What This Page Covers

This page provides an informational overview of market volatility explained monthly, focusing on publicly available data, context, and commonly discussed considerations. It is designed to help readers understand the topic clearly and objectively.

Understanding market volatility explained monthly

Market volatility explained monthly refers to the analysis and understanding of how market fluctuations are observed and interpreted over the course of a month. Often, investors and financial analysts seek to comprehend these monthly changes to make informed decisions about their portfolios. People search for this topic to gain insights into short-term market trends and to better understand the potential risks and opportunities that may arise within a given month.

In financial contexts, market volatility is frequently discussed in terms of price variations of assets such as stocks, bonds, or commodities. The monthly perspective allows for a more granular view of these fluctuations compared to longer-term analyses like quarterly or annual reports. This approach can be particularly beneficial for active traders or those interested in short-term investment strategies.

Key Factors to Consider

Several key factors are associated with market volatility explained monthly, each contributing to the overall understanding of market dynamics:

- Economic Indicators: Monthly reports on employment, inflation, and consumer spending can significantly impact market volatility. These indicators provide insights into the economic health and can influence investor sentiment.

- Geopolitical Events: Political tensions or policy changes can lead to heightened volatility, as markets react to potential impacts on global trade and economic stability.

- Corporate Earnings Reports: The release of monthly or quarterly earnings reports can cause stock prices to fluctuate based on company performance relative to market expectations.

- Market Sentiment: Investor psychology plays a crucial role in market volatility. Fear and greed can drive rapid buying or selling, leading to increased price swings.

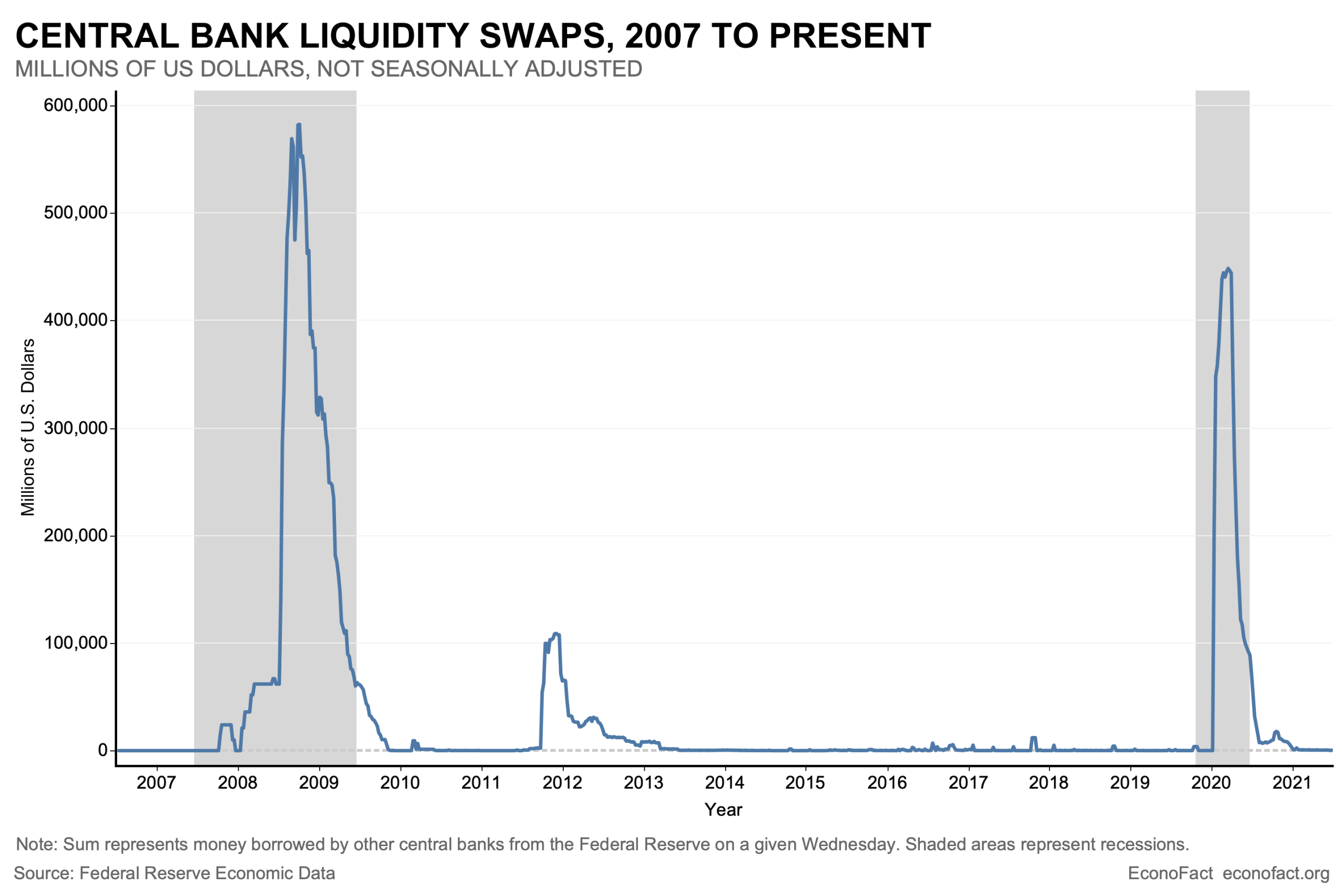

- Interest Rate Announcements: Central bank policy decisions regarding interest rates can affect borrowing costs and economic activity, often resulting in market volatility.

Common Scenarios and Examples

To better understand market volatility explained monthly, consider the following scenarios:

During a month when a central bank announces a surprise interest rate hike, markets may experience increased volatility as investors reassess their positions in light of changing borrowing costs. Similarly, if a major corporation reports earnings that exceed expectations, its stock price might surge, contributing to overall market volatility.

Another example could be a geopolitical event, such as an unexpected election result or a trade negotiation breakdown, leading to uncertainty and volatility in related markets. In these cases, investors may shift their strategies to hedge against potential losses or capitalize on new opportunities.

Practical Takeaways for Readers

- Important observations include the fact that market volatility is a natural aspect of financial markets, and understanding its causes can help in making informed decisions.

- Common misunderstandings include the belief that volatility is inherently negative; in reality, it can present both risks and opportunities depending on the context.

- Readers should consider reviewing sources such as economic reports, central bank announcements, and reputable financial news outlets to stay informed about factors influencing monthly market volatility.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is market volatility explained monthly?

Market volatility explained monthly involves analyzing the fluctuations in market prices over a one-month period to understand short-term trends and potential risks.

Why is market volatility explained monthly widely discussed?

It is widely discussed because it helps investors and analysts gauge short-term market dynamics, aiding in the development of informed investment strategies.

Is market volatility explained monthly suitable for everyone to consider?

While understanding market volatility can be beneficial, it may not be essential for every investor. Individual circumstances and investment goals should guide whether this analysis is necessary.

Where can readers learn more about market volatility explained monthly?

Readers can learn more from official filings, company reports, and reputable financial publications that provide monthly market analyses.

Understanding complex topics takes time and thoughtful evaluation. Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply