What This Page Covers

This page provides an informational overview of the topic “should you invest in technical analysis explained,” focusing on publicly available data, context, and commonly discussed considerations. It is designed to help readers understand the topic clearly and objectively.

Understanding Should You Invest in Technical Analysis Explained

Technical analysis is a method used by traders and investors to evaluate securities and make trading decisions by analyzing statistical trends gathered from trading activity, such as price movement and volume. The question “should you invest in technical analysis explained” often arises among those looking to enhance their investment strategies and gain insights into market behavior. This topic is commonly discussed in financial and market-related contexts as it helps individuals make informed decisions by understanding historical data patterns and predicting future price movements.

Key Factors to Consider

When considering whether to invest in technical analysis, several key factors should be taken into account:

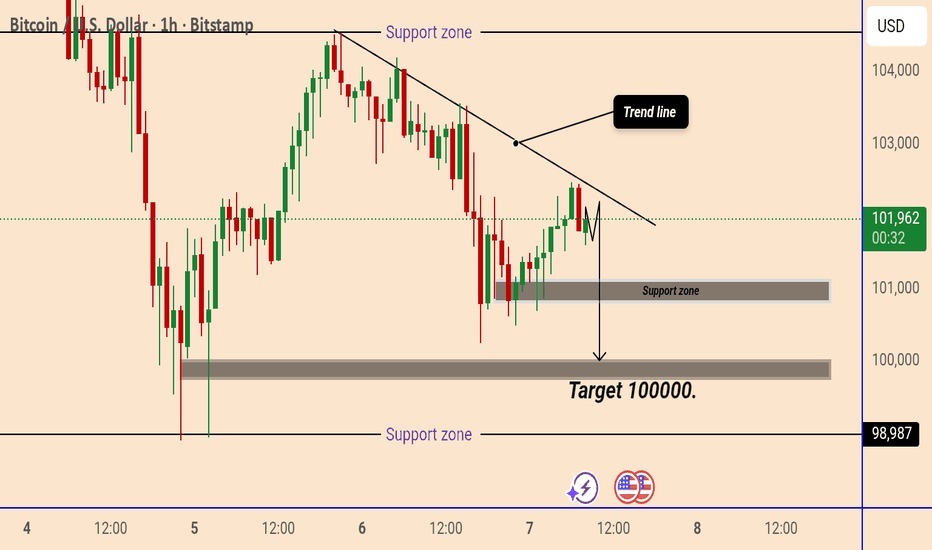

- Market Trends: Understanding the current market trends is crucial. Technical analysis often involves identifying patterns and trends to forecast future movements.

- Indicators and Tools: There are numerous technical indicators, such as moving averages, relative strength index (RSI), and Bollinger Bands, each offering different insights. Selecting the appropriate tools can significantly impact analysis outcomes.

- Data Interpretation: The ability to interpret charts and data accurately is essential. Misinterpretation can lead to incorrect predictions and potential losses.

- Risk Management: Incorporating risk management strategies is vital when using technical analysis. This includes setting stop-loss orders and understanding risk/reward ratios.

- Market Volatility: Technical analysis is particularly effective in volatile markets where patterns are more pronounced.

Common Scenarios and Examples

To illustrate how technical analysis is applied, consider the following scenarios:

Imagine an investor using technical analysis to decide whether to buy or sell a stock. By analyzing historical price charts, they might identify a “head and shoulders” pattern, which could indicate a potential reversal in the stock’s current trend. Based on this analysis, the investor might decide to sell the stock if the pattern suggests an upcoming downturn.

Another example could involve a trader using moving averages to determine entry and exit points. By plotting the 50-day and 200-day moving averages, the trader might look for a “golden cross” (when the 50-day moving average crosses above the 200-day moving average) as a signal to buy, anticipating a bullish trend.

Practical Takeaways for Readers

- Understanding the basics of technical analysis can provide valuable insights into market trends and potential investment opportunities.

- Common misunderstandings include the belief that technical analysis guarantees success. It should be used as part of a broader strategy, not in isolation.

- Readers may want to review information from financial publications, market analysis reports, and educational resources to further their understanding of technical analysis.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is should you invest in technical analysis explained?

Technical analysis involves evaluating securities through statistical trends from trading activity. It helps in making informed investment decisions.

Why is should you invest in technical analysis explained widely discussed?

The topic is widely discussed because it provides insights into price movements and market behavior, aiding investors in making data-driven decisions.

Is should you invest in technical analysis explained suitable for everyone to consider?

While technical analysis can be beneficial, it may not suit everyone. Individual circumstances, risk tolerance, and investment goals should be considered.

Where can readers learn more about should you invest in technical analysis explained?

Readers can explore official filings, company reports, or reputable financial publications to learn more about technical analysis.

Understanding complex topics takes time and thoughtful evaluation. Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply