What This Page Covers

This page provides an informational overview of market volatility outlook breaking, focusing on publicly available data, context, and commonly discussed considerations. It is designed to help readers understand the topic clearly and objectively.

Understanding Market Volatility Outlook Breaking

Market volatility outlook breaking refers to the sudden and often unexpected changes in the anticipated level of volatility within financial markets. These fluctuations can be prompted by a variety of factors, including economic data releases, geopolitical events, or shifts in investor sentiment. People search for this term to gain insights into the dynamics influencing market conditions and to better prepare for potential risks or opportunities. In financial contexts, it is a topic of significant interest because it affects investment strategies, portfolio management, and risk assessment.

Key Factors to Consider

Several key factors are typically associated with market volatility outlook breaking:

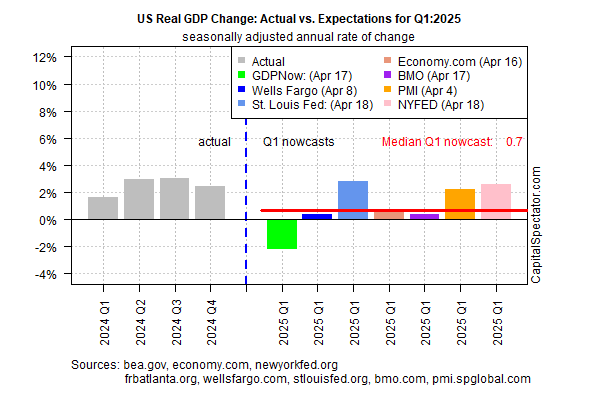

- Economic Indicators: Reports such as GDP growth, employment figures, and consumer confidence indices can impact market expectations and lead to volatility shifts.

- Monetary Policy: Central bank announcements regarding interest rates or quantitative easing measures often influence market stability and investor behavior.

- Geopolitical Events: Political instability, international conflicts, or trade negotiations can introduce uncertainty, affecting market volatility.

- Market Sentiment: Changes in investor sentiment, often driven by news media, can lead to rapid market movements.

- Technological Innovations: Developments in technology, such as high-frequency trading, can amplify volatility by increasing the speed and volume of transactions.

Common Scenarios and Examples

Real-world scenarios that illustrate market volatility outlook breaking include:

- Brexit Referendum: The unexpected outcome of the 2016 Brexit vote led to significant market volatility as investors reassessed the economic implications for the UK and Europe.

- COVID-19 Pandemic: The global health crisis in 2020 caused unprecedented market fluctuations as economies shut down and governments introduced stimulus measures.

- US-China Trade Tensions: Ongoing trade negotiations and tariffs between the US and China have periodically resulted in market uncertainty and volatility.

Practical Takeaways for Readers

- Stay informed about economic indicators and geopolitical events that could influence market volatility.

- Avoid making hasty investment decisions based solely on market volatility; consider long-term strategies.

- Review multiple information sources, such as official economic reports and reputable financial publications, for a well-rounded perspective.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is market volatility outlook breaking?

Market volatility outlook breaking involves the sudden changes in expected market volatility, influenced by various economic, political, and social factors.

Why is market volatility outlook breaking widely discussed?

It is widely discussed because understanding market volatility helps investors manage risk and make informed decisions in uncertain environments.

Is market volatility outlook breaking suitable for everyone to consider?

While it is important for investors to be aware of market volatility, the relevance and implications vary based on individual investment goals and risk tolerance.

Where can readers learn more about market volatility outlook breaking?

Readers can explore official filings, company reports, or reputable financial publications to gain a deeper understanding of market volatility and related trends.

Understanding complex topics takes time and thoughtful evaluation. Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply