What This Page Covers

This page provides an informational overview of stock trends trends breaking, focusing on publicly available data, context, and commonly discussed considerations. It is designed to help readers understand the topic clearly and objectively.

Understanding Stock Trends Trends Breaking

Stock trends trends breaking refers to the analysis and identification of significant shifts or changes in stock market patterns. Investors and analysts often seek this information to anticipate potential market movements and adjust their strategies accordingly. The topic is frequently discussed in financial circles due to its relevance in understanding market dynamics and making informed investment decisions. People search for “stock trends trends breaking” to gain insights into potential market shifts that could impact their investment portfolios.

Key Factors to Consider

Several factors play a crucial role in determining stock trends trends breaking. These include:

- Market Sentiment: Investor sentiment, driven by economic indicators, news events, and geopolitical developments, can lead to trend changes.

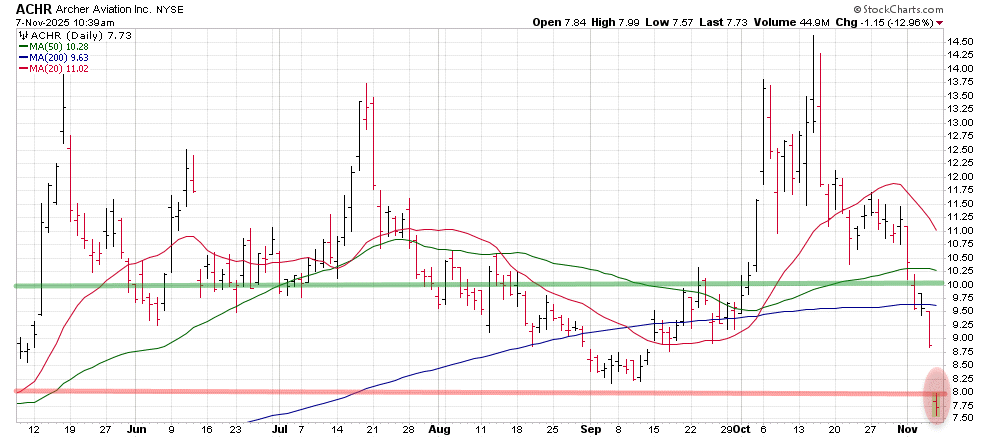

- Technical Indicators: Tools like moving averages, relative strength index (RSI), and Bollinger Bands help identify trend reversals or continuations.

- Economic Data: Economic reports such as GDP growth, unemployment rates, and inflation figures significantly influence market trends.

- Corporate Earnings: Quarterly earnings reports provide insights into a company’s financial health, impacting its stock price trends.

- Volume Changes: An increase or decrease in trading volume can signal potential trend shifts.

Common Scenarios and Examples

In practice, stock trends trends breaking can manifest in various scenarios. For instance:

- A sudden geopolitical event, such as a trade dispute, may cause a rapid shift in market sentiment, leading to breaking trends.

- Unexpected changes in central bank policies, such as interest rate adjustments, often result in significant market reactions and trend changes.

- Technological advancements or new product launches by major companies can disrupt existing trends within specific sectors.

- Seasonal patterns, such as holiday shopping trends, may temporarily shift consumer behavior and affect retail stocks.

These examples illustrate how real-world events and developments can lead to fluctuations in stock trends.

Practical Takeaways for Readers

- Stay informed about global economic and political events as they can influence stock trends significantly.

- Avoid over-reliance on any single technical indicator; instead, use a combination of tools for a comprehensive analysis.

- Understand that stock trends trends breaking is not an exact science; it involves a degree of uncertainty and requires ongoing monitoring.

- Review information from reputable sources such as financial news outlets, company earnings reports, and official economic data releases.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is stock trends trends breaking?

Stock trends trends breaking refers to the identification and analysis of shifts or changes in stock market trends, often used by investors to inform their strategies.

Why is stock trends trends breaking widely discussed?

It is a topic of interest because understanding potential trend shifts can help investors make informed decisions and potentially capitalize on market movements.

Is stock trends trends breaking suitable for everyone to consider?

This analysis may not be suitable for all investors, as it requires understanding of market dynamics and risk tolerance. Individual circumstances should be considered.

Where can readers learn more about stock trends trends breaking?

Readers can explore official filings, company reports, and reputable financial publications like The Wall Street Journal and Bloomberg for further insights.

Understanding complex topics takes time and thoughtful evaluation. Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply