What This Page Covers

This page provides an informational overview of strategies for blockchain for passive income, focusing on publicly available data, context, and commonly discussed considerations. It is designed to help readers understand the topic clearly and objectively.

Understanding strategies for blockchain for passive income

Strategies for blockchain for passive income involve utilizing blockchain technology and related financial tools to generate revenue without active management. People search for this topic as blockchain has emerged as a transformative technology that offers various income-generating opportunities beyond traditional investments. In financial and market-related contexts, these strategies are often discussed as part of the broader trend towards decentralized finance (DeFi), which aims to democratize access to financial services. By leveraging blockchain technology, individuals can potentially earn passive income through mechanisms such as staking, lending, and yield farming.

Key Factors to Consider

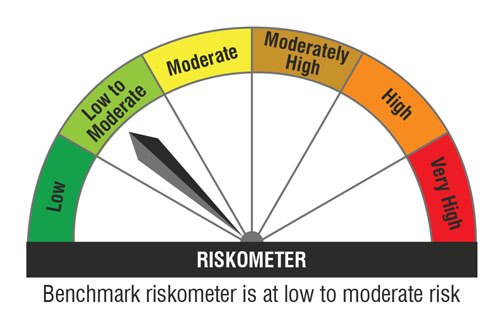

When exploring strategies for blockchain for passive income, several key factors should be considered. Firstly, understanding the underlying technology and its applications is crucial. Blockchain enables secure, transparent transactions and can automate processes through smart contracts. Secondly, the regulatory environment plays a significant role, as compliance with local laws is essential for legal and sustainable participation. Additionally, market volatility and risk should be assessed, as blockchain assets can experience significant price fluctuations. Finally, security is paramount, given the prevalence of cyber threats in the digital space.

Common Scenarios and Examples

To illustrate how strategies for blockchain for passive income are applied in practice, consider the following scenarios:

1. **Staking:** An individual holds a certain amount of cryptocurrency in a wallet to support the operations of a blockchain network. In return, they receive rewards in the form of additional coins or tokens. This method is commonly used in proof-of-stake (PoS) networks.

2. **Lending:** Platforms like Aave or Compound allow users to lend their cryptocurrency assets to others, earning interest over time. This process is automated through smart contracts, ensuring security and transparency.

3. **Yield Farming:** Participants provide liquidity to decentralized exchanges and earn rewards. This complex strategy involves using various protocols to maximize returns, often requiring a more sophisticated understanding of DeFi tools.

Practical Takeaways for Readers

- Important observations include the need for thorough research and risk assessment before engaging in blockchain-based passive income strategies.

- Common misunderstandings often involve underestimating the risks associated with market volatility and the security challenges of digital assets.

- Readers may want to review information sources such as blockchain whitepapers, academic research, and reliable financial news outlets to gain a comprehensive understanding.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is strategies for blockchain for passive income?

Strategies for blockchain for passive income involve utilizing blockchain technologies to generate revenue streams without active involvement, often through mechanisms like staking, lending, and yield farming.

Why is strategies for blockchain for passive income widely discussed?

Interest in this topic stems from the growing popularity of blockchain technology and decentralized finance, which offer innovative ways to generate income outside traditional financial systems.

Is strategies for blockchain for passive income suitable for everyone to consider?

These strategies may not be suitable for everyone, as they require a certain level of technical understanding and risk tolerance. Individual circumstances and goals should be carefully evaluated.

Where can readers learn more about strategies for blockchain for passive income?

Readers can explore official filings, company reports, or reputable financial publications to gain more insights into blockchain-based passive income strategies.

Understanding complex topics takes time and thoughtful evaluation. Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply