Investment strategies vary as widely as the individuals who utilize them. One such strategy that has been gaining traction among conservative investors is long-term, low-risk investment. But as with any investment plan, understanding its benefits and drawbacks is crucial. Let’s dive deep into exploring the pros and cons of long-term, low-risk investment.

The Appeal of Long-Term, Low-Risk Investment

The primary appeal of long-term investment is the potential for compounding returns. Over time, the returns on your investments can generate their own earnings, resulting in exponential growth. For example, if you invest $1000 with an annual return of 5%, you will have $1050 after one year. If you keep your money invested, you’ll earn 5% on $1050 the next year, which equates to $52.50, and so on. Over the long term, these returns can add up to a significant sum.

Low-risk investments, on the other hand, are typically characterized by stable returns and lower volatility compared to high-risk investments. This means they are less likely to suffer large losses, making them an attractive option for risk-averse investors.

The Drawbacks of Long-Term, Low-Risk Investment

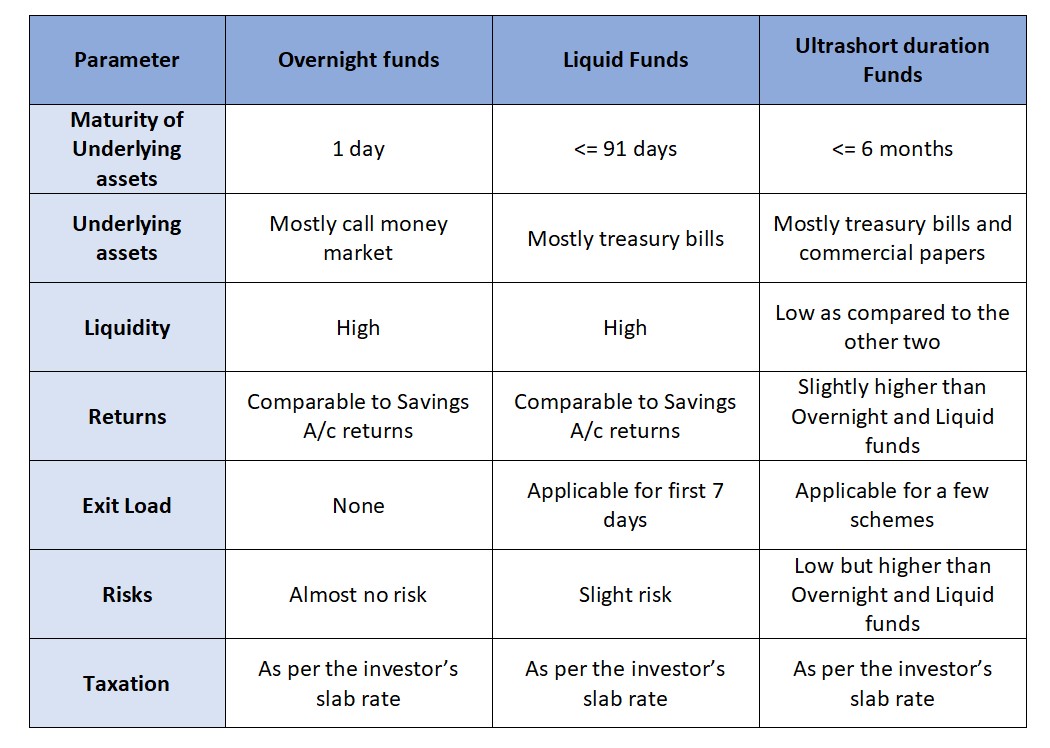

Despite its merits, long-term, low-risk investment is not without its drawbacks. One of the main disadvantages is the potential for lower returns. Because low-risk investments often involve conservative assets like bonds or money market funds, they typically offer lower returns than riskier assets like stocks.

Additionally, while long-term investing allows for the magic of compounding, it also requires patience and the ability to tolerate market fluctuations. Investors may have to endure periods of sub-par returns or even losses, which can be stressful.

Practical Tips for Long-Term, Low-Risk Investment

-

Understand your risk tolerance: Every investor has a different level of risk tolerance. Understanding yours can help you select the right mix of high-risk and low-risk investments.

-

Diversify your portfolio: Diversification can reduce risk and increase potential returns. This involves spreading your investments across various asset classes and sectors.

-

Stay patient: Long-term investing requires patience. Don’t panic when the market dips and don’t get carried away when it soars. Stick to your plan and allow your investments to grow over time.

FAQs on Long-Term, Low-Risk Investment

What is considered a low-risk investment?

Low-risk investments are typically those that come with a lower probability of loss of principal or a lower standard deviation of returns. They include assets like government bonds, CDs, money market funds, and certain types of annuities.

Why should I consider long-term investment?

Long-term investment can be beneficial because it allows your returns to compound over time, potentially leading to significant growth. It also allows you to ride out market volatility and reduces the impact of short-term market fluctuations on your portfolio.

Life is full of challenges and opportunities. The key is to embrace them with an open mind and a willing heart. Remember, the journey of a thousand miles begins with a single step. So, take that step today, and embark on your journey towards financial independence.

Leave a Reply