What This Page Covers

This page provides an informational overview of top portfolio diversification vs real estate, focusing on publicly available data, context, and commonly discussed considerations.

It is designed to help readers understand the topic clearly and objectively.

Understanding top portfolio diversification vs real estate

Top portfolio diversification and real estate investment represent two distinct strategies within financial planning. Portfolio diversification involves spreading investments across various asset classes to reduce risk and enhance returns, while real estate investment focuses on acquiring properties for income generation and capital appreciation. People often search for this topic to weigh the benefits and drawbacks of each approach, aiming to optimize their investment strategies.

In financial contexts, diversification is lauded for its ability to mitigate risks by not being overly reliant on a single asset class. Real estate, on the other hand, is often discussed in terms of its potential for stable income through rental yields and its tangible nature, which many investors find appealing.

Key Factors to Consider

When comparing top portfolio diversification with real estate, several key factors should be considered:

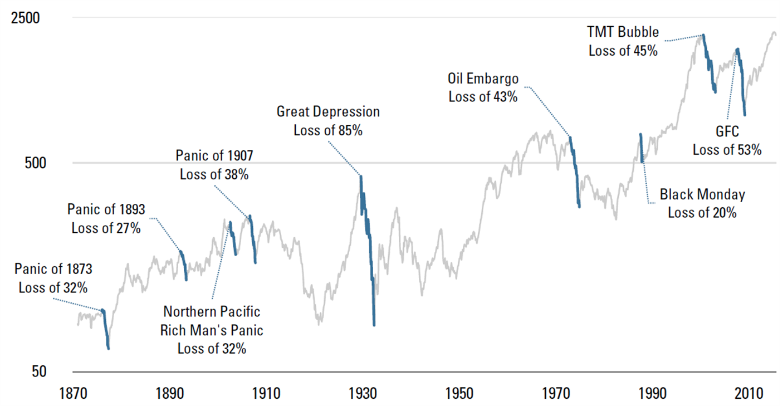

- Risk Management: Diversification aims to reduce the impact of volatility by spreading risk across multiple investments. Real estate can be less volatile compared to stocks or bonds but is not immune to market downturns.

- Liquidity: Stocks and bonds are typically more liquid than real estate, which can be a deciding factor for those needing quick access to their funds.

- Income Generation: Real estate can offer steady rental income, whereas diversified portfolios may rely on dividends and interest, which can fluctuate based on market conditions.

- Capital Requirements: Real estate often requires significant initial capital and ongoing maintenance costs, while portfolio diversification can start with smaller investments.

- Market Exposure: A diversified portfolio provides broader market exposure which can be beneficial in various economic conditions, whereas real estate is usually more localized.

Common Scenarios and Examples

Consider an investor with a $500,000 capital. They might choose to invest in a diversified portfolio comprising stocks, bonds, and mutual funds, which allows them to adjust their allocations based on market trends. This approach provides flexibility and quick rebalancing potential to align with financial goals.

Alternatively, the same investor might opt to purchase a rental property. This decision could yield consistent monthly income and potential tax benefits. However, the investor must consider potential challenges such as property management and market-specific risks like real estate market downturns.

Practical Takeaways for Readers

- Top portfolio diversification offers risk management benefits by spreading investments across various asset classes.

- Real estate investments can provide stable income but require significant capital and involve specific risks.

- It is crucial to understand the liquidity constraints and market exposure differences between these two approaches.

- Readers should review financial reports, market analyses, and economic forecasts to make informed decisions.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice.

Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is top portfolio diversification vs real estate?

Top portfolio diversification refers to spreading investments across various asset classes to mitigate risk, whereas real estate investment focuses on purchasing property for income and capital gains.

Why is top portfolio diversification vs real estate widely discussed?

This topic is widely discussed because both strategies offer distinct advantages and risks, and investors are keen to understand which approach aligns best with their financial objectives.

Is top portfolio diversification vs real estate suitable for everyone to consider?

Suitability depends on individual financial goals, risk tolerance, and capital availability. Each investor must evaluate these factors to determine the best strategy.

Where can readers learn more about top portfolio diversification vs real estate?

Readers can explore official filings, company reports, and reputable financial publications such as The Wall Street Journal, Bloomberg, and Financial Times for more insights.

Understanding complex topics takes time and thoughtful evaluation.

Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply