Understanding stock market trends could be the key to unlocking your financial potential. In this article, we will delve into the nitty-gritty of stock trends, explaining them as they unfold live in the market.

What Are Stock Trends?

Stock trends refer to the direction in which the price of a particular stock is moving. They are usually classified into three primary categories: upward trends (bull markets), downward trends (bear markets), and sideways or horizontal trends.

Identifying Stock Trends Live

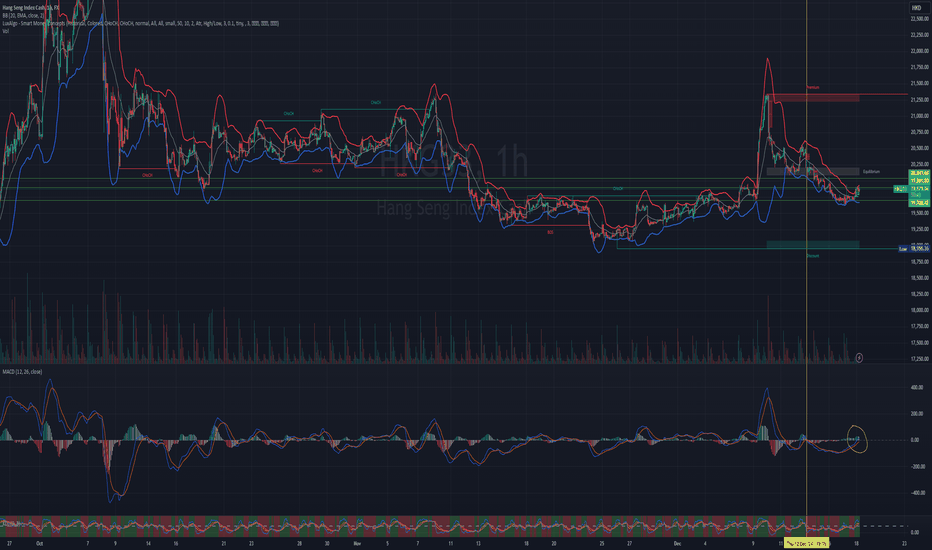

Identifying trends as they unfold live in the market requires a keen eye and a good understanding of market dynamics. Tools like trend lines, moving averages, and technical indicators can help traders spot these trends as they happen.

Understanding Upward and Downward Trends

An upward trend, or bull market, occurs when the price of a stock is on a general upward trajectory. Conversely, a downward trend, or bear market, happens when the price of a stock is on a downward path. The terms “bull” and “bear” come from the way these animals attack. A bull thrusts its horns up into the air, while a bear swipes its paws downward.

Grasping Sideways Trends

Sideways trends, also known as horizontal trends, occur when the price of a stock is moving sideways. This usually happens when the forces of supply and demand are nearly equal, causing the stock’s price to move within a narrow range.

Practical Tips for Understanding Stock Trends

-

Start by observing the bigger picture. Don’t focus solely on short-term price movements. Look at the overall trend.

-

Use technical analysis tools to help identify trends. These tools can be especially handy when analyzing live stock trends.

-

Always keep in mind that trends can change abruptly due to various factors, such as changes in market sentiment or major news events.

FAQs on Stock Trends

What causes stock trends?

Stock trends are primarily driven by changes in supply and demand. If more people want to buy a stock (demand) than sell it (supply), then the price moves up. Conversely, if more people want to sell a stock than buy it, the price moves down.

How long do stock trends last?

Stock trends can last anywhere from a few minutes to several years, depending on various factors such as the stock’s fundamentals, market sentiment, and broader economic factors.

How can I use stock trends to make investment decisions?

Understanding stock trends can help you make informed investment decisions. For example, you might choose to buy a stock in an upward trend in anticipation of further price increases. Or you might choose to sell a stock in a downward trend to avoid potential losses.

As we conclude, remember that understanding stock trends is just one piece of the investment puzzle. It requires practice, patience, and continual learning. So, keep exploring, stay curious, and never stop learning. You’ve got this!

Leave a Reply