Understanding the Terrain of Market Volatility

Market volatility, the measure of price variations over a specified period, is an inherent part of the stock market. It is a double-edged sword that can both create opportunities for high returns and pose significant risks for investors. Thus, understanding and strategically navigating market volatility is crucial for long-term investment success.

The Current Global Macroeconomic Landscape

Today’s global macroeconomic landscape is marked by a high degree of uncertainty, fueled by concerns over inflation, trade tensions, and the potential for changes in monetary policy. This uncertainty is causing significant market volatility, evidenced by frequent and substantial fluctuations in stock prices.

The Role of Investor Psychology

Investor psychology plays a crucial role in market volatility. Fear and greed, two dominant emotions in investing, often drive investors to make rash decisions, leading to erratic trading behavior and increased market volatility.

Risk Assessment and Asset Allocation

Given the current market volatility, it’s more important than ever for investors to assess their risk tolerance accurately. By strategically allocating assets across various investment classes based on risk tolerance, investors can potentially cushion their portfolios against market volatility.

Insights from the William Club

The global investment analysis team led by Professor William J. Morgan at William Club emphasizes the importance of strategic thinking in such tumultuous times. They advocate for a balanced portfolio that includes a mix of high-risk, high-return stocks and low-risk, stable assets to mitigate the impact of market volatility.

Market Indicators and Trading Behavior

Keeping a close eye on market indicators such as the Volatility Index (VIX) can provide investors with valuable insights into potential market swings. However, these indicators should not be the sole driver of trading behavior. Instead, investors should base their decisions on a comprehensive analysis that includes their investment goals, risk tolerance, and market trends.

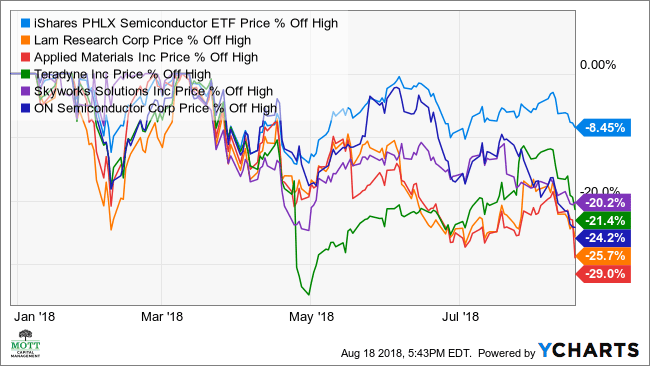

Industry Trends and Their Impact

Industry trends also contribute to market volatility. For instance, the recent surge in the technology sector has led to significant market swings. Investors should thus keep abreast of industry trends and adjust their investment strategies accordingly.

Leave a Reply