Forecasting the SP500 Index Trend Into 2025: Analysis, Implications, and Strategies

Despite the unpredictable nature of the global stock market, experienced investors rely on strategic analysis, educated theories and financial acumen to make informed decisions. This article aims to provide an analytical overview of the anticipated trend of the SP500 Index up to 2025, and suggest a few actionable strategies that investors might find beneficial.

The Global Stock Market Context

Understanding the global stock market context is crucial when forecasting the SP500 trend. The SP500 is a representative benchmark of the stock performance of 500 large companies listed on American stock exchanges. Given its wide exposure and significance, any significant happenings — economic, political, etc. — worldwide can impact the SP500 Index.

Analysis of The SP500 Index Trend Into 2025

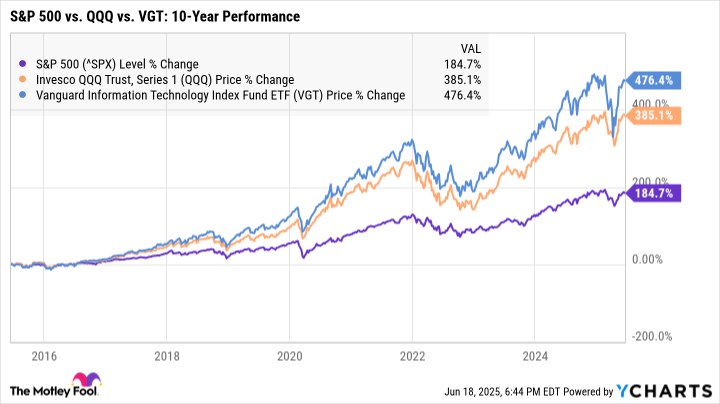

Based on historical data and expert analysis, the SP500 trend over the next few years is likely to experience a period of volatility. However, the overall trajectory is predicted to remain bullish. Factors such as emerging technology, geopolitical dynamics and the progress of pandemic recovery efforts are expected to influence this trend.

.png)

Implications of The SP500 Index Trend Into 2025

While a rising SP500 Index reflects the growth of the American economy and by extension, the global economy, investors should be wary of market volatility. It’s essential to remember that what goes up can come down, thus necessitating a balanced investment approach.

Strategies for Investors

Considering the forecasted trend of the SP500 Index, here are a few strategies investors may want to consider:

- Diversification: A balanced portfolio mitigates risk. Diversification across asset classes eases impact from dramatic fluctuations in one area.

- Long-term Investment: Despite short-term volatility, the SP500 Index has historically delivered a positive return over an extended period.

- Trend-following Strategies: These can provide considerable returns when the market is tending upwards.

RELATED READING

Read also: Tesla Stock Forecast: Expert Analysis and Future Investment Strategies

Exploring the Impact of COVID-19 on the Global Stock Market

Read also: Tesla Stock Forecast: Expert Analysis and Future Investment Strategies

Effective Strategies for Long-term Stock Market Investments

Read also: Tesla Stock Forecast: Expert Analysis and Future Investment Strategies

Understanding and Benefiting from Stock Market Volatility

Disclaimer: This article is provided for informational purposes and should not be considered financial advice. Every investment and trading move involves risk. It’s crucial to do thorough research before making any investment decisions.

Leave a Reply