What This Page Covers

This page provides an informational overview of 2025 trends in financial independence for passive income, focusing on publicly available data, context, and commonly discussed considerations. It is designed to help readers understand the topic clearly and objectively.

Understanding 2025 Trends in Financial Independence for Passive Income

As we approach 2025, the concept of financial independence through passive income continues to garner attention. This trend refers to the ability to sustain one’s lifestyle through income streams that require minimal active involvement. People search for this topic as they aim to secure financial stability and freedom, often driven by the desire to retire early or pursue personal interests without financial constraints. In financial and market-related contexts, discussions frequently revolve around investment strategies, technological advancements, and innovative financial products that can facilitate the generation of passive income.

Key Factors to Consider

Several key factors influence the trends in financial independence for passive income as we move towards 2025. Firstly, the rise of digital platforms has democratized access to various income-generating opportunities, such as peer-to-peer lending and real estate crowdfunding. Additionally, the integration of artificial intelligence in financial services is streamlining investment processes, making it easier for individuals to manage and optimize their portfolios. Economic conditions, such as interest rates and inflation, also play a critical role in determining the viability of different passive income strategies. Finally, regulatory changes and tax policies can significantly impact the attractiveness of certain investment vehicles.

Common Scenarios and Examples

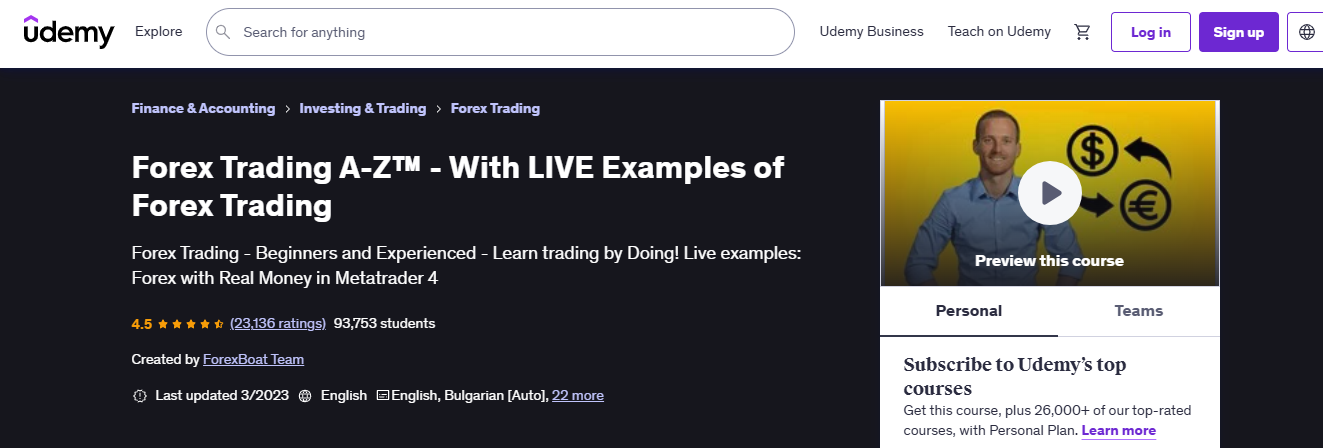

To better understand how these trends manifest, consider the scenario of an individual leveraging technology to build a diversified income portfolio. For instance, they might use robo-advisors to automate stock investments, participate in crowdfunding platforms to invest in real estate, and allocate funds to dividend-paying stocks for consistent income. Another example could involve using online marketplaces to sell digital products or courses, generating royalties and sales income with minimal ongoing effort. These scenarios illustrate practical applications of passive income strategies that align with the evolving financial landscape of 2025.

Practical Takeaways for Readers

- Recognize the importance of diversification in building a sustainable passive income portfolio.

- Understand that while technology offers new opportunities, it is essential to evaluate the risks and perform due diligence.

- Familiarize yourself with economic indicators and regulatory changes that may impact passive income strategies.

- Consult reputable sources, such as financial news outlets and official financial reports, to stay informed about industry developments.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is 2025 trends in financial independence for passive income?

2025 trends in financial independence for passive income refer to emerging patterns and strategies that individuals and institutions use to generate income streams requiring minimal active involvement, aiming for financial stability and independence.

Why is 2025 trends in financial independence for passive income widely discussed?

This topic is widely discussed due to the growing interest in achieving financial freedom, advancements in technology that facilitate passive income generation, and the dynamic economic environment influencing investment opportunities.

Is 2025 trends in financial independence for passive income suitable for everyone to consider?

While the concept can be appealing, its suitability varies depending on individual financial goals, risk tolerance, and market understanding. Personalized assessment is crucial.

Where can readers learn more about 2025 trends in financial independence for passive income?

Readers can explore official filings, company reports, and reputable financial publications such as The Wall Street Journal and Bloomberg for more insights.

Understanding complex topics takes time and thoughtful evaluation. Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply