What This Page Covers

This page provides an informational overview of the pros and cons of technical analysis without losing money, focusing on publicly available data, context, and commonly discussed considerations.

It is designed to help readers understand the topic clearly and objectively.

Understanding Pros and Cons of Technical Analysis Without Losing Money

Technical analysis is a method used by traders and investors to forecast the future price movements of securities based on historical price data and trading volume. The concept of evaluating the pros and cons of technical analysis without losing money is a compelling topic for many investors who wish to leverage these tools effectively while minimizing risk. People often search for this topic to gain insights into how they can utilize technical analysis to make informed decisions without incurring significant losses. It is a common discussion point in financial markets where analytical tools are discussed in terms of their efficacy, limitations, and practical application.

Key Factors to Consider

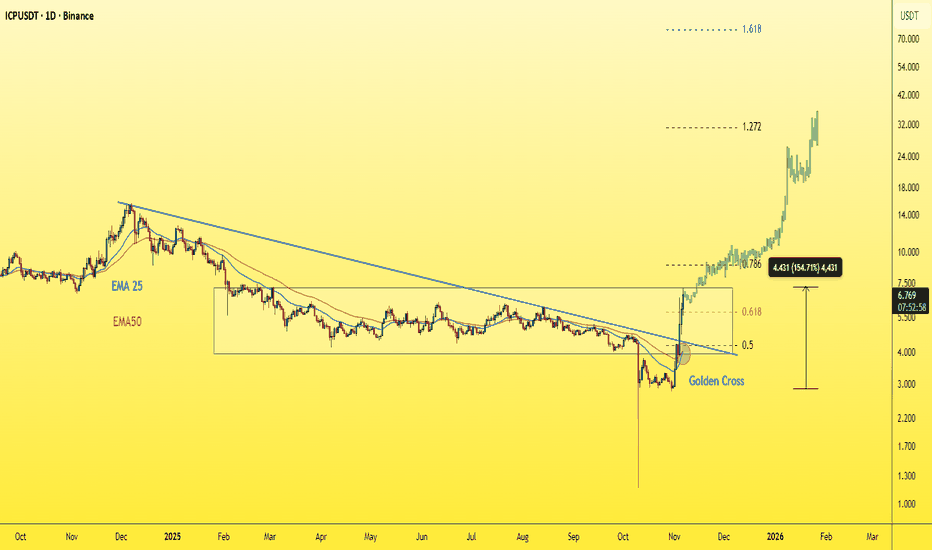

When considering technical analysis, several key factors come into play. Firstly, technical indicators like moving averages, Bollinger Bands, and Relative Strength Index (RSI) are popular tools that traders use to identify trends and potential reversals. Another factor is the time frame of the analysis; short-term traders might use minute-by-minute data, while long-term traders may look at daily or weekly charts. Importantly, while technical analysis can provide insights, it is not foolproof and should be used in conjunction with other strategies to manage risk effectively. Investors need to be aware that relying solely on technical analysis without considering market fundamentals can lead to incomplete evaluations.

Common Scenarios and Examples

One common scenario involves a trader using technical analysis to identify a stock’s support and resistance levels. For instance, if a stock consistently rebounds after hitting a particular price point, that level may be considered a support level. Conversely, if it struggles to rise above a certain price, that may be a resistance level. By identifying these levels, traders can make more informed decisions about entry and exit points while minimizing potential losses. Another example is the use of candlestick patterns to predict future price movements. Patterns like ‘doji’ or ‘hammer’ can indicate potential reversals, allowing traders to make strategic decisions without solely relying on speculation.

Practical Takeaways for Readers

- Highlight important observations readers should be aware of. Technical analysis should be used as one of several tools in a trader’s toolkit and not as the sole method of decision-making.

- Clarify common misunderstandings related to pros and cons of technical analysis without losing money. Many believe technical analysis can predict the future precisely, which is a misconception. Instead, it should be seen as a way to gauge probabilities.

- Explain what information sources readers may want to review independently. Investors should consider reviewing company reports, industry news, and macroeconomic indicators alongside technical analysis to form a more comprehensive understanding.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is pros and cons of technical analysis without losing money?

Technical analysis involves using historical data to forecast future price movements, and understanding its pros and cons can help minimize financial risk.

Why is pros and cons of technical analysis without losing money widely discussed?

It is a popular topic because many investors seek to optimize their trading strategies and minimize losses by using informed analysis techniques.

Is pros and cons of technical analysis without losing money suitable for everyone to consider?

While technical analysis can be beneficial, it may not be suitable for everyone. It requires understanding and experience, and individual circumstances should be considered.

Where can readers learn more about pros and cons of technical analysis without losing money?

Readers can explore official filings, company reports, or reputable financial publications to gain more insights into technical analysis.

Understanding complex topics takes time and thoughtful evaluation. Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply