological advancements, regulatory changes, and economic conditions, which necessitates strategic investment planning.

Is should you invest in finance for 2025 suitable for everyone to consider?

While the topic is relevant, its suitability depends on individual circumstances, including financial goals, risk tolerance, and investment knowledge. Professional advice is recommended.

Where can readers learn more about should you invest in finance for 2025?

Readers can explore official filings, company reports, reputable financial publications, and consult financial advisors for comprehensive insights.

Understanding complex topics takes time and thoughtful evaluation. Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply