What This Page Covers

This page provides an informational overview of inflation forecast daily, focusing on publicly available data, context, and commonly discussed considerations. It is designed to help readers understand the topic clearly and objectively.

Understanding inflation forecast daily

Inflation forecast daily refers to the estimation of inflation rates, usually on a day-to-day basis, using current economic indicators and market data. People often search for this term to gain insights into potential future price changes that could impact purchasing power, savings, and investment decisions. It is commonly discussed in financial and market-related contexts because inflation influences interest rates, consumer behavior, and overall economic health.

Investors, policymakers, and businesses monitor inflation forecasts to make informed decisions. Daily forecasts provide more immediate insights compared to monthly or yearly projections, helping stakeholders react promptly to economic shifts. This continuous analysis involves examining variables such as consumer price indices, producer price indices, and commodity prices.

Key Factors to Consider

Several factors play a crucial role in shaping inflation forecast daily. Understanding these can provide clarity on how inflationary trends might evolve:

- Consumer Price Index (CPI): A primary indicator of inflation, the CPI tracks changes in the price level of a basket of consumer goods and services. Daily updates help in assessing short-term inflation trends.

- Producer Price Index (PPI): While CPI measures consumer goods, PPI tracks changes in the prices received by domestic producers for their output. It can serve as a leading indicator for future CPI movements.

- Commodity Prices: Fluctuations in the prices of commodities like oil, gold, and agricultural products can signal changes in inflation expectations.

- Exchange Rates: Currency valuations affect import and export prices, influencing domestic inflation.

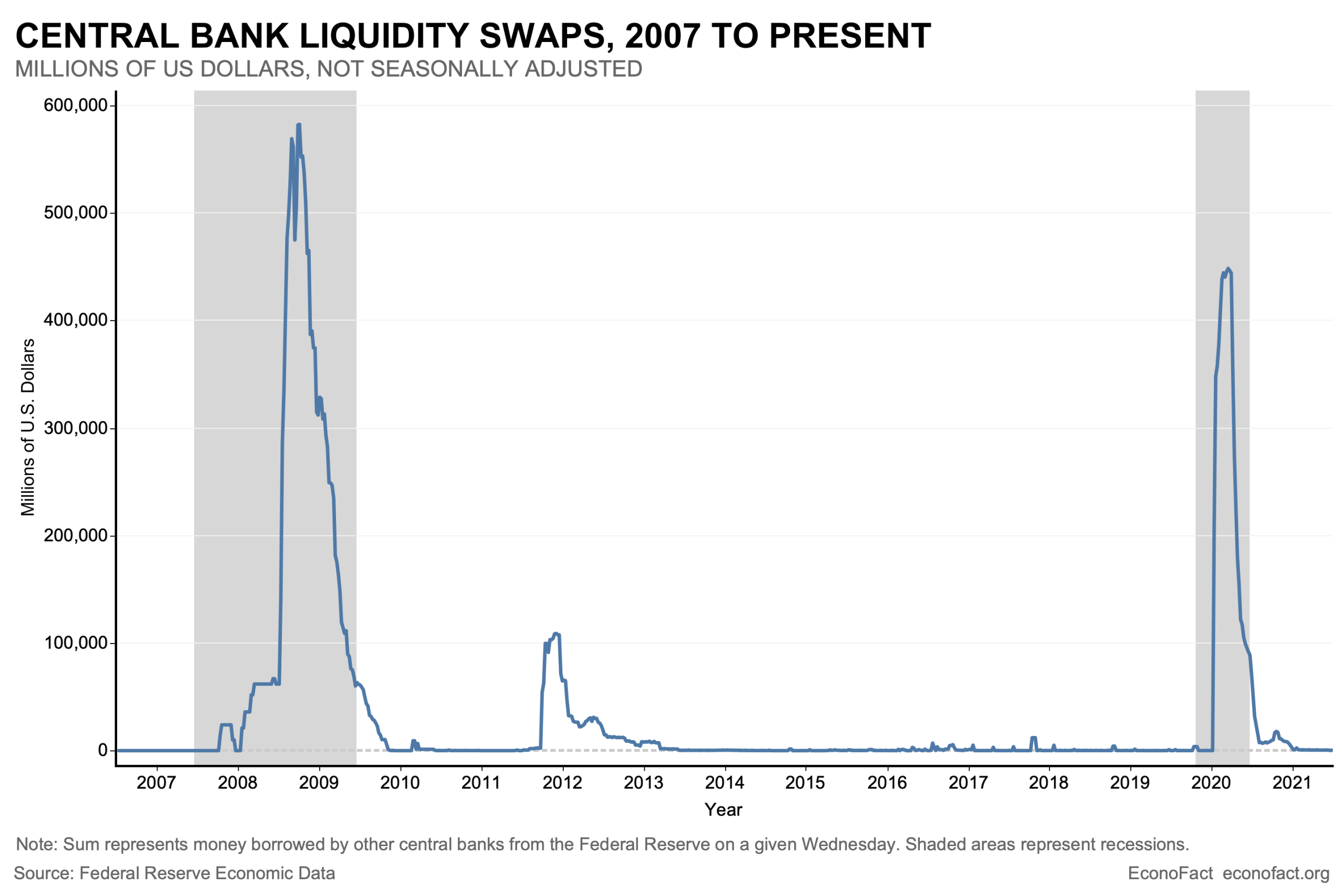

- Monetary Policy: Central bank policies, interest rate decisions, and quantitative easing measures directly impact inflation forecasts.

Common Scenarios and Examples

To better understand how inflation forecast daily is analyzed, consider these scenarios:

In a situation where commodity prices, such as oil, rise sharply, analysts might predict an uptick in inflation due to increased transportation and production costs. Conversely, if a central bank announces an interest rate hike, inflation forecasts may show a potential slowdown as borrowing costs rise, curbing consumer spending.

Another example is during periods of currency devaluation. If a country’s currency weakens, import prices could rise, leading to higher inflation forecasts. Analysts and businesses closely monitor these indicators to adjust pricing strategies and investment portfolios accordingly.

Practical Takeaways for Readers

- Stay informed about key economic indicators like CPI and PPI, as they offer valuable insights into inflation trends.

- Understand that inflation forecasts are subject to change and influenced by numerous variables, making them estimations rather than certainties.

- Review reputable financial publications, central bank announcements, and official economic reports for accurate data and analysis.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is inflation forecast daily?

Inflation forecast daily is the estimation of inflation rates on a day-to-day basis, using current economic indicators and market data to predict short-term price changes.

Why is inflation forecast daily widely discussed?

It is widely discussed because it helps investors, businesses, and policymakers anticipate and respond to economic changes that affect purchasing power, interest rates, and investment strategies.

Is inflation forecast daily suitable for everyone to consider?

While useful, its applicability varies depending on individual circumstances, such as investment goals and risk tolerance. It is important for individuals to evaluate how it aligns with their specific needs.

Where can readers learn more about inflation forecast daily?

Readers can explore official filings, company reports, and reputable financial publications to gain more insights into inflation forecasts.

Understanding complex topics takes time and thoughtful evaluation. Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply