Analyzing QQQ Performance: Strategic Insights for Forward-Thinking Investors

The Global Stock Market Context

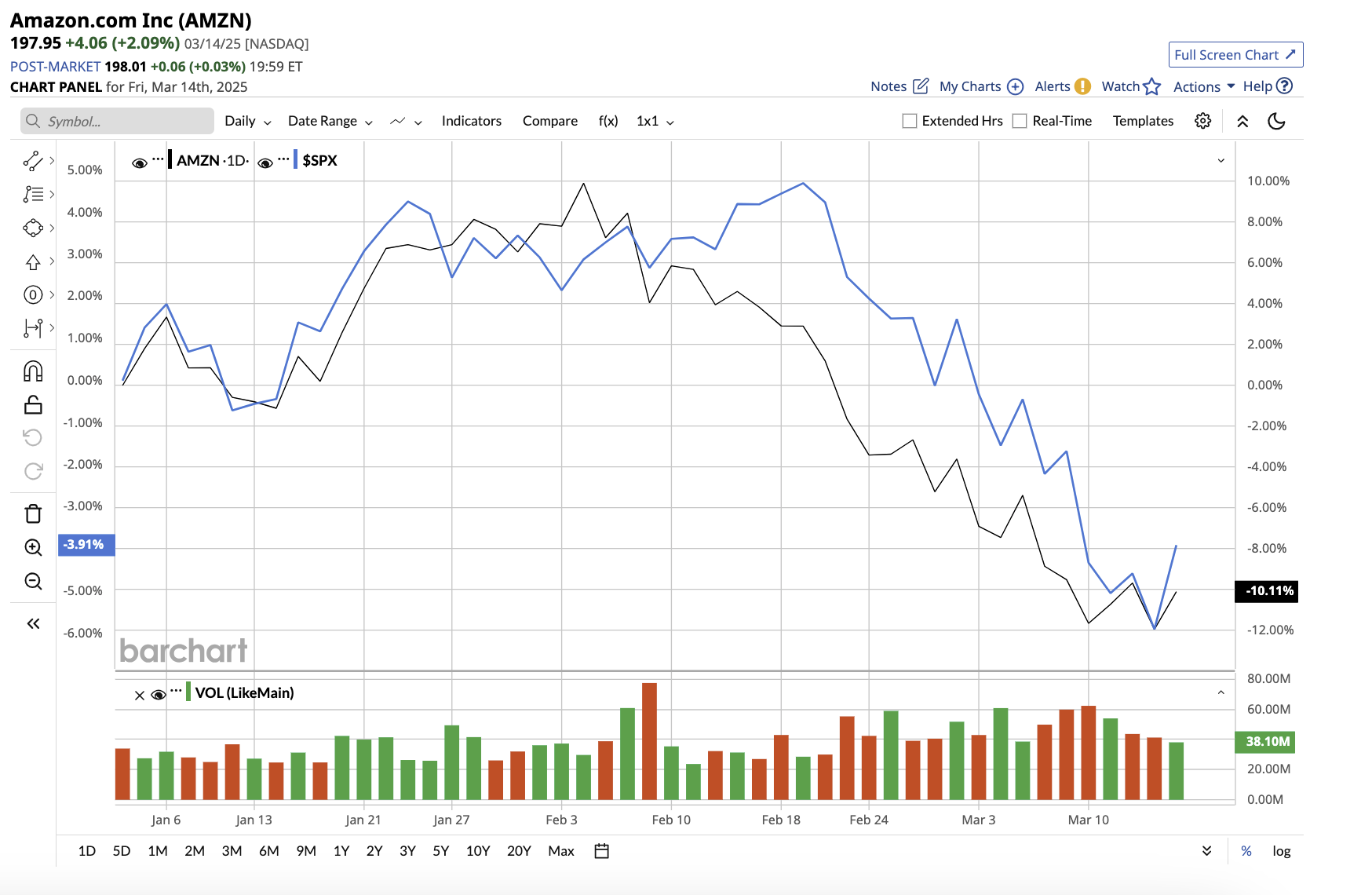

Understanding global stock market trends is a fundamental step in analyzing the QQQ performance. The Invesco QQQ ETF, also known as “the Qs” or “cubes,” is one of the most popular Exchange Traded Funds in the world. It offers exposure to the 100 largest non-financial companies listed on the NASDAQ, including heavyweight tech giants such as Apple, Microsoft, and Amazon. The performance of this ETF can provide a comprehensive insight into the broader economies and market trends.

The Core Tenets of QQQ performance

A lacework of features determines the QQQ’s performance, but at its heart are the following:

- Dominance of Tech Stocks: QQQ’s portfolio is heavily weighted towards information technology shares. The tech sector’s performance can, therefore, directly influence the performance of this ETF.

- Concentration of Holdings: Half of QQQ’s assets are allocated among its top ten holdings. When these ‘top ten’ perform well, the QQQ excels, but the converse is also true.

- Global Economic Conditions: The success of leading tech companies — and in turn, QQQ’s performance — largely depends on the global economic context.

The Importance of a Forward-Thinking Investor’s Approach

While historical analysis of QQQ performance is crucial, this alone isn’t enough. Forward-thinking investors supplement past data interpretation with future incident anticipation, macroeconomic trends, and dynamics of international relations.

QQQ Performance in the Near-term Outlook

Globally, economies are gradually transitioning towards digital alternatives. Categories taking the lead include cloud computing, artificial intelligence, cybersecurity, and ecommerce. Naturally, the tech-heavy QQQ ETF is poised to experience this surge in digitization, suggesting it might be an attractive investment for those betting on the ongoing tech revolution.

RELATED READING

Read also: Amazon Stock Prediction: Insights for a Profitable Investment Strategy amid Global Volatility

Demystifying ETFs: A Comprehensive Guide for Beginners

Read also: Amazon Stock Prediction: Insights for a Profitable Investment Strategy amid Global Volatility

A Novice’s Trail to Tech Stocks: 5 Essential Picks in 2022

Read also: Amazon Stock Prediction: Insights for a Profitable Investment Strategy amid Global Volatility

Global Economic Trends: What Looms Ahead for Investors?

Disclaimer

The purpose of this article is to educate and inform. It should not be viewed as financial advice or as a recommendation to buy or sell securities. Potential investors should carefully consider their personal finances, risk tolerance, and consult with a qualified financial advisor before making any investment decisions.

Leave a Reply