What This Page Covers

This page provides an informational overview of stock trends for beginners, focusing on publicly available data, context, and commonly discussed considerations. It is designed to help readers understand the topic clearly and objectively.

Understanding Stock Trends for Beginners

Stock trends for beginners refer to the patterns and movements in stock prices that are often analyzed to determine potential future behavior in the stock market. Individuals search for this information to gain a foundational understanding of how stocks behave and to make informed decisions. In financial contexts, stock trends are typically evaluated through various analytical tools and historical data to identify patterns that might suggest future price movements.

Beginners are particularly interested in stock trends as they provide a gateway into understanding market dynamics without the necessity of complex financial knowledge. By observing trends, new investors can begin to grasp concepts such as bullish and bearish markets, cyclical patterns, and market volatility. This foundational knowledge is crucial for anyone looking to engage with the stock market more actively.

Key Factors to Consider

When examining stock trends, beginners should consider several key factors:

- Market Sentiment: The overall attitude of investors towards a particular stock or the market as a whole can greatly influence stock trends. Positive sentiment might drive prices up, while negative sentiment can lead to declines.

- Economic Indicators: Factors such as interest rates, unemployment rates, and GDP growth are crucial in assessing market conditions that impact stock trends.

- Historical Data: Past performance and historical price data can provide insights into potential future trends, although they are not predictive guarantees.

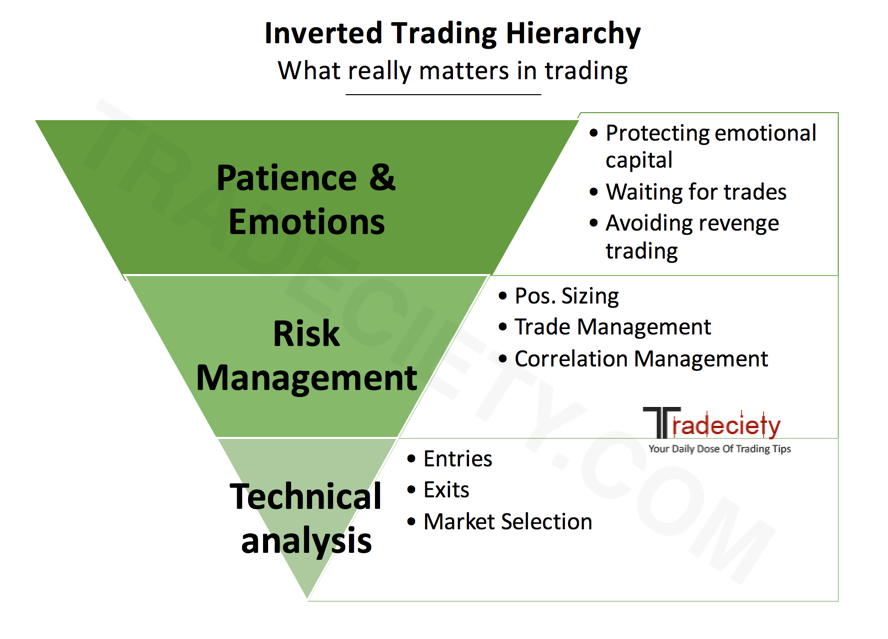

- Technical Analysis: This involves using charts and models to identify patterns that might indicate future price movements. Common tools include moving averages and the Relative Strength Index (RSI).

- Industry Trends: The performance of an industry can impact the stocks within it. Tracking industry developments can offer clues about stock trends.

Common Scenarios and Examples

To better understand stock trends, consider the following scenarios:

Scenario 1: A Bull Market

In a bull market, stock prices are generally rising. For beginners, this scenario is characterized by increased investor confidence and expectations of strong future earnings. For example, during a bull market, a company releasing positive quarterly earnings reports might see its stock price rise as investors anticipate continued growth.

Scenario 2: A Bear Market

Conversely, a bear market is marked by declining stock prices. This might occur due to economic downturns or external shocks, like geopolitical tensions. For beginners, understanding the signals of a bear market, such as widespread pessimism or reduced spending, is crucial for making informed decisions.

Scenario 3: Market Correction

A market correction involves a short-term decline in stock prices following a significant upward trend. It is considered a normal part of market cycles. Beginners should recognize that corrections can present buying opportunities when viewed within a broader market context.

Practical Takeaways for Readers

- Recognize that stock trends are influenced by numerous factors, including investor sentiment and economic conditions.

- Avoid relying solely on past performance to predict future stock movements as trends are not definitive indicators.

- Consult various information sources, such as financial news outlets and official company filings, to build a comprehensive understanding.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is stock trends for beginners?

Stock trends for beginners are patterns or movements in stock prices that help new investors understand market dynamics and potential future behaviors.

Why is stock trends for beginners widely discussed?

This topic is widely discussed because it helps newcomers to the stock market build foundational knowledge, enabling them to make more informed investment decisions.

Is stock trends for beginners suitable for everyone to consider?

While stock trend analysis is beneficial, its suitability depends on individual financial goals and risk tolerance. New investors should evaluate their personal circumstances and seek advice when necessary.

Where can readers learn more about stock trends for beginners?

Readers can learn more by reviewing official company filings, financial reports, and reputable financial publications that offer in-depth market analysis.

Understanding complex topics takes time and thoughtful evaluation. Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply