With the advent of technology and real-time data, predicting global markets has never been more achievable. Real-time global market predictions, an emerging field that leverages advanced algorithms and machine learning techniques, are transforming the financial landscape. But how does it work, and what implications does it hold for investors and traders alike? Let’s delve deeper into this fascinating development.

Understanding Real-Time Global Markets Prediction

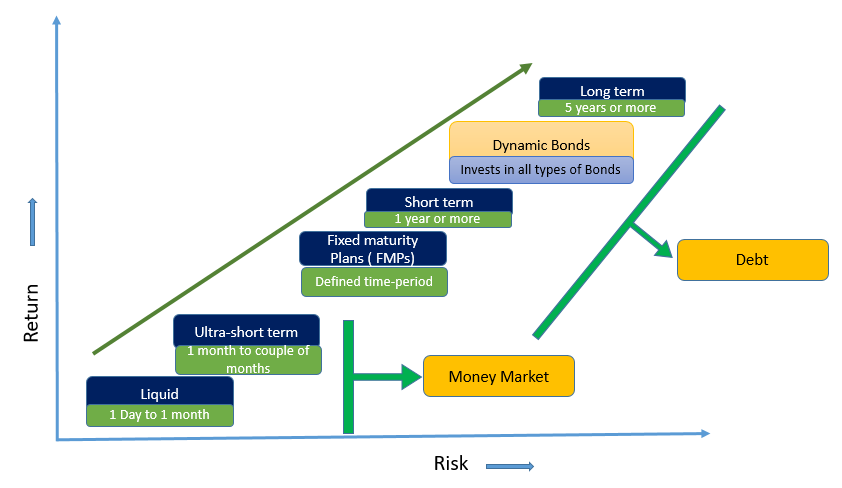

It begins with understanding what real-time global market prediction is all about. In essence, it involves using technology to forecast market trends and price movements in real-time. This predictive analysis can cover a vast range of markets – from stocks, commodities, and currencies to derivatives and bonds.

The Power of Real-Time Data

Real-time data forms the backbone of these predictions. Instead of relying on historical data, real-time predictions utilize the continuous stream of information generated by the global financial markets. This data is analyzed instantly, providing valuable insights into potential market movements. The advantage? Faster, more accurate predictions that can adapt to changing market conditions.

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) play a pivotal role in real-time global markets prediction. These technologies can process vast amounts of data at incredible speeds, identifying patterns and trends that would be impossible for humans to discern. By learning from each prediction, AI and ML can continually refine their predictive models, improving their accuracy over time.

Practical Tips for Using Real-Time Predictions

-

Always consider real-time predictions as one tool among many. They should not replace thorough research and sound judgment.

-

Understand that while AI and ML can provide powerful insights, they are not infallible. Predictions are still subject to potential errors and should be treated with caution.

-

Use real-time predictions to supplement your trading strategy, not dictate it. They can provide valuable insights, but the final decision should always be yours.

Frequently Asked Questions

What is real-time global markets prediction?

Real-time global markets prediction is the process of forecasting market trends and price movements in real-time using advanced technologies like AI and ML.

How accurate are these predictions?

While AI and ML can significantly enhance prediction accuracy, no method is 100% reliable. Predictions should always be used in conjunction with other trading tools and strategies.

Can real-time predictions replace human judgment?

While real-time predictions can offer valuable insights, they should never replace human judgment. The final trading decision should always be made by the trader.

As we embrace the future of trading, remember that real-time global market predictions are a tool to aid your decisions, not make them for you. Embrace the power of technology, but continue to rely on your judgment and intuition. The world of trading is constantly evolving, and so should our strategies.

Leave a Reply