Swing trading is a popular strategy utilized by many traders across the globe. It’s designed to capture gains in a financial instrument within an overnight hold to several weeks. If you’re new to swing trading and looking to grasp the basics, you’re in the right place. Let’s dive deeper into some simple tips for successful swing trading.

Understanding Swing Trading

Before we delve into the tips, it’s essential to understand what swing trading is. Swing trading is a style that attempts to capture gains in a stock (or any financial instrument) over a period of a few days to several weeks. Swing traders primarily use technical analysis to look for trading opportunities, paying less attention to the fundamental analysis.

Choose the Right Market

Choosing the right market is the first crucial step in swing trading. Different markets have different characteristics that can make them more or less suitable for swing trading. For example, highly liquid markets like forex or big-cap stocks are often a good choice because they allow for easy entry and exit.

Use Technical Analysis

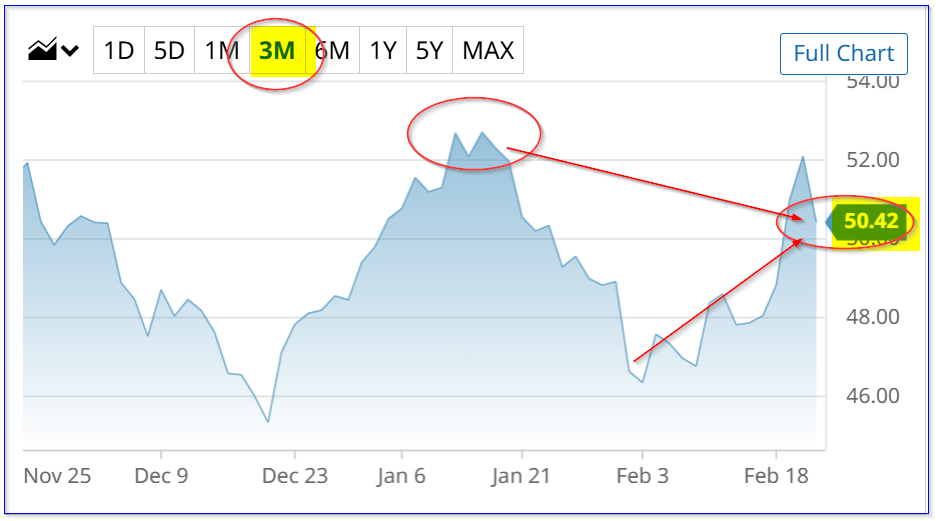

Technical analysis is vital in swing trading. It involves studying price patterns and trends on charts to predict future price movements. By understanding patterns like support and resistance levels, trend lines, and moving averages, you can make more informed trading decisions.

Manage Your Risk

As with any trading strategy, risk management is crucial in swing trading. Always determine your exit strategy before you enter a trade. Know when you will take profits and when you will cut losses. Use stop losses to protect your capital and never risk more than a small percentage of your trading account on any single trade.

Practical Tips for Swing Trading

-

Start with a demo account to practice without risking real money.

-

Do not let emotions dictate your trading decisions.

-

Stay informed about market news and economic events.

-

Keep a trading journal to record your trades and learn from your mistakes.

FAQs About Swing Trading

What is the best time frame for swing trading?

Typically, the daily time frame is best suited for swing trading. However, some traders also use weekly time frames for a broader market perspective.

Is swing trading suitable for beginners?

Yes, swing trading is suitable for beginners. It is less time-intensive than day trading and can provide a good introduction to technical analysis.

Can swing trading be done part-time?

Yes, swing trading can be done part-time. As it typically involves holding positions for several days, it doesn’t require constant market monitoring.

As we draw to a close, remember that success in swing trading, like any other endeavor, comes from consistent learning and practice. Keep refining your skills, stay patient, and never stop learning. Happy Trading!

Leave a Reply