What This Page Covers

This page provides an informational overview of finance step by step, focusing on publicly available data, context, and commonly discussed considerations.

It is designed to help readers understand the topic clearly and objectively.

Understanding finance step by step

Finance step by step is a structured approach to understanding financial concepts, processes, and strategies incrementally. Many individuals search for this topic as they aim to demystify complex financial jargon and practices. By breaking down finance into manageable steps, people can grasp fundamental elements such as budgeting, saving, investing, and understanding market trends. This approach is widely discussed in financial and market-related contexts because it offers a methodical way to build financial literacy, equipping individuals with the knowledge to make informed financial decisions.

Key Factors to Consider

When approaching finance step by step, several key factors should be taken into account:

- **Budgeting:** Creating a budget is often the first step in financial planning. It involves tracking income and expenses to ensure financial stability and is a fundamental component of personal finance.

- **Saving:** Setting aside a portion of income for future needs or emergencies is crucial. This step involves understanding different savings accounts and strategies to maximize returns.

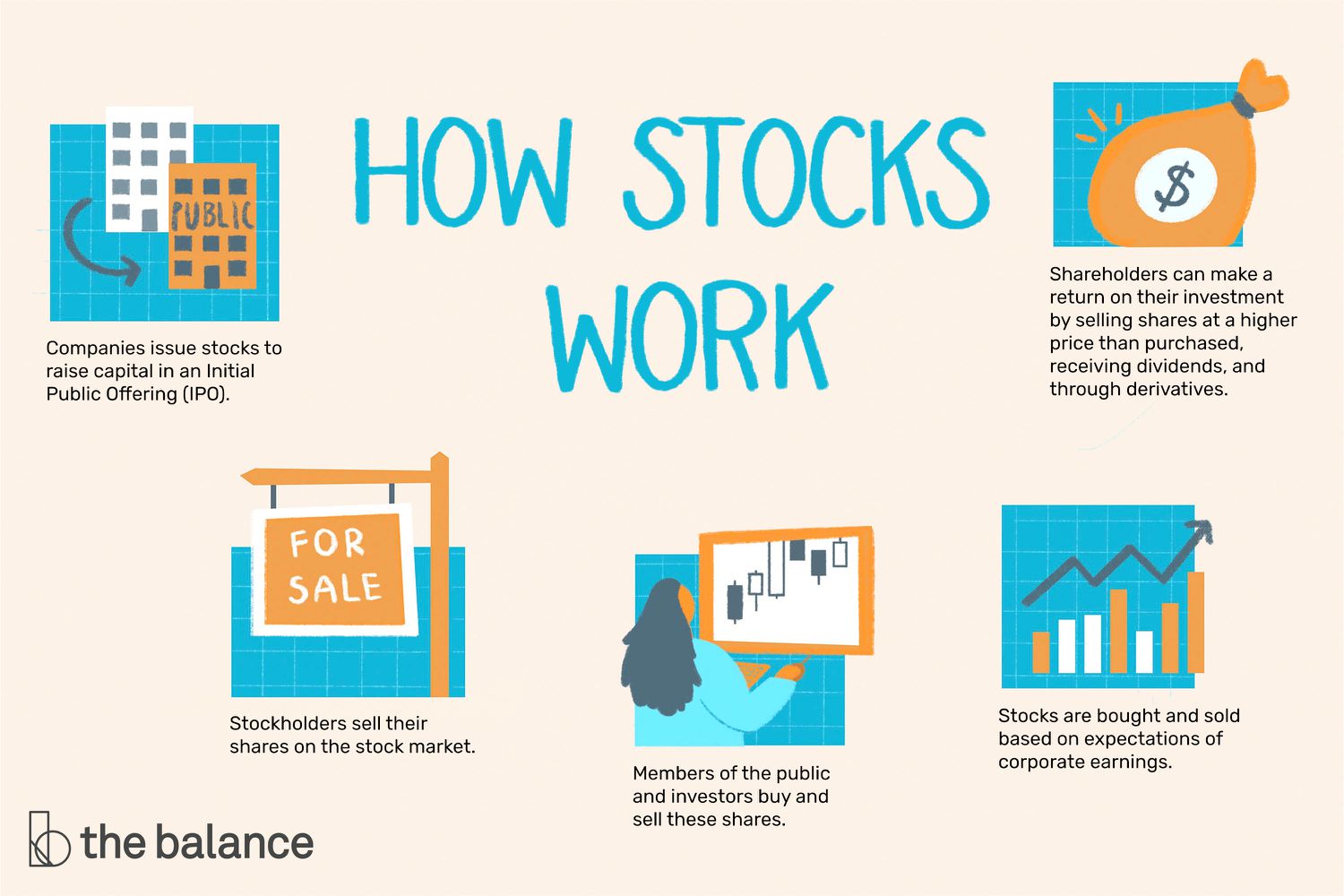

- **Investing:** Learning about various investment options, such as stocks, bonds, and mutual funds, is essential for wealth accumulation. Understanding risk management and diversification are key elements in this step.

- **Credit Management:** Understanding how credit works, including credit scores and reports, can help individuals manage debts effectively and maintain financial health.

- **Market Trends:** Staying informed about economic indicators and market trends can aid individuals in making more informed investment decisions.

Common Scenarios and Examples

Consider a young professional starting their career. They begin with budgeting, tracking their monthly income and expenses, and identifying areas to cut costs. As they build savings, they explore high-yield savings accounts to grow their emergency fund. Once comfortable with savings, they start learning about investment options, beginning with low-risk mutual funds to gain exposure to the market. Over time, they diversify their portfolio by investing in stocks and bonds, always mindful of their risk tolerance and investment goals. By understanding credit management, they maintain a healthy credit score, allowing them to secure favorable loan terms for major purchases like a home or car.

Practical Takeaways for Readers

- Highlight important observations readers should be aware of: Finance is a gradual learning process that builds over time.

- Clarify common misunderstandings related to finance step by step: It is not about achieving quick success but about developing a solid understanding and strategy.

- Explain what information sources readers may want to review independently: Readers should consider official financial filings, company reports, and reputable financial publications for in-depth analysis.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is finance step by step?

Finance step by step is a methodical approach to understanding and managing financial activities and strategies by breaking them down into sequential, manageable steps.

Why is finance step by step widely discussed?

This approach is popular because it simplifies complex financial concepts, making them accessible to individuals aiming to enhance their financial literacy and decision-making capabilities.

Is finance step by step suitable for everyone to consider?

While it can be beneficial for many, individual circumstances such as financial goals, risk tolerance, and current financial status should be considered when applying this approach.

Where can readers learn more about finance step by step?

Readers can explore official filings, company reports, and reputable financial publications to gain a deeper understanding of financial concepts and strategies.

Understanding complex topics takes time and thoughtful evaluation. Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply