What This Page Covers

This page provides an informational overview of how to invest in asset allocation in Asia, focusing on publicly available data, context, and commonly discussed considerations. It is designed to help readers understand the topic clearly and objectively.

Understanding how to invest in asset allocation in Asia

Asset allocation is a fundamental investment strategy that involves diversifying a portfolio across different asset classes, such as equities, bonds, real estate, and cash, to manage risk and achieve financial goals. In the context of Asia, this strategy takes on unique dimensions due to the region’s diverse economic conditions, regulatory environments, and growth potential. Investors often search for information on asset allocation in Asia to capitalize on the region’s dynamic markets and to understand how best to diversify their investments geographically and sectorally. This topic is commonly discussed in financial circles due to Asia’s growing influence in the global economy, offering both opportunities and challenges for investors.

Key Factors to Consider

When investing in asset allocation in Asia, several key factors should be considered:

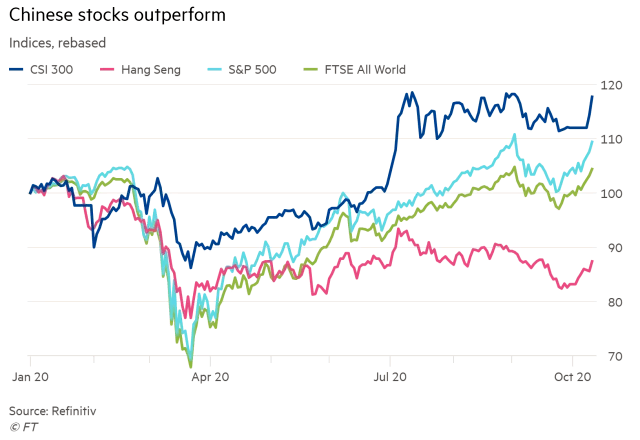

- Economic Growth Trends: Asia is home to some of the world’s fastest-growing economies. Understanding the macroeconomic trends in countries like China, India, and Southeast Asian nations can guide asset allocation decisions.

- Regulatory Environment: Each Asian country has its own regulatory framework. Investors need to be aware of these regulations as they can significantly impact investment opportunities and risks.

- Market Volatility: Asian markets can be volatile. Investors must consider the risk tolerance of their portfolios and adjust their asset allocation strategies accordingly.

- Currency Fluctuations: Currency risk is a major consideration when investing internationally. The strength or weakness of local currencies against the investor’s home currency can affect returns.

- Sectorial Opportunities: Asia offers diverse sector opportunities, from technology in South Korea to manufacturing in China and financial services in Singapore. Understanding these sectors can help in making informed allocation choices.

Common Scenarios and Examples

One common scenario in asset allocation in Asia involves a diversified investment in both emerging and developed markets within the region. For instance, an investor might allocate a portion of their portfolio to Chinese equities, capitalizing on China’s robust technology and consumer sectors, while also investing in Japanese government bonds for stability and risk management. Another example is investing in Indian infrastructure projects, which can offer growth potential due to the government’s focus on development, while balancing the portfolio with investments in established markets like Hong Kong or Singapore for liquidity and regulatory transparency.

Practical Takeaways for Readers

- Investing in Asia requires a nuanced understanding of diverse markets and economic conditions. Thorough research and analysis are critical.

- Common misunderstandings include underestimating the impact of regional political climates and over-relying on short-term growth indicators.

- Readers may want to review economic reports, market analyses, and country-specific regulatory guidelines to make informed decisions.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is how to invest in asset allocation in Asia?

Investing in asset allocation in Asia involves diversifying a portfolio across various asset classes within the Asian markets to balance risk and return.

Why is how to invest in asset allocation in Asia widely discussed?

The topic is widely discussed due to Asia’s economic growth, diverse markets, and increasing role in the global economy, offering both opportunities and challenges for investors.

Is how to invest in asset allocation in Asia suitable for everyone to consider?

Asset allocation in Asia may not be suitable for everyone, as it requires a good understanding of regional markets and individual risk tolerance and investment goals should be assessed.

Where can readers learn more about how to invest in asset allocation in Asia?

Readers can learn more from official filings, company reports, reputable financial publications, and economic analyses specific to Asian markets.

Understanding complex topics takes time and thoughtful evaluation. Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply