What This Page Covers

This page provides an informational overview of best investment for financial freedom, focusing on publicly available data, context, and commonly discussed considerations. It is designed to help readers understand the topic clearly and objectively.

Understanding Best Investment for Financial Freedom

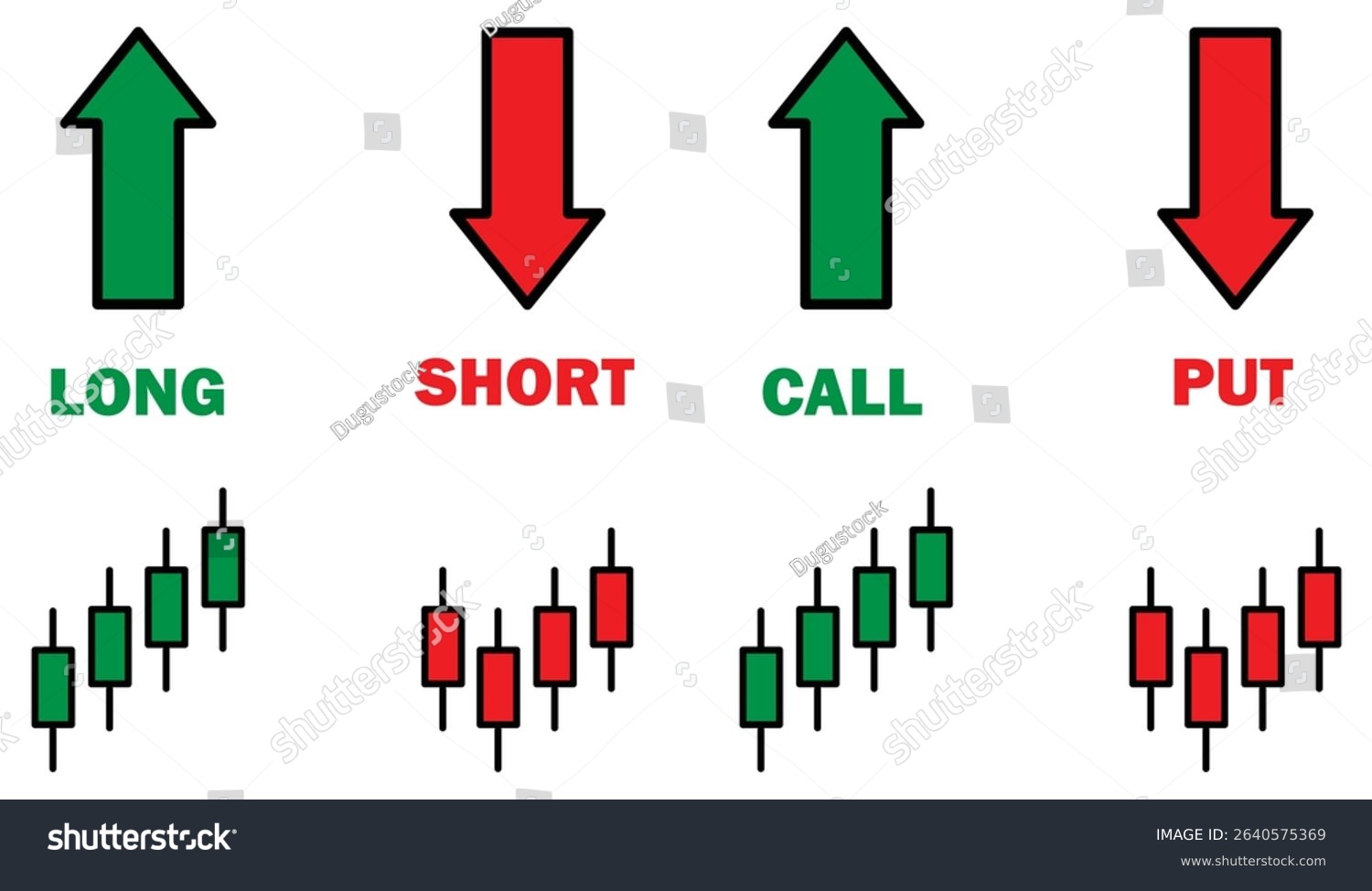

The concept of the best investment for financial freedom revolves around the strategic allocation of resources to achieve a state where one’s passive income exceeds their living expenses. This topic is highly searched as individuals aspire to gain autonomy over their financial futures. Financial freedom allows individuals to make life choices without being constrained by money. Discussions about this topic often highlight the importance of diversification, risk assessment, and long-term planning in financial and market-related contexts.

Key Factors to Consider

Several factors play a crucial role when considering the best investments for financial freedom. Primarily, understanding one’s risk tolerance is essential, as it dictates the types of investments that are suitable. Asset allocation, which involves spreading investments across various asset classes like stocks, bonds, and real estate, is another significant factor. This diversification helps mitigate risks and optimize returns. Additionally, understanding the time horizon is critical; longer investment durations generally allow for more aggressive strategies, whereas shorter time frames necessitate more conservative approaches. Finally, staying informed about market trends and economic indicators helps in making timely and informed decisions.

Common Scenarios and Examples

Consider a scenario where an individual, aiming for financial freedom, decides to invest in a diversified portfolio consisting of index funds, real estate, and bonds. Over time, the consistent returns from these investments, combined with the compounding effect, could potentially generate enough passive income to cover living expenses. Another example is an entrepreneur who reinvests profits into expanding their business, eventually reaching a point where the business generates substantial passive income. These scenarios illustrate the importance of strategic planning and patience in achieving financial freedom.

Practical Takeaways for Readers

- Highlight important observations readers should be aware of, such as the significance of starting early and the power of compound interest.

- Clarify common misunderstandings related to best investment for financial freedom, like the misconception that high-risk investments always yield higher returns.

- Explain what information sources readers may want to review independently, such as financial reports, investment guides, and economic forecasts.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is best investment for financial freedom?

The best investment for financial freedom involves a strategic mix of assets that generate sufficient passive income to cover living expenses, allowing for financial independence.

Why is best investment for financial freedom widely discussed?

The topic is widely discussed because financial freedom provides individuals with the autonomy to make lifestyle choices without being constrained by financial limitations.

Is best investment for financial freedom suitable for everyone to consider?

While the principles of investing for financial freedom are broadly applicable, individual circumstances such as risk tolerance, financial goals, and time horizon must be considered.

Where can readers learn more about best investment for financial freedom?

Readers can learn more about best investments for financial freedom through official filings, company reports, and reputable financial publications such as The Wall Street Journal or Financial Times.

Understanding complex topics takes time and thoughtful evaluation. Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply