What This Page Covers

This page provides an informational overview of a beginner’s guide to index funds for working professionals, focusing on publicly available data, context, and commonly discussed considerations. It is designed to help readers understand the topic clearly and objectively.

Understanding Beginner Guide to Index Fund for Working Professionals

An index fund is a type of mutual fund or exchange-traded fund (ETF) designed to replicate the performance of a specific index, such as the S&P 500. For working professionals who are new to investing, understanding index funds can provide a straightforward way to participate in the stock market with relatively low risk and minimal effort. Many people search for information about index funds because they offer a passive investment strategy, which can be appealing to those with busy professional lives who may not have time to actively manage their investments. In financial and market-related contexts, index funds are often discussed as a cost-effective option for diversifying a portfolio and achieving steady long-term growth.

Key Factors to Consider

When considering index funds, there are several key factors that working professionals should keep in mind:

- Cost Efficiency: Index funds typically have lower expense ratios compared to actively managed funds, making them more cost-efficient for investors.

- Diversification: By investing in an index fund, investors gain exposure to a broad range of companies within the index, which helps to spread risk.

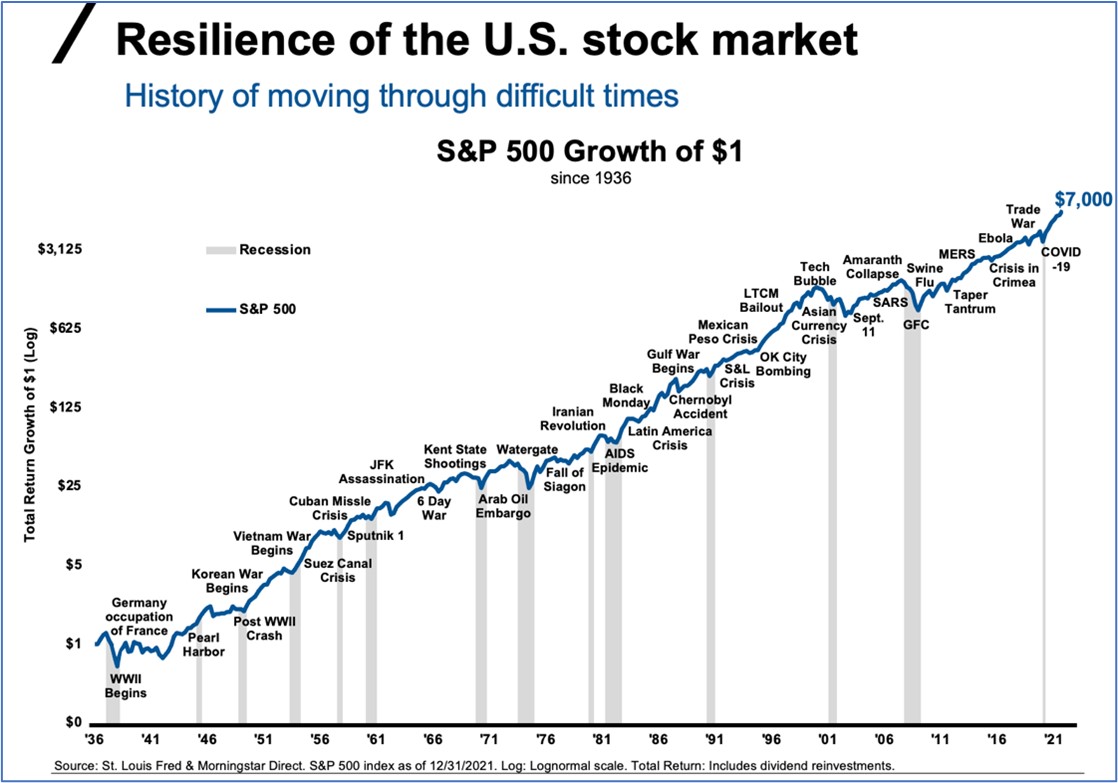

- Long-Term Performance: Historically, index funds have provided solid returns over the long term, making them suitable for retirement planning and wealth accumulation.

- Market Volatility: While index funds aim to replicate index performance, they are still subject to market volatility, which can affect returns in the short term.

- Simplicity: Index funds offer a simple investment strategy that does not require extensive market research or active management.

Common Scenarios and Examples

Consider a working professional looking to invest for retirement. They might opt for an S&P 500 index fund, which includes 500 of the largest U.S. companies, providing a diversified and relatively stable investment. Another scenario might involve a professional who wants to invest in international markets. They may choose a global index fund to gain exposure to a variety of international economies, spreading their investment risk across different countries. In practice, professionals often use index funds as core holdings in their portfolios, complementing them with other investments like bonds or real estate to achieve a balanced asset allocation.

Practical Takeaways for Readers

- Investing in index funds can offer a balanced approach to building wealth over time, with lower fees and reduced complexity.

- A common misunderstanding is that index funds are risk-free; while they are less risky than individual stocks, they are still subject to market fluctuations.

- Readers may want to review information from financial advisors, official fund prospectuses, and reputable financial news sources to ensure they make informed investment decisions.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is a beginner guide to index fund for working professionals?

A beginner guide to index funds for working professionals explains how index funds work, their benefits, and considerations for those new to investing, particularly those balancing busy careers.

Why is a beginner guide to index fund for working professionals widely discussed?

This topic is widely discussed because index funds offer a simple, cost-effective way to invest in the stock market, appealing to professionals who may not have the time to actively manage their investments.

Is a beginner guide to index fund for working professionals suitable for everyone to consider?

While index funds are suitable for many investors, individual circumstances such as financial goals, risk tolerance, and investment horizon should be considered before investing.

Where can readers learn more about a beginner guide to index fund for working professionals?

Readers can learn more by reviewing official fund prospectuses, exploring company reports, and reading reputable financial publications that provide insights into index fund investing.

Understanding complex topics takes time and thoughtful evaluation. Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply