What This Page Covers

This page provides an informational overview of the pros and cons of long term investment, focusing on publicly available data, context, and commonly discussed considerations. It is designed to help readers understand the topic clearly and objectively.

Understanding pros and cons of long term investment

Long term investment refers to the strategy of holding assets for an extended period, typically five years or more. Investors often pursue this approach to benefit from the potential of compounded returns and to ride out short-term market volatility. The pros and cons of long term investment are widely searched as individuals seek to make informed decisions about their financial futures. People are interested in understanding the potential benefits, such as wealth accumulation and tax advantages, as well as the drawbacks, which may include limited liquidity and market unpredictability. This topic is commonly discussed in financial and market-related contexts because it directly impacts investment strategies and financial planning.

Key Factors to Consider

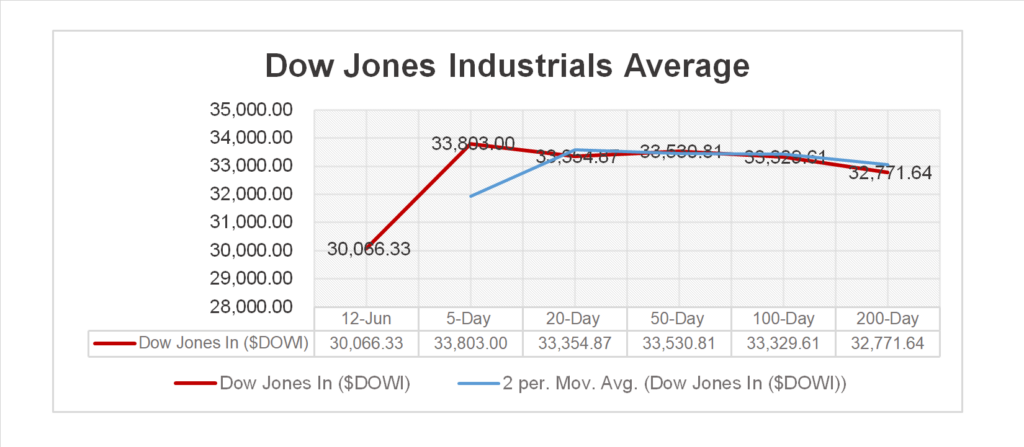

Several key factors influence the pros and cons of long term investment. Firstly, market volatility plays a significant role. Over the long term, the market typically shows an upward trend, but short-term fluctuations can be severe. Secondly, the power of compounding is a critical advantage, as reinvested earnings can significantly boost returns. Thirdly, inflation is a factor investors must consider, as it can erode purchasing power over time. Additionally, the investor’s financial goals and risk tolerance are crucial in deciding whether a long term investment strategy is appropriate. Lastly, diversification is essential, as it can help manage risk by spreading investments across various asset classes.

Common Scenarios and Examples

Consider an individual who invests in a diversified portfolio of stocks and bonds with the intention of funding their retirement in 20 years. Over this period, the investor might experience economic downturns, such as a recession, which temporarily decreases portfolio value. However, by maintaining the investment, they could benefit from eventual market recoveries and compounded growth. Another example is investing in real estate, where property values may fluctuate due to economic conditions. Yet, over the long term, real estate can appreciate and generate rental income, illustrating both the potential benefits and challenges of long term investing.

Practical Takeaways for Readers

- Highlight important observations readers should be aware of: Long term investment can potentially yield higher returns due to the compounding effect and market growth over time.

- Clarify common misunderstandings related to pros and cons of long term investment: It is not immune to risks, and investors should be prepared for periods of market downturns.

- Explain what information sources readers may want to review independently: Investors should consider reviewing historical market data, economic forecasts, and financial analyses from reputable sources.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is pros and cons of long term investment?

The pros and cons of long term investment involve understanding the potential for greater returns through compounding and market growth, balanced against risks like market volatility and inflation.

Why is pros and cons of long term investment widely discussed?

This topic is widely discussed because it affects financial planning and investment strategies, with individuals seeking to optimize returns and manage risks over extended periods.

Is pros and cons of long term investment suitable for everyone to consider?

The suitability of long term investment varies based on individual circumstances, such as financial goals, risk tolerance, and investment horizon. It is important to assess personal needs and consult professionals.

Where can readers learn more about pros and cons of long term investment?

Readers can learn more from official filings, company reports, or reputable financial publications that provide in-depth analyses and insights into long term investment strategies.

Understanding complex topics takes time and thoughtful evaluation. Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply