What This Page Covers

This page provides an informational overview of whether you should invest in a recession, focusing on publicly available data, context, and commonly discussed considerations. It is designed to help readers understand the topic clearly and objectively.

Understanding should you invest in recession

The question of whether to invest during a recession is a common concern among investors and individuals interested in financial markets. A recession is generally characterized by a decline in economic activity, typically evidenced by two consecutive quarters of negative GDP growth. The search for information on investing during a recession is driven by the desire to understand how economic downturns affect investment opportunities and risks. In financial and market-related contexts, this topic is frequently discussed as investors seek to determine the best strategies to preserve and grow their wealth amidst economic uncertainties.

Key Factors to Consider

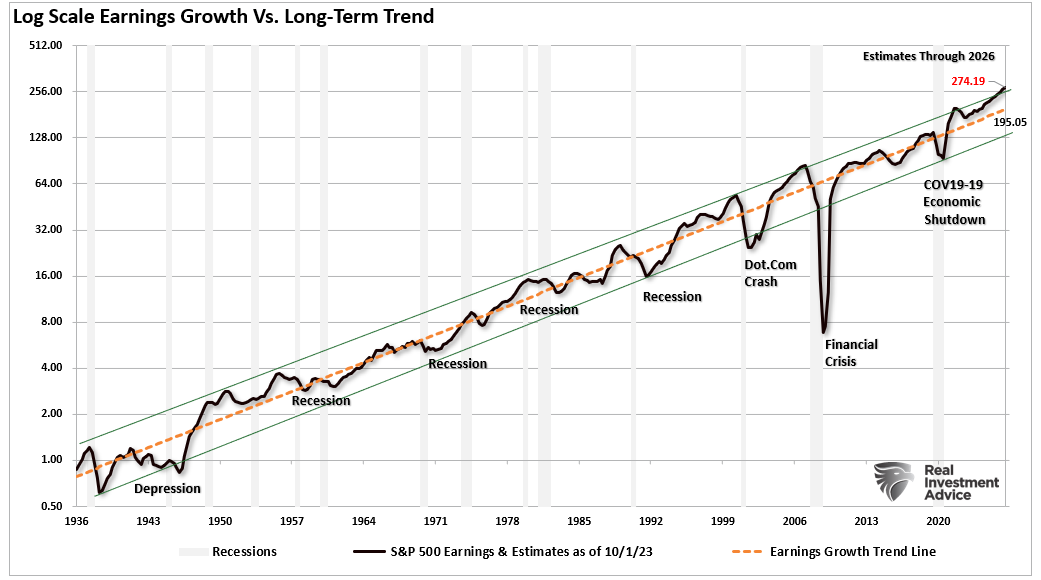

When contemplating investment during a recession, several key factors should be considered. Firstly, understanding market cycles and historical data can provide insights into how different asset classes perform during downturns. Stocks, for instance, often experience volatility, but certain sectors, like consumer staples and healthcare, may demonstrate resilience due to consistent demand. Secondly, interest rates play a significant role; lower rates, which are common during recessions, can make borrowing cheaper but also affect bond yields negatively. Additionally, individual risk tolerance is crucial — investors must assess their capacity to withstand potential losses and market fluctuations. Lastly, cash flow management becomes critical; having liquid assets can provide flexibility and security during economic contractions.

Common Scenarios and Examples

In practice, analyzing whether to invest during a recession often involves examining various scenarios. For instance, during the 2008 financial crisis, many investors shifted their focus to defensive stocks and bonds, which provided more stability compared to more volatile assets. Similarly, real estate can be an attractive option if property prices decline significantly, but this may vary depending on local market conditions. Another example is the technology sector, which has shown robust growth even in challenging economic times, driven by innovation and changing consumer behaviors. Such scenarios illustrate the importance of being adaptable and informed when making investment decisions during a recession.

Practical Takeaways for Readers

- Highlight important observations readers should be aware of, such as the potential for certain asset classes to perform differently during economic downturns.

- Clarify common misunderstandings related to investing in a recession, such as the assumption that all investments lose value during these times, which is not necessarily the case.

- Explain what information sources readers may want to review independently, like official economic reports, financial news outlets, and analysis from reputable financial institutions.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is should you invest in recession?

Investing in a recession refers to the strategic allocation of resources into financial assets during periods of economic decline, with the aim of capitalizing on potential opportunities or mitigating risks.

Why is should you invest in recession widely discussed?

The topic is widely discussed due to the inherent challenges and opportunities that recessions present, prompting investors to seek strategies that can protect or grow their portfolios.

Is should you invest in recession suitable for everyone to consider?

Investing during a recession is not suitable for everyone; it depends on individual financial situations, risk tolerance, and investment goals. Careful consideration and professional advice are recommended.

Where can readers learn more about should you invest in recession?

Readers can learn more from general sources such as official filings, company reports, or reputable financial publications, which offer insights and analyses on market trends and economic conditions.

Understanding complex topics takes time and thoughtful evaluation. Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply