What This Page Covers

This page provides an informational overview of financial planning in simple terms, focusing on publicly available data, context, and commonly discussed considerations. It is designed to help readers understand the topic clearly and objectively.

Understanding Financial Planning in Simple Terms

Financial planning, in simple terms, is the process of managing your financial resources to achieve personal economic goals. It’s about understanding where your money is going, setting achievable financial objectives, and creating a plan to meet those objectives. People often search for “financial planning in simple terms” because they want to demystify the complex jargon typically associated with finance and make informed decisions without needing an advanced degree in economics. Financial planning encompasses various aspects such as budgeting, saving, investing, and retirement planning, and is a common topic in financial discussions due to its relevance to both personal and business finance.

Key Factors to Consider

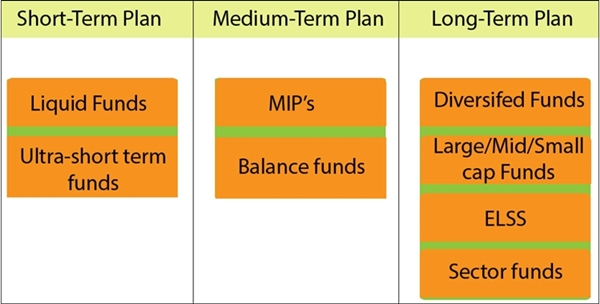

When considering financial planning in simple terms, several critical factors come into play. First and foremost is understanding your current financial situation, which involves assessing your income, expenses, assets, and liabilities. Another key factor is setting clear and realistic financial goals. These goals could range from short-term objectives like buying a new car, to long-term aspirations such as retirement planning. Budgeting is another essential element, as it ensures that your spending aligns with your financial goals. Additionally, risk management, which includes understanding insurance needs and investment risks, is crucial. Lastly, the importance of regular review and adjustment of your financial plan cannot be overstated, as it helps accommodate changes in your financial situation or life goals.

Common Scenarios and Examples

Consider a young professional who has recently entered the workforce. Their initial financial planning might involve setting up a budget to manage student loan repayments, saving for an emergency fund, and contributing to a retirement savings plan. As their career progresses and they start a family, their financial planning priorities might shift towards saving for a child’s education and purchasing life insurance. Another example is a couple nearing retirement who need to focus on maximizing their retirement savings, managing healthcare costs, and planning for the distribution of their estate. These scenarios illustrate how financial planning can be tailored to different stages of life and individual priorities.

Practical Takeaways for Readers

- One important observation is that financial planning should be a continuous process, adapting as your life circumstances change.

- A common misunderstanding is that financial planning is only for the wealthy; in reality, it is beneficial for anyone looking to manage their finances effectively.

- Readers may want to review information sources such as financial news websites, government publications on personal finance, and educational resources from financial institutions to enhance their understanding.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is financial planning in simple terms?

Financial planning in simple terms is the process of organizing your finances to achieve personal and financial goals.

Why is financial planning in simple terms widely discussed?

It is widely discussed because it helps individuals manage their finances effectively, ensuring they can meet their goals and prepare for future uncertainties.

Is financial planning in simple terms suitable for everyone to consider?

While financial planning is beneficial for most people, individual circumstances such as financial literacy and personal goals can influence its suitability.

Where can readers learn more about financial planning in simple terms?

Readers can turn to official filings, company reports, reputable financial publications, and educational resources offered by financial institutions.

Understanding complex topics takes time and thoughtful evaluation. Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply