What This Page Covers

This page provides an informational overview of stock trading vs real estate, focusing on publicly available data, context, and commonly discussed considerations.

It is designed to help readers understand the topic clearly and objectively.

Understanding Stock Trading vs Real Estate

Stock trading and real estate investment represent two distinct approaches to wealth accumulation and capital appreciation. Stock trading involves buying and selling shares of publicly traded companies on stock exchanges. Investors typically seek to capitalize on price fluctuations, dividends, and other financial instruments associated with stocks. Real estate investment, on the other hand, involves purchasing properties with the expectation of generating rental income, capital gains, or both.

People often search for stock trading vs real estate to understand which investment avenue might align better with their financial goals, risk tolerance, and investment horizon. Discussions in financial circles frequently revolve around factors such as liquidity, market volatility, potential returns, and the time commitment required for each investment type.

Key Factors to Consider

When comparing stock trading to real estate, several critical factors come into play:

- Liquidity: Stocks are generally more liquid than real estate, allowing investors to buy and sell shares quickly. In contrast, real estate transactions can take weeks or months to finalize.

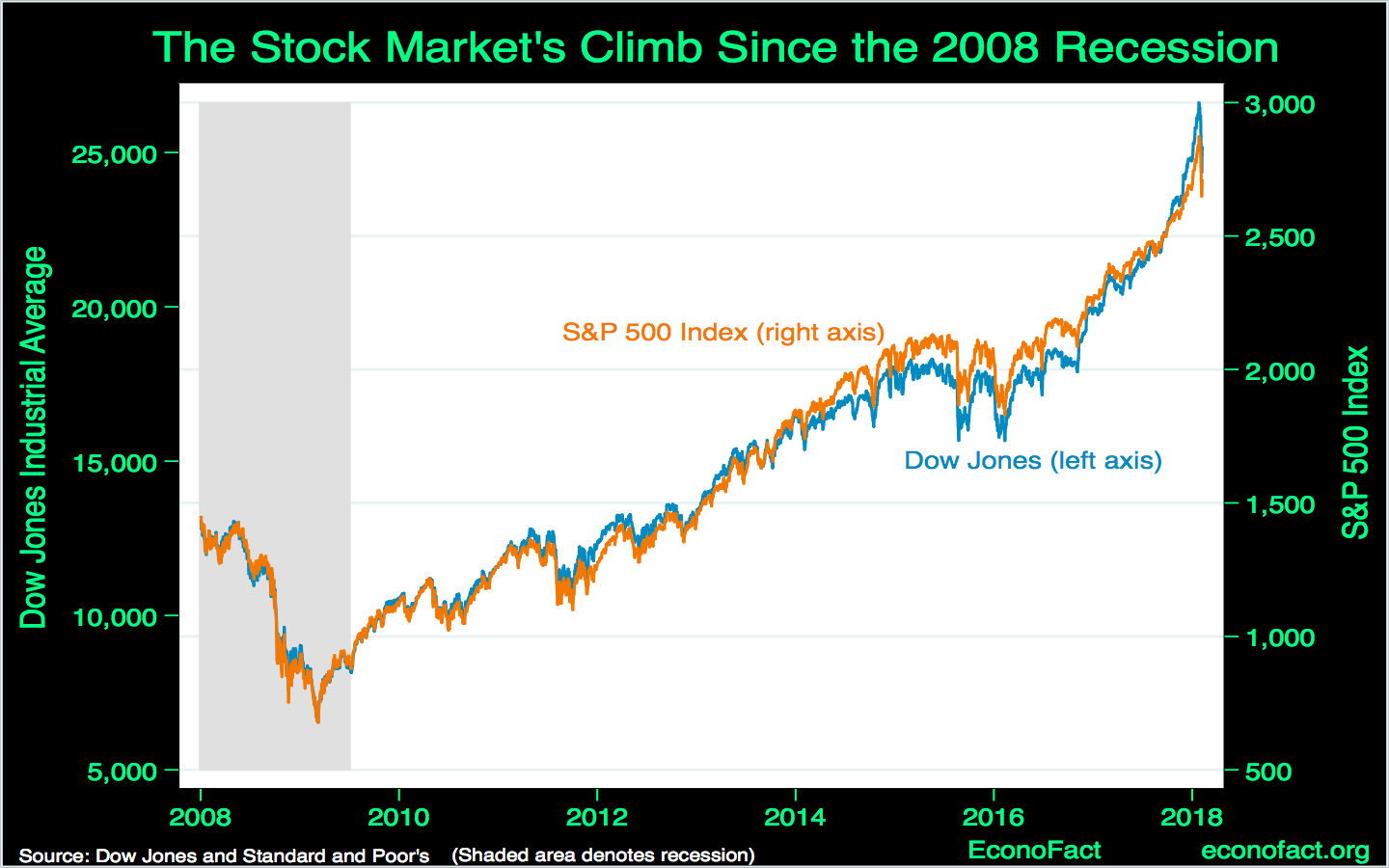

- Volatility: Stock markets can be volatile, with prices subject to rapid changes due to market sentiment, economic data, and geopolitical events. Real estate tends to be less volatile, with property values typically changing more gradually.

- Capital Requirements: Investing in real estate often requires a substantial initial capital outlay for down payments and property-related expenses, whereas stock trading can be started with smaller amounts of capital.

- Management Intensity: Real estate investments often require active management, including property maintenance and tenant interactions. Stock trading can be less time-consuming, especially when using passive investment strategies.

- Returns: Both investment types offer potential returns, but they vary. Stock trading may offer quicker, but riskier returns, whereas real estate can provide steady income through rental payments and long-term appreciation.

Common Scenarios and Examples

Consider an investor deciding between purchasing stocks in a technology company or investing in a residential property. In a bullish market, the stock investment could yield significant short-term gains due to increasing stock prices and potential dividends. However, if the market turns bearish, the investor might face losses.

On the other hand, investing in a residential property in a growing suburb might provide steady rental income and potential appreciation as the area develops. However, this requires the investor to manage the property and deal with tenant issues, which can be time-consuming.

These scenarios illustrate how different market conditions and personal circumstances can influence the suitability of stock trading vs real estate for individual investors.

Practical Takeaways for Readers

- It is crucial for investors to assess their risk tolerance and investment goals before choosing between stock trading and real estate.

- A common misunderstanding is that one investment type is universally better than the other; in reality, both have unique advantages and risks.

- Investors should consider reviewing financial statements, market analyses, and expert opinions to make informed decisions.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is stock trading vs real estate?

Stock trading involves buying and selling shares of publicly traded companies, while real estate investment involves purchasing properties for rental income or capital gains.

Why is stock trading vs real estate widely discussed?

The topic is popular because both investment forms have distinct characteristics and appeal to different types of investors based on their financial goals and risk tolerance.

Is stock trading vs real estate suitable for everyone to consider?

Not necessarily. Suitability depends on individual financial circumstances, risk appetite, and investment knowledge.

Where can readers learn more about stock trading vs real estate?

Readers can explore official filings, company reports, reputable financial publications, and consult with financial advisors for comprehensive insights.

Understanding complex topics takes time and thoughtful evaluation. Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply