Growth vs Value Investing: A Comprehensive 2025 Market Analysis Across Global Financial Markets

In the dynamic world of investing, both novices and seasoned professionals alike grapple with a critical dichotomy: growth vs value investing. The global stock market scenario of 2025 offers a compelling canvas to examine these two prevalent investment philosophies. Throughout this analysis, we aim to provide a detailed understanding of growth and value, enabling prudent investors to navigate through their investment journey wisely.

Understanding Growth Investing

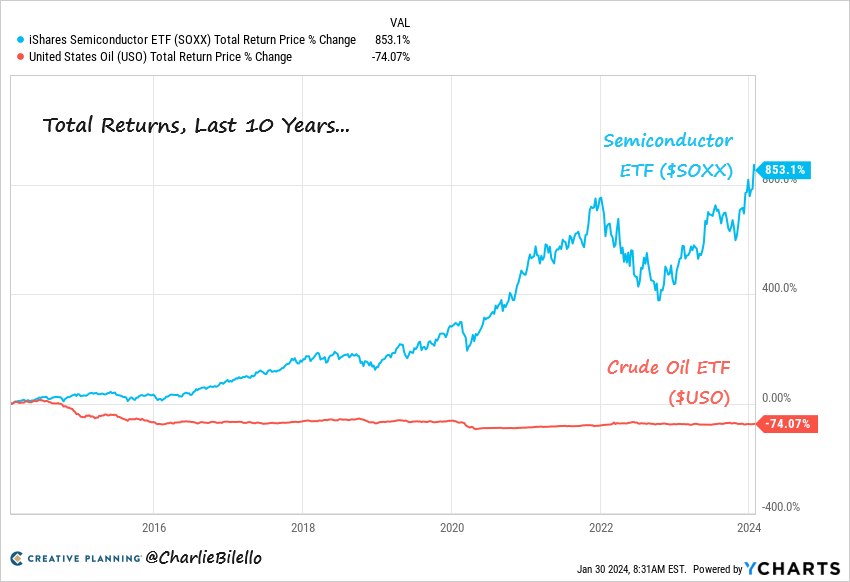

At its core, growth investing zeroes in on companies that demonstrate signs of above-average growth, through revenue or earnings. Growth investors often focus on high-growth sectors like technology, clean energy, and biotech, anticipating substantial returns once these companies’ promise unfolds fully.

The Basis of Value Investing

Conversely, value investing centres on finding stocks that appear to be undervalued by the market. Value investors inherently believe that the market occasionally overlooks the intrinsic worth of some firms. As a result, they seek opportunities in sectors that are not in the limelight but hold potential for substantial gains in the long term.

Growth vs Value in the 2025 Market: Global Stock Market Context

As the global market continues to evolve, the pendulum of preference swings between growth and value investing. The 2025 market conditions exhibit a unique mix of opportunities and challenges for both investment approaches.

Growth Investing Outlook

According to our analysis, growth sectors such as tech and renewables continue to flourish in 2025, providing ample opportunities for growth investments. However, investors must be wary of potential market bubbles and lofty valuations, underlining the importance of thorough financial analysis and careful stock picking.

Value Investing Outlook

Meanwhile, value investing thrives in sectors that investors typically overlook. For instance, traditional manufacturing, utilities, and energy companies have shown strong performance while trading at compounding discounts in 2025. It’s worth noting that value stocks often require patience as their true value might take time to come to fruition.

Actionable Insights for Prudent Investors

Regardless of your preference between growth and value, understanding the nuances of the global stock market in 2025 can significantly fine-tune your investment approach. Steady diversification across both growth and value stocks can be an optimal strategy, providing potential for substantial returns while mitigating risk.

RELATED READING

-

Read also: Unmasking Wall Street’s Future: An In-depth Earnings Preview Amid Global Market Uncertainty

Decoding Market Fluctuations: A 2025 Perspective

-

Read also: Unmasking Wall Street’s Future: An In-depth Earnings Preview Amid Global Market Uncertainty

Future-proofing your Portfolio: Growth Stocks in 2025

-

Read also: Unmasking Wall Street’s Future: An In-depth Earnings Preview Amid Global Market Uncertainty

The Rise of Undervalued Stocks: Value Investing Insights for 2025

Disclaimer

The content provided in this article is intended for informational purposes only. It should not be taken as financial advice. Always consult with a professional financial advisor before making any major financial decisions. Investment markets possess inherent risks, and past performance cannot guarantee future results.

At the William Club, we commit to a disciplined, data-driven, and insightful market analysis to help propel your investment strategies. 2025 holds several exciting possibilities, and we’re here to help you navigate them confidently.

Leave a Reply