Analyzing Tesla’s 2025 Delivery Targets: A Deep Dive for Astute Investors

The world of investment is dynamic and filled with opportunities, but the challenge lies in making the right choice. What every investor seeks is guidance to navigate through the labyrinth of uncertainties that the stock market presents. In this context, taking a closer look at Tesla’s delivery targets for 2025 could provide a wealth of information.

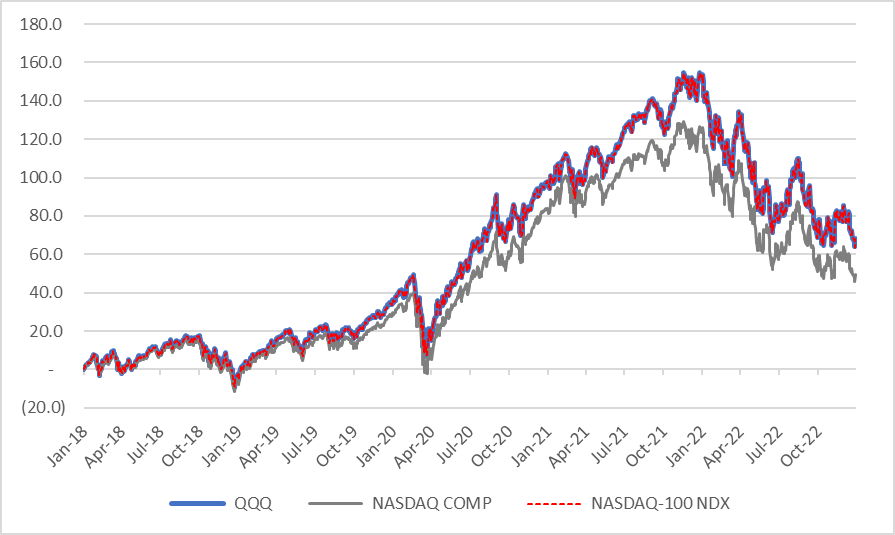

The Global Stock Market Context

In an increasingly globalized world, the relationships between different stock markets and economic indices have grown more intertwined than ever before. Thus, an understanding of the future potential of Tesla, as it stands within the broader market context, can be crucial to an astute investor.

Analyzing Tesla’s 2025 Delivery Targets

Tesla is undoubtedly a game-changer in the automobile industry with its commitment to electric cars, renewable energy solutions, and innovative technology. Recent years saw Tesla kicking into high gear, and the company’s delivery targets for 2025 are testament to its ambition to revolutionize the automotive market continually.

The company’s bold plans entail ambitious delivery targets, with the aim to deliver around 20 million electric vehicles (EVs) by 2025, a dramatic increase from its current levels. Such an undertaking will undoubtedly impact the global auto industry but could also significantly influence Tesla’s stock performance.

What does this mean for Investors?

What Tesla’s ambitious delivery targets imply for investors is twofold. On one hand, successfully achieving these numbers means Tesla could capture a considerable market share in the EV segment, which could translate into substantial growth potential for Tesla’s stock.

On the other hand, the risks are palpable. Tesla faces steep competition from both traditional automakers and emerging challengers in the EV industry. The burden of production and supply chain complexities associated with meeting such high targets might also create difficulties.

An astute investor should, therefore, weigh the potential gains against the inherent risks involved, integrating considerations of Tesla’s 2025 delivery targets as part of a balanced investment strategy.

RELATED READING

For more insights into the stocks and the broader market, you might enjoy these related articles:

-

Read also: Forecasting Google Cloud’s Financial Horizon: Profitability Analysis for 2025

The Future of Electric Vehicles: Global Market Predictions for 2025

-

Read also: Forecasting Google Cloud’s Financial Horizon: Profitability Analysis for 2025

-

Read also: Forecasting Google Cloud’s Financial Horizon: Profitability Analysis for 2025

Understanding Tesla’s Stock Performance: A Comprehensive Review

Conclusion

While the opportunity presented by Tesla’s 2025 delivery targets is compelling, it may not be devoid of risk. Incorporating both these perspectives into a strategic investment decision is the task of an astute investor. This approach embodies the essence of the William Club investment philosophy – disciplined, data-driven, and insightful.

Disclaimer: This article is meant for informational purposes only and should not be taken as financial advice. Each investor’s portfolio and risk tolerance may differ, and the strategies suggested may not be suitable for all investors. Always consult a financial adviser before making any investment decisions.

Leave a Reply