What This Page Covers

This page provides an informational overview of the ultimate guide to retirement plan for financial freedom, focusing on publicly available data, context, and commonly discussed considerations. It is designed to help readers understand the topic clearly and objectively.

Understanding Ultimate Guide to Retirement Plan for Financial Freedom

The concept of an “ultimate guide to retirement plan for financial freedom” encompasses the strategies and tools individuals can use to ensure a secure and independent financial future post-retirement. People search for this guide to gain insights into effective ways to manage their finances, allowing them to retire comfortably without financial stress. In financial and market-related contexts, this guide is often discussed as a comprehensive approach to managing savings, investments, and expenditures in alignment with long-term financial goals.

Key Factors to Consider

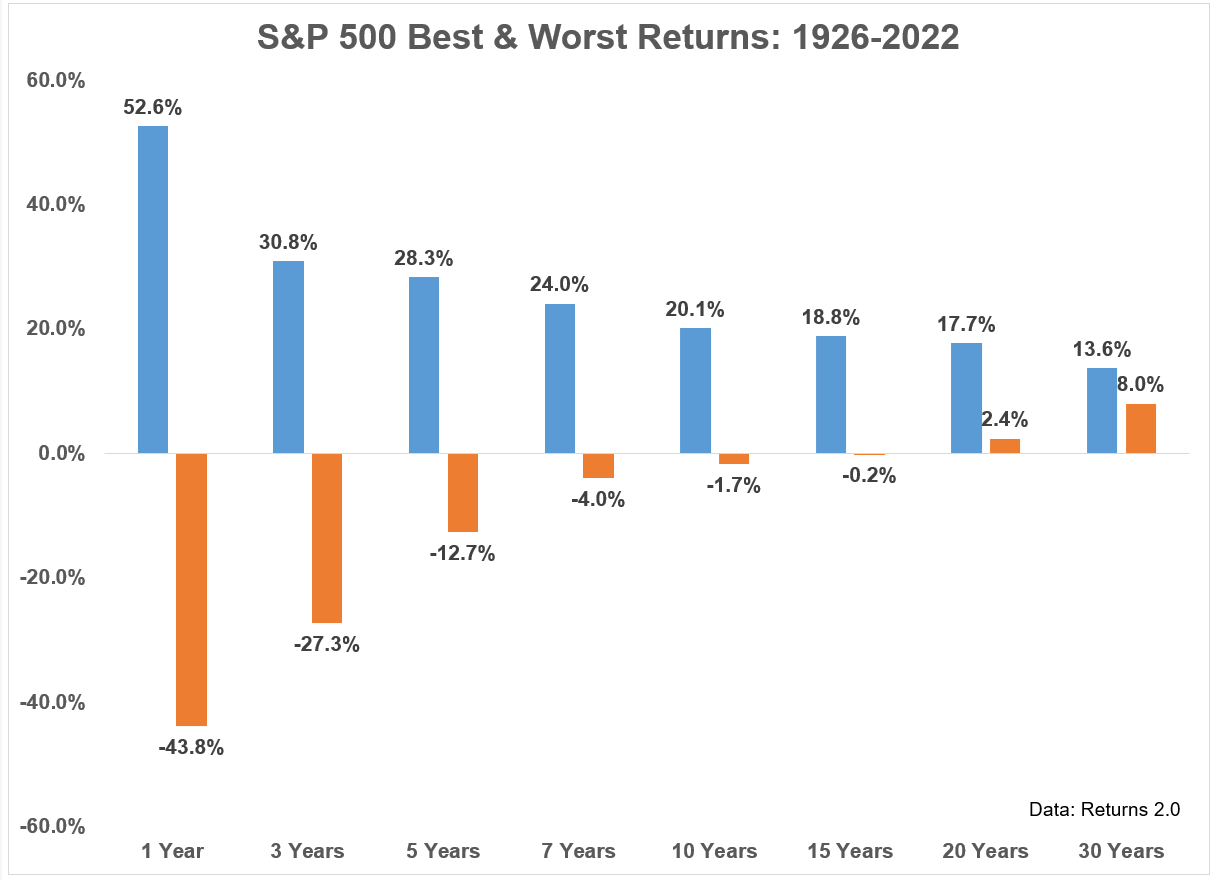

Several key factors are critical when considering a retirement plan for financial freedom. First, understanding your retirement goals and timeline is essential. This involves estimating the amount needed to sustain your desired lifestyle and determining how long you expect to live in retirement. Second, the importance of diversifying investments cannot be overstated, as it helps mitigate risks associated with market fluctuations. Third, consider tax implications, since different retirement accounts can have varying tax advantages. Lastly, regular review and adjustment of your retirement plan are necessary to accommodate changes in life circumstances and financial markets.

Common Scenarios and Examples

Consider the example of an individual planning to retire at 65, with a goal of sustaining a comfortable lifestyle throughout retirement. They might start by calculating their expected annual expenses and comparing them to their projected retirement income from savings, investments, and social security. By analyzing different scenarios, such as early retirement or increased healthcare costs, they can adjust their savings rate or investment strategy accordingly. Another scenario might involve a couple with differing retirement timelines, requiring a coordinated approach to asset allocation and withdrawal strategies to ensure long-term financial stability.

Practical Takeaways for Readers

- Highlight important observations readers should be aware of, such as the significance of starting early with retirement savings and the power of compound interest over time.

- Clarify common misunderstandings related to the ultimate guide to retirement plan for financial freedom, such as the belief that a one-size-fits-all strategy exists; in reality, retirement plans must be tailored to individual circumstances.

- Explain what information sources readers may want to review independently, including official retirement planning guides, financial calculators, and reputable financial publications.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is the ultimate guide to retirement plan for financial freedom?

The ultimate guide to retirement plan for financial freedom is a comprehensive approach to planning and managing finances to ensure a secure and independent retirement.

Why is the ultimate guide to retirement plan for financial freedom widely discussed?

This topic is widely discussed because it addresses the critical need for individuals to prepare financially for retirement, ensuring their ability to maintain their desired lifestyle without financial stress.

Is the ultimate guide to retirement plan for financial freedom suitable for everyone to consider?

While it is beneficial for most individuals, suitability depends on personal circumstances, including financial goals, income levels, and retirement timelines.

Where can readers learn more about the ultimate guide to retirement plan for financial freedom?

Readers can learn more from general sources such as official filings, company reports, or reputable financial publications like financial newsletters, government resources, and books on retirement planning.

Understanding complex topics takes time and thoughtful evaluation. Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply