What This Page Covers

This page provides an informational overview of a beginner guide to asset allocation for passive income, focusing on publicly available data, context, and commonly discussed considerations. It is designed to help readers understand the topic clearly and objectively.

Understanding Beginner Guide to Asset Allocation for Passive Income

A beginner guide to asset allocation for passive income is a strategic approach to investing that aims to provide a steady income stream with minimal active management. Investors often search for this topic to find ways to optimize their portfolios without constantly buying and selling assets. Asset allocation involves diversifying investments across various asset classes, such as stocks, bonds, and real estate, to balance risk and reward in alignment with personal financial goals.

In financial discussions, this guide is frequently addressed as a foundational concept for those looking to ensure financial stability through consistent income. It is particularly relevant for individuals planning for retirement or seeking to supplement their earnings with passive income streams. The approach hinges on the idea of diversification, which can mitigate risks associated with market volatility while tapping into the potential growth of various asset categories.

Key Factors to Consider

When considering asset allocation for passive income, several key factors should be taken into account:

- Risk Tolerance: Understanding your ability and willingness to endure market fluctuations is crucial. This will guide the proportion of assets allocated to higher-risk investments, like stocks, versus more stable ones, such as bonds.

- Investment Horizon: The length of time you plan to invest can influence your asset allocation. Longer horizons may allow for more aggressive strategies, while shorter ones may necessitate a conservative approach.

- Income Needs: Determine the level of passive income required to meet your financial goals. This will help tailor your investment portfolio to generate the desired cash flow.

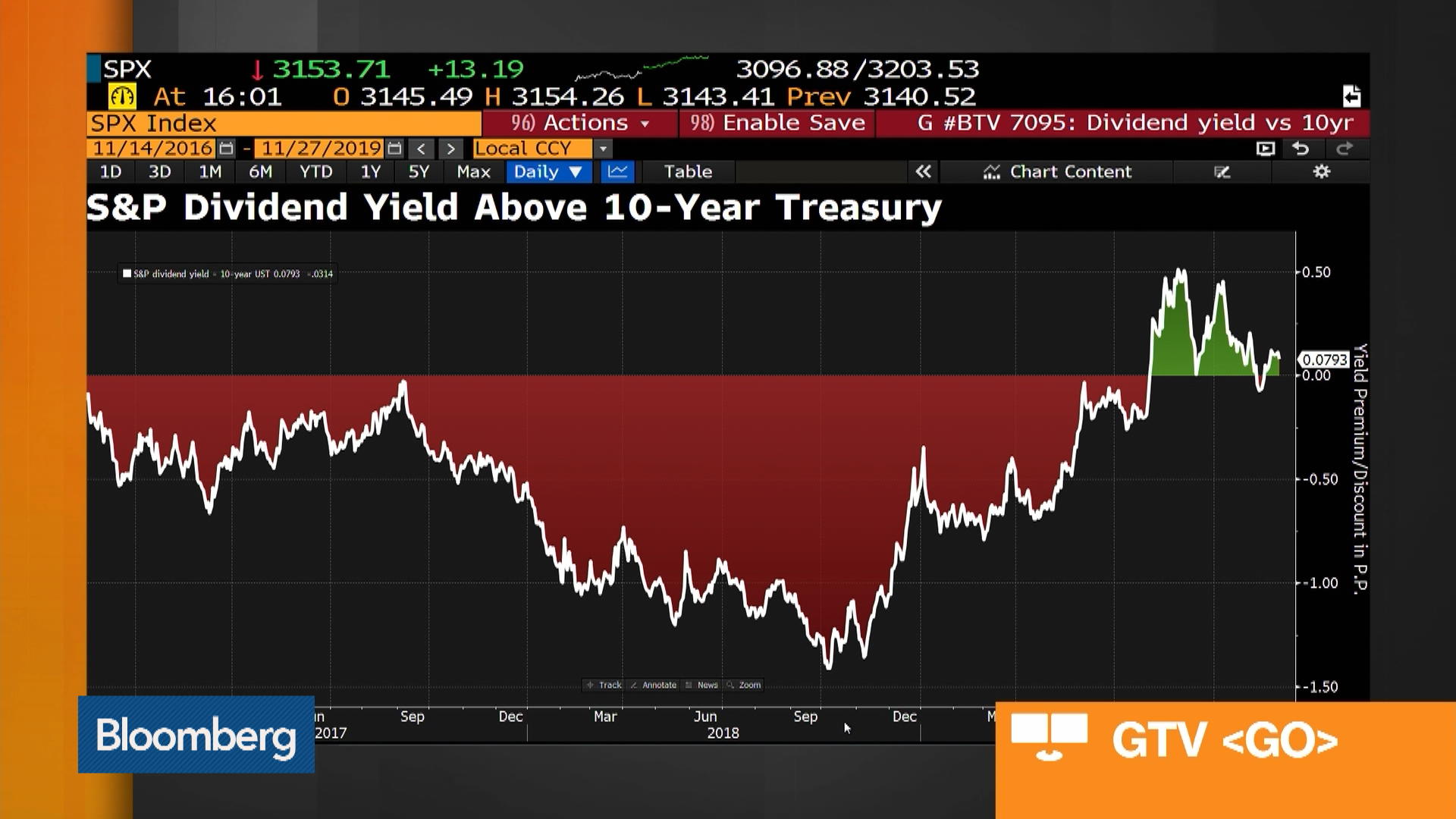

- Market Conditions: Economic indicators and market trends can impact asset performance. Staying informed can help in adjusting allocations to optimize returns.

- Tax Implications: Different asset classes and investment accounts can have varying tax treatments, which should be considered when planning for passive income.

Common Scenarios and Examples

Consider a scenario where an investor seeks to generate passive income through a diversified portfolio. They might allocate 50% of their investments in dividend-paying stocks, 30% in bonds for stability, and 20% in real estate investment trusts (REITs) for property exposure without direct ownership.

Another example involves a retiree who desires a conservative approach. This individual may allocate 70% of their portfolio to government bonds and high-grade corporate bonds, ensuring a stable income stream, while keeping 30% in a mix of dividend stocks and REITs to capture moderate growth potential.

In both scenarios, the focus is on creating a balanced portfolio that aligns with the investor’s financial objectives, risk tolerance, and time horizon, illustrating how asset allocation can be customized to individual needs.

Practical Takeaways for Readers

- Understanding and defining personal financial goals is essential before deciding on an asset allocation strategy.

- A diverse portfolio can potentially reduce risks and optimize returns over time.

- It’s a common misconception that asset allocation is a one-time task; regular reviews and adjustments are necessary to maintain alignment with changing financial circumstances and market conditions.

- Readers may want to review financial statements, investor reports, and expert analyses from reputable publications to build a well-informed perspective.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is a beginner guide to asset allocation for passive income?

A beginner guide to asset allocation for passive income is a strategic approach to diversifying investments across various asset classes to generate a steady income with minimal active management.

Why is a beginner guide to asset allocation for passive income widely discussed?

This topic is widely discussed because it offers a framework for investors to achieve financial stability through passive income, which is particularly appealing for retirement planning and wealth preservation.

Is a beginner guide to asset allocation for passive income suitable for everyone to consider?

While it can be beneficial, asset allocation for passive income may not suit everyone. Individual circumstances, such as risk tolerance, financial goals, and market conditions, should be considered.

Where can readers learn more about a beginner guide to asset allocation for passive income?

Readers can learn more from official filings, company reports, and reputable financial publications, as well as through consultations with financial advisors.

Understanding complex topics takes time and thoughtful evaluation. Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply