What This Page Covers

This page provides an informational overview of stocks explained for investors, focusing on publicly available data, context, and commonly discussed considerations.

It is designed to help readers understand the topic clearly and objectively.

Understanding stocks explained for investors

Stocks, often referred to as equities or shares, represent ownership in a company. When investors buy stocks, they purchase a piece of the company, entitling them to a portion of the profits and losses. The term “stocks explained for investors” typically encompasses a broad range of topics, including how stocks function, why they are important in financial markets, and the various factors that influence their value.

People frequently search for these explanations to gain a clearer understanding of investment opportunities, make informed decisions, and grasp market dynamics. Stocks are a cornerstone of many investment portfolios, and understanding them is crucial for anyone looking to enter the financial markets. This topic is commonly discussed in financial contexts due to its relevance to market trends, economic health, and individual financial growth.

Key Factors to Consider

Several key factors are associated with stocks explained for investors, which can influence their investment decisions. These include:

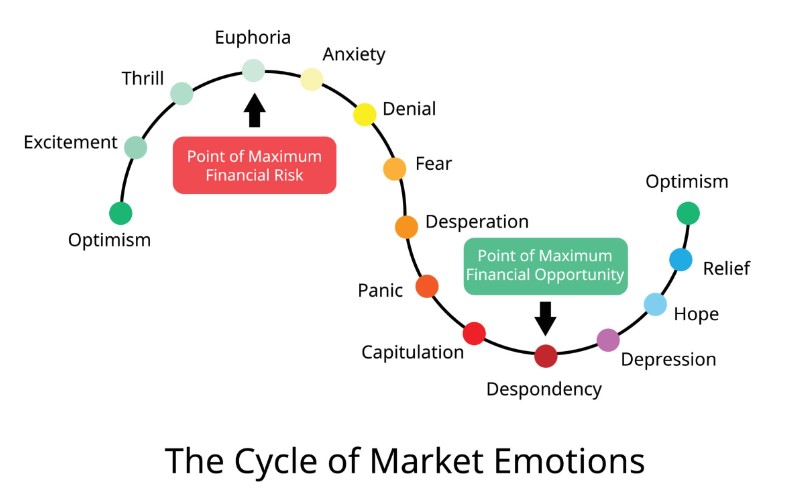

- Market Trends: Understanding market trends is crucial. They provide insights into the general movement of stock prices, influenced by economic indicators, investor sentiment, and geopolitical events.

- Company Performance: The financial health and operational performance of a company significantly affect its stock price. Investors often analyze financial statements, such as balance sheets and income statements, to assess company performance.

- Valuation Metrics: Metrics like the Price-to-Earnings (P/E) ratio, earnings per share (EPS), and dividend yield help investors evaluate whether a stock is fairly priced.

- Risk Factors: Every investment carries risk. Understanding the specific risks associated with a stock, including market risk, credit risk, and operational risk, is essential for evaluating its potential impact on an investment portfolio.

Common Scenarios and Examples

To illustrate how stocks are analyzed, consider a scenario where an investor is evaluating a technology company. The investor reviews the company’s latest earnings report, noting an increase in revenue and net income, which suggests strong financial health. They also examine market trends, observing that the technology sector is experiencing growth due to increased demand for digital services.

Using valuation metrics, the investor finds that the company’s P/E ratio is lower than its competitors, indicating potential undervaluation. By assessing these factors, the investor concludes that the stock may be a worthwhile addition to their portfolio, given their risk tolerance and investment goals.

Another example might involve an investor focusing on dividend-paying stocks. They might analyze a utility company with a consistent track record of paying dividends, indicating financial stability. By understanding the company’s dividend yield and payout ratio, the investor can assess whether the stock aligns with their income-generating strategy.

Practical Takeaways for Readers

- Understanding the fundamentals of stocks is essential for making informed investment decisions.

- Stock prices are influenced by a variety of factors, including market trends, company performance, and economic indicators.

- Common misunderstandings include equating high stock prices with high value and ignoring the impact of market volatility.

- Readers should consider reviewing official filings, company reports, and reputable financial publications to gather comprehensive information.

Important Notice

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research or consult qualified professionals before making decisions.

Frequently Asked Questions

What is stocks explained for investors?

Stocks explained for investors refers to the broad understanding of how stocks function, their role in financial markets, and the various factors influencing their valuation and performance.

Why is stocks explained for investors widely discussed?

This topic is widely discussed because stocks are a fundamental component of investment portfolios, and understanding them is crucial for market participation and decision-making.

Is stocks explained for investors suitable for everyone to consider?

While understanding stocks is beneficial, each individual must consider their financial goals, risk tolerance, and investment knowledge before engaging with stock investments.

Where can readers learn more about stocks explained for investors?

Readers can learn more by exploring official filings, company reports, financial news outlets, and reputable financial publications.

Understanding complex topics takes time and thoughtful evaluation. Staying informed, asking the right questions, and maintaining a long-term perspective can help readers make more confident decisions over time.

Leave a Reply