What This Page Covers

This page provides an informational overview of market analysis trends real time, focusing on publicly available data, context, and commonly discussed considerations. It is designed to help readers understand the topic clearly and objectively.

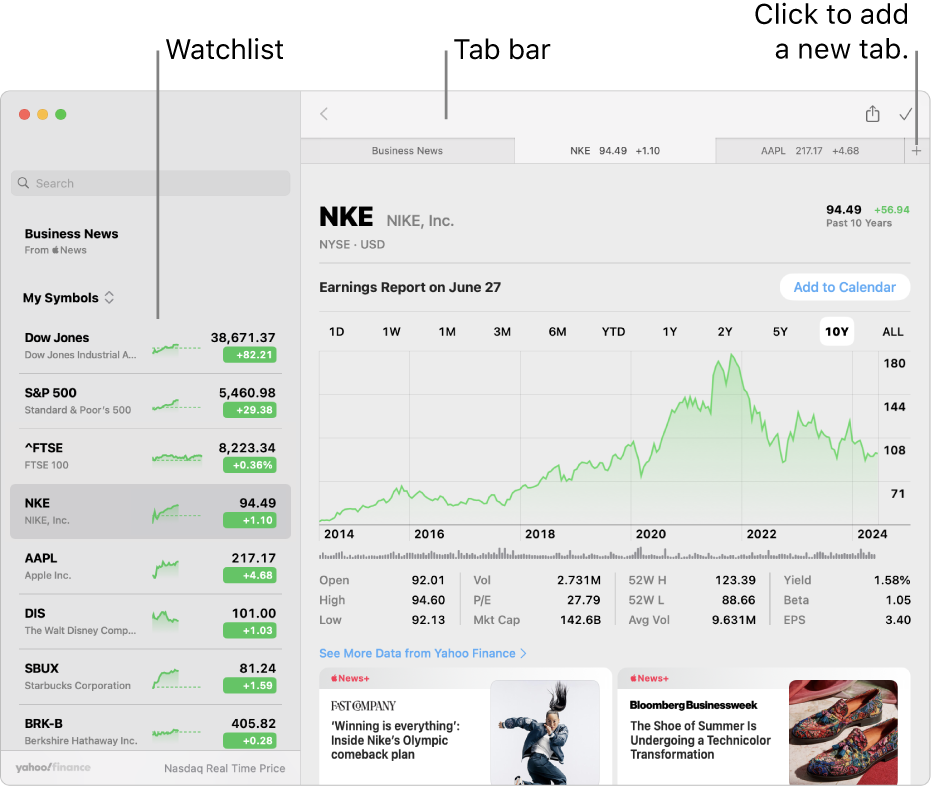

Understanding Market Analysis Trends Real Time

Market analysis trends in real time refer to the process of evaluating market data as it becomes available, often through digital platforms that offer live updates. This type of analysis is crucial for investors, analysts, and businesses who need to make timely decisions based on the latest market conditions. People search for real-time market analysis to gain insights into financial markets, track changes in asset prices, and assess economic indicators as they unfold. In financial and market-related contexts, real-time analysis is commonly discussed in terms of its ability to provide immediate insights that can influence trading strategies and investment decisions.

Key Factors to Consider

Several key factors are typically associated with market analysis trends in real time:

- Data Sources: Reliable data sources are essential for accurate real-time analysis. Investors often rely on financial news platforms, stock exchanges, and specialized market data providers.

- Technology: The tools and software used to analyze real-time data play a crucial role. Advanced analytics platforms enable users to filter and interpret data efficiently.

- Market Volatility: Real-time analysis is particularly valuable in volatile markets where prices can change rapidly. Understanding volatility helps in managing risks and making informed decisions.

- Economic Indicators: Monitoring economic indicators like employment rates, GDP growth, and inflation in real time can provide insights into broader market trends.

- Trading Volume: Analyzing trading volume in real-time helps determine the strength and direction of market movements, providing context for price changes.

Common Scenarios and Examples

Real-time market analysis can be applied in various scenarios. For instance, during a major economic announcement, such as an interest rate decision by a central bank, investors might use real-time analysis to assess immediate market reactions. Another example is during earnings season when companies release their quarterly financial results. Traders analyze this data in real time to adjust their portfolios based on the latest performance metrics. Additionally, geopolitical events or natural disasters can cause sudden market shifts, where real-time analysis helps determine the immediate impact on global markets.

Practical Takeaways for Readers

- Real-time market analysis provides crucial insights but requires access to reliable data sources and tools.

- A common misunderstanding is that real-time analysis always leads to profitable decisions. While it offers timely information, it does not guarantee specific outcomes.

- Readers should consider reviewing official filings, company reports, and reputable financial publications for comprehensive market analysis.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is market analysis trends real time?

Market analysis trends real time refers to the evaluation of market data as it is updated continuously, providing immediate insights into financial market conditions.

Why is market analysis trends real time widely discussed?

The interest in real-time market analysis stems from its ability to offer timely insights that can influence trading strategies and investment decisions, especially in volatile markets.

Is market analysis trends real time suitable for everyone to consider?

While beneficial, real-time market analysis may not be suitable for everyone. Individual circumstances and investment goals should guide the use of this analysis.

Where can readers learn more about market analysis trends real time?

Readers can explore official filings, company reports, and reputable financial publications to gain a deeper understanding of real-time market analysis.

Understanding complex topics takes time and thoughtful evaluation. Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply