What This Page Covers

This page provides an informational overview of pros and cons of dividend stock, focusing on publicly available data, context, and commonly discussed considerations.

It is designed to help readers understand the topic clearly and objectively.

Understanding pros and cons of dividend stock

Dividend stocks are shares of companies that pay out a portion of their earnings to shareholders in the form of dividends. These stocks are often favored by investors seeking a steady income stream in addition to capital gains. The pros and cons of dividend stock are widely discussed in financial circles due to their potential to provide both income and growth.

Investors often search for information on dividend stocks to evaluate whether they align with their investment goals and risk tolerance. While some investors appreciate the regular income and perceived stability, others may be concerned about the potential for lower capital appreciation compared to non-dividend-paying stocks.

Key Factors to Consider

When evaluating dividend stocks, several key factors should be considered:

- Dividend Yield: This is a measure of how much a company pays in dividends each year relative to its stock price. A higher yield may indicate a more substantial income stream but could also signal potential risks if the yield is unsustainably high.

- Payout Ratio: This is the percentage of earnings paid to shareholders in dividends. A lower payout ratio may suggest that a company is reinvesting in growth, while a higher ratio might indicate limited reinvestment potential.

- Company Stability: Companies with a strong history of paying dividends are often seen as stable and reliable. However, past performance is not always indicative of future results.

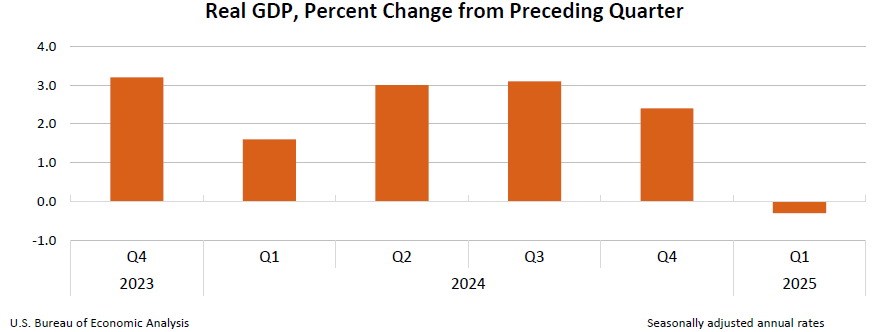

- Market Conditions: Economic factors and market conditions can influence dividend policies. Investors should consider how external factors might affect a company’s ability to maintain or grow its dividend payouts.

Common Scenarios and Examples

To better understand how the pros and cons of dividend stock are analyzed, consider the following scenarios:

An investor seeking regular income might prioritize stocks with a high dividend yield, such as utility companies or real estate investment trusts (REITs), which are known for their consistent payouts. However, these stocks might offer lower growth potential compared to tech companies that reinvest profits into expansion.

Conversely, an investor focused on capital appreciation might prefer companies with lower or no dividends, like certain technology firms, which reinvest earnings to fuel growth. While these stocks might offer higher growth potential, they do not provide the same immediate income benefits as high-dividend stocks.

Practical Takeaways for Readers

- Investors should balance the benefits of dividend income against the potential for capital appreciation.

- It’s crucial to understand that a high dividend yield can sometimes be a red flag, indicating financial distress or unsustainable payouts.

- Reviewing a company’s financial statements, including cash flow and earnings reports, can provide valuable insights into its dividend sustainability.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice.

Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is pros and cons of dividend stock?

The pros and cons of dividend stock refer to the benefits and drawbacks of investing in stocks that pay dividends, focusing on income generation and potential growth limitations.

Why is pros and cons of dividend stock widely discussed?

Dividend stocks are widely discussed because they offer a dual benefit of income and potential growth, making them attractive to a range of investors, particularly those seeking steady income.

Is pros and cons of dividend stock suitable for everyone to consider?

The suitability of dividend stocks depends on individual financial goals, risk tolerance, and investment horizon. It’s important for each investor to evaluate how dividend stocks fit into their overall strategy.

Where can readers learn more about pros and cons of dividend stock?

Readers can explore official filings, company reports, or reputable financial publications to gain a deeper understanding of dividend stocks.

Understanding complex topics takes time and thoughtful evaluation.

Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply