The global economy is an ever-changing entity, with numerous financial factors and indicators at play. One such pivotal economic indicator is inflation. This article aims to provide a comprehensive understanding of the monthly inflation outlook, its significance, and how to effectively plan for it.

What is Inflation?

Inflation is the rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling. Central banks attempt to limit inflation, and avoid deflation, in order to keep the economy running smoothly.

Understanding the Monthly Inflation Outlook

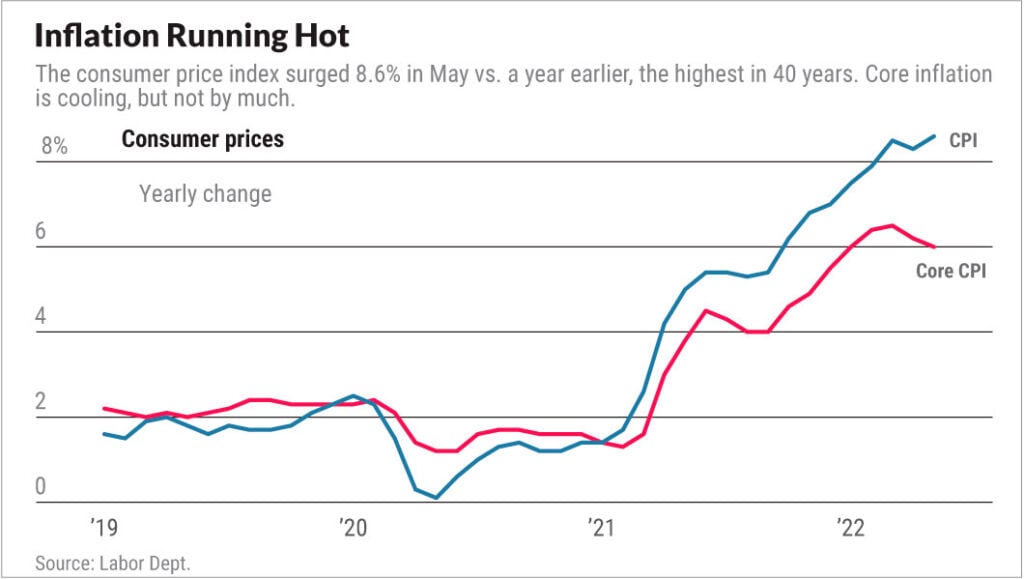

The monthly inflation outlook is a projection of future inflation rates based on current and historical data. Economists and financial analysts study trends in various economic indicators, including unemployment rates, consumer price index (CPI), and producer price index (PPI), to predict future inflation rates. These forecasts help businesses, investors, and governments make informed decisions regarding spending, investment, and policy-making.

Significance of the Monthly Inflation Outlook

Understanding the monthly inflation outlook is crucial for several reasons. For businesses, it helps in budgeting and forecasting, pricing decisions, and wage negotiations. For investors, it can influence investment strategies as it impacts the real return on investment. Governments and central banks use the inflation outlook to adjust monetary policy, which can affect interest rates, currency exchange rates, and economic growth.

Practical Tips for Planning for Inflation

- Stay Informed: Regularly monitor economic indicators and inflation forecasts.

- Diversify Investments: Inflation can erode the value of money over time, so diversify your investments to protect against this risk.

- Consider Inflation-Protected Securities: These are government bonds that are indexed to inflation, ensuring that your investment grows at the same rate as inflation.

- Adjust Business Strategies: Businesses may need to adjust their pricing strategies and cost management in response to inflation.

FAQs about Monthly Inflation Outlook

What factors influence the monthly inflation outlook?

Diverse factors such as changes in commodity prices, currency exchange rates, fiscal policies, and global economic conditions can influence the monthly inflation outlook.

How accurate are inflation forecasts?

While experts use sophisticated models and a wealth of data to make inflation forecasts, they are not 100% accurate due to the unpredictable nature of the economy.

How does inflation affect consumers?

Inflation can erode purchasing power, meaning consumers can buy less with the same amount of money. However, moderate inflation is a sign of a healthy economy and can encourage spending and investment.

Remember, navigating through the world of finance and economics can be complicated. However, with the right knowledge and strategic planning, you can turn these complexities into opportunities. Stay informed, stay proactive, and let’s harness the power of understanding the monthly inflation outlook to achieve financial success.

Leave a Reply